Investors Eye Oversold Healthcare Stocks for Potential Gains

The healthcare sector has seen a number of oversold stocks that may represent attractive buying opportunities for investors. An important tool for assessing whether a stock is oversold is the Relative Strength Index (RSI). The RSI compares an asset’s strength on days when prices rise to its strength on days when prices fall. Typically, an asset is considered oversold when the RSI is below 30, according to Benzinga Pro.

Below is a list of major oversold stocks in the healthcare sector, each with an RSI around or below 30.

UnitedHealth Group Inc UNH

- On April 21, UnitedHealth reported first-quarter results that fell short of expectations and revised its fiscal year 2025 adjusted EPS guidance downward. CEO Andrew Witty stated, “UnitedHealth Group grew to serve more people more comprehensively but did not perform up to our expectations, and we are aggressively addressing those challenges to position us well for the years ahead, and return to our long-term earnings growth rate target of 13 to 16%.” The company’s stock has decreased about 19% in the last month, with a 52-week low of $412.02.

- RSI Value: 27.1

- UNH Price Action: Shares closed down 1.3% at $418.64 on Friday.

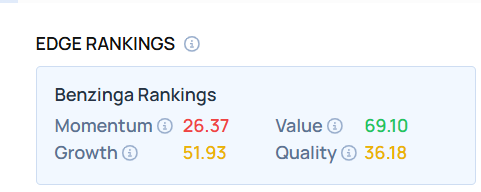

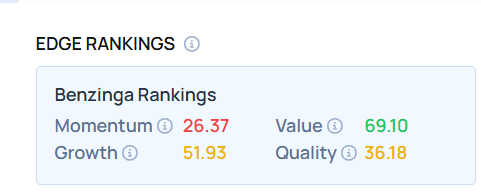

- Edge Stock Ratings: 26.37 Momentum score with a Value score of 69.10.

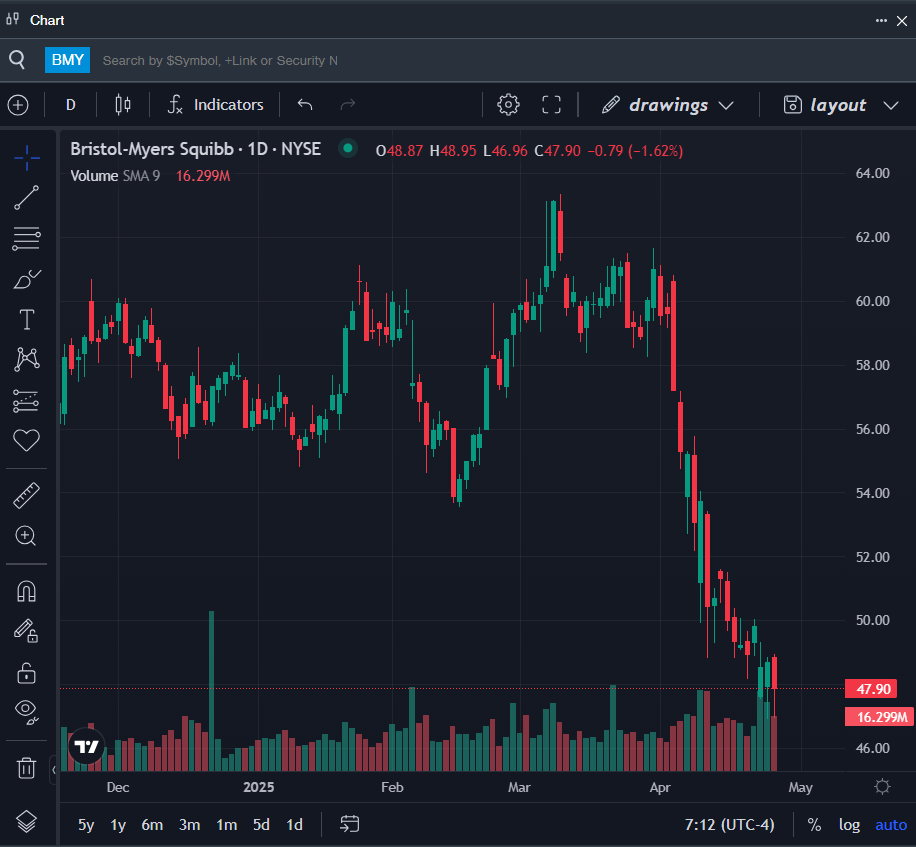

Bristol-Myers Squibb Co BMY

- On April 24, Bristol Myers Squibb announced first-quarter revenues of $11.20 billion, surpassing the consensus estimate of $10.70 billion. CEO Christopher Boerner stated, “Our strong execution in the first quarter drove continued momentum across our Growth Portfolio and meaningful progress in the pipeline.” The stock has dropped approximately 20% in the past month, hitting a 52-week low of $39.35.

- RSI Value: 25

- BMY Price Action: Shares closed down 1.6% at $47.90 on Friday.

- Benzinga Pro’s charting tool illustrated trends in BMY stock.

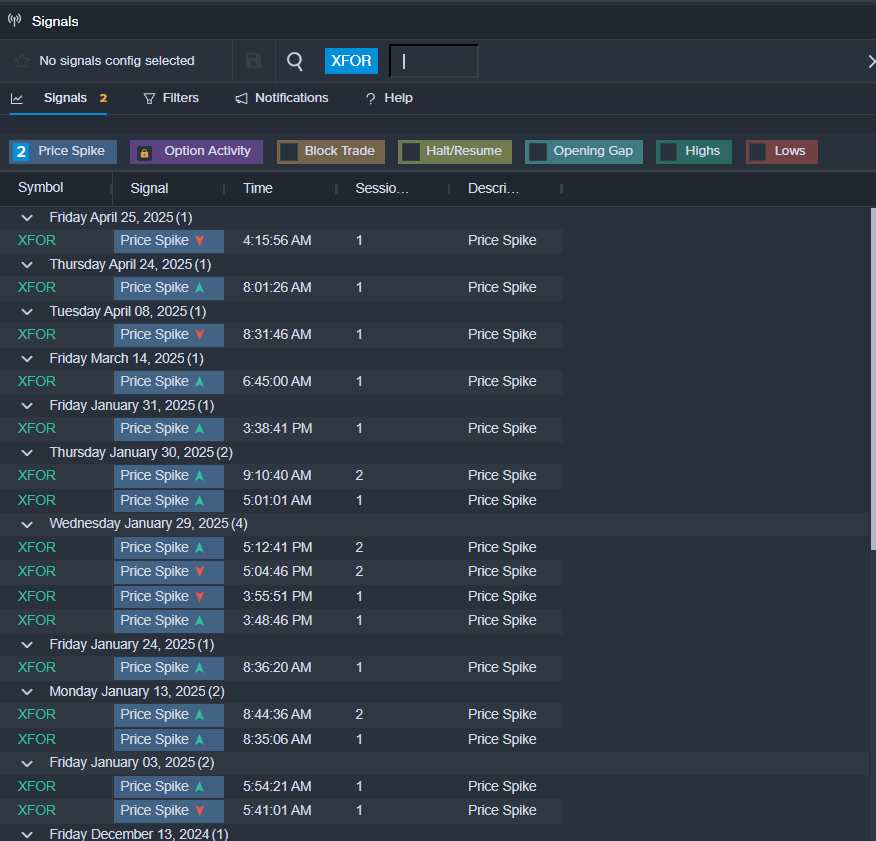

X4 Pharmaceuticals Inc XFOR

- On April 24, X4 Pharmaceuticals announced a 1-for-30 reverse stock split. The company has a 52-week low of $0.17.

- RSI Value: 14.7

- XFOR Price Action: Shares closed at $5.70 on Friday.

- Benzinga Pro’s signals indicated a potential breakout for XFOR shares.

Investors interested in tracking performance can utilize BZ Edge Rankings to compare these stocks against others in the sector.

Read This Next:

Photo via Shutterstock