Analysts See 20% Upside for iShares Tech ETF Based on Targets

Analyzing the holdings of ETFs within our coverage at ETF Channel, we compared the trading prices of each holding against their average analyst 12-month forward target prices. For the iShares Expanded Tech-Software Sector ETF (Symbol: IGV), the weighted average implied analyst target price is calculated at $113.89 per unit.

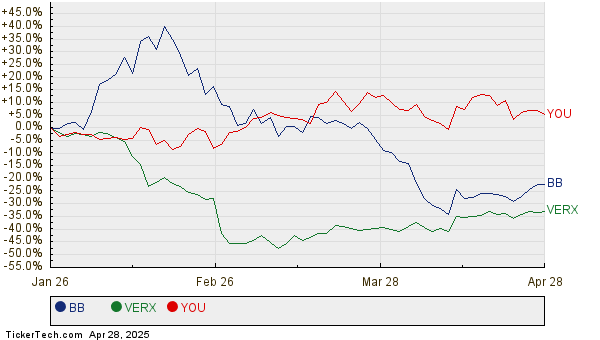

Currently trading around $94.76 per unit, IGV holds a potential upside of 20.19%, based on average analyst targets for its underlying holdings. Three stocks within IGV with significant upside potential include BlackBerry Ltd (Symbol: BB), Vertex Inc (Symbol: VERX), and Clear Secure Inc (Symbol: YOU). BlackBerry’s recent trading price sits at $3.38 per share, while analysts have set an average target at $4.45 per share, indicating a 31.66% upside. Vertex has a recent share price of $39.74, with a target of $49.33, translating to a 24.14% upside. Clear Secure is currently valued at $25.31, with an expected analyst target of $30.62, reflecting a 21.00% increase.

Below is a twelve-month price history chart comparing the stock performances of BB, VERX, and YOU:

Additionally, here’s a summary table of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Expanded Tech-Software Sector ETF | IGV | $94.76 | $113.89 | 20.19% |

| BlackBerry Ltd | BB | $3.38 | $4.45 | 31.66% |

| Vertex Inc | VERX | $39.74 | $49.33 | 24.14% |

| Clear Secure Inc | YOU | $25.31 | $30.62 | 21.00% |

Are analysts justified in their target predictions, or are they too optimistic about these stocks’ future performance? Investors need to consider whether these forecasts are grounded in recent developments in the companies and the industry. High price targets relative to a stock’s trading price can signify optimism, but they may also indicate a need for caution if the estimates have not adjusted to current realities. These considerations require thorough evaluation from investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Oversold Dividend Stocks

CUSA Historical Stock Prices

LVB Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.