Analyst Targets Suggest Potential Upside for CCM Global Equity ETF

At ETF Channel, we analyzed the underlying holdings of various ETFs in our coverage. Focusing on the CCM Global Equity ETF (Symbol: CCMG), we compared the trading prices of its components to their respective average analyst 12-month forward target prices. This led us to determine that CCMG’s weighted average implied analyst target price is $30.30 per unit.

As of now, CCMG trades at approximately $27.16 per unit. This indicates that analysts foresee an 11.58% upside potential based on the average target prices of the underlying holdings. Among these holdings, three stocks show significant upside potential: Norfolk Southern Corp (Symbol: NSC), Somnigroup International Inc (Symbol: SGI), and Reliance Inc (Symbol: RS).

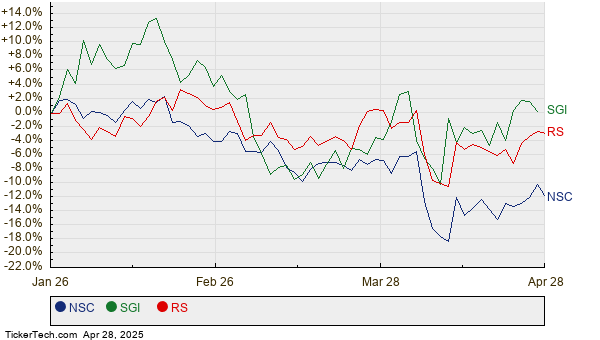

Norfolk Southern Corp, with a recent trading price of $221.71 per share, has an average analyst target of $260.25 per share, reflecting a potential upside of 17.38%. Somnigroup International Inc holds a recent price of $60.73 with a target of $70.90, translating to a 16.75% upside. Similarly, Reliance Inc’s recent price stands at $284.25, while analysts expect a target price of $327.17, indicating a possible increase of 15.10%. Below is a twelve-month price history chart showing the stock performance of NSC, SGI, and RS:

Below is a summary table of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| CCM Global Equity ETF | CCMG | $27.16 | $30.30 | 11.58% |

| Norfolk Southern Corp | NSC | $221.71 | $260.25 | 17.38% |

| Somnigroup International Inc | SGI | $60.73 | $70.90 | 16.75% |

| Reliance Inc | RS | $284.25 | $327.17 | 15.10% |

Analysts may raise valid questions about whether these targets are optimistic or based on sound justification considering recent developments in the companies and their industries. A high price target compared to a stock’s trading price generally signals optimism. However, it could also hint at potential downgrades if such targets are outdated. Further research is advised for investors to navigate these considerations.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Explore More:

• MSI Videos

• Top Ten Hedge Funds Holding PLCY

• UBCP market cap history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.