Comparing XPeng and Li Auto: A Look at Investment Potential

XPeng (XPEV) and Li Auto (LI) are two leading players in China’s expanding new-energy vehicle (NEV) market. These automakers have gained significant investor interest by targeting unique segments—XPeng focuses on AI-driven electric vehicles, while Li Auto specializes in extended-range electric vehicles (EREVs). As NEV sales in China grow, fueled by consumer demand and government backing, these companies are in a competitive race for market share. This comparison will explore which company offers better investment opportunities.

The Case for XPeng Stock

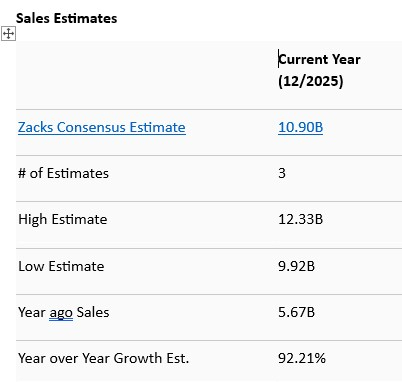

XPeng has demonstrated strong growth. In the first quarter of 2025, the company delivered a record 94,008 vehicles, representing a remarkable 331% increase year-over-year. This growth is largely attributed to the success of the Mona M03, an affordable electric coupe appealing to budget-conscious consumers while offering advanced technology. Analysts predict XPeng’s revenue will soar by 92% in 2025, with earnings projected to increase by 65%.

Image Source: Zacks Investment Research

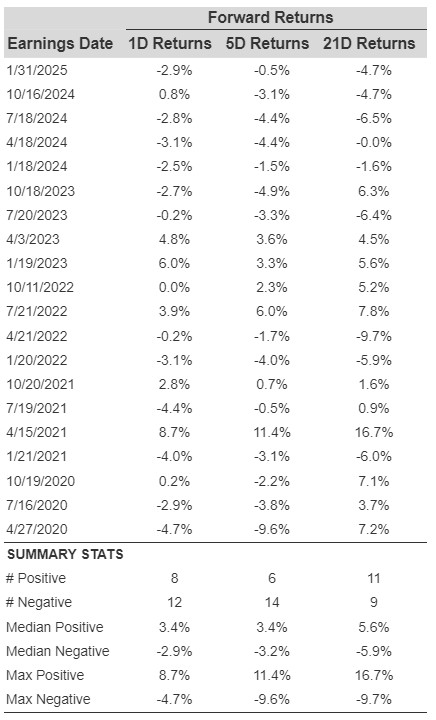

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Historically, XPeng struggled with margins, but recent improvements have been significant. The vehicle margin increased to 10% in Q4 2024 from 4.1% the previous year. Even though it remains behind Li Auto’s industry-leading margin of 19.8%, XPeng is on a clear path toward breaking even by late 2025, with gross profits skyrocketing to RMB 5.8 billion in 2024 from RMB 451 million in 2023.

XPeng’s competitive advantage lies in its advanced AI and autonomous driving technologies. Innovations such as the AI Hawkeye Visual Solution, XOS 5.4 operating system, and smart driving features in the P7+ sedan enhance its market position. Additionally, XPeng’s exploration into flying cars and humanoid robots indicates a forward-thinking strategy that can yield substantial long-term returns.

Nevertheless, XPeng’s current valuation raises concerns. It trades at a forward sales multiple of 1.52, significantly higher than Li Auto’s 0.92. After a remarkable 148% stock increase in the past year, some investors might perceive the valuations as overly stretched. Despite this, XPeng’s delivery growth and improving profitability, supported by favorable analyst ratings (average recommendation of 1.97), appeal to many investors looking for further upside.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Case for Li Auto Stock

Li Auto has established a strong reputation for its premium EREVs and operational excellence. In 2024, the company sold over 500,000 vehicles, representing a 33% rise from the previous year, while achieving a net income of $1.5 billion—an impressive achievement in a sector where many competitors are still unprofitable. In Q1 2025, it delivered 92,864 units, marking a 15.5% year-over-year increase.

From a financial perspective, Li Auto has a clear advantage. Total revenues for 2024 reached $19.8 billion, with healthy operating margins despite pricing pressures. Its vehicle margin stood at 19.8%, significantly higher than XPeng’s 10%, indicating better pricing power and cost management. With $9 billion in cash and manageable debt levels, Li Auto is well-positioned to fund research and development, infrastructure growth, and international expansion without straining its fiscal health.

Li Auto’s expanding product lineup looks promising. The company plans to introduce several battery electric vehicle (BEV) models within the next 12-18 months, diversifying beyond its hybrid offerings. Upcoming releases include the Li MEGA minivan and new SUVs like the Li i8 and i6, aimed at enhancing delivery volumes and expanding its customer base.

However, Li Auto faces its own hurdles. The company’s growth rates are plateauing compared to XPeng’s rapid ascent. Additionally, gross margins have experienced pressure, dropping from 23.5% to 20.3% year-over-year due to aggressive pricing strategies and shifts in product mix. Its heavy reliance on the Chinese market also makes it susceptible to domestic economic slowdowns, regulatory shifts, and changes in EV subsidy policies. Although Li Auto has begun its international expansion with service centers in Dubai, Kazakhstan, and Germany, overseas revenue contributions remain limited.

While XPeng carries a higher valuation, Li Auto’s lower forward valuation is more justified by its profitability and cash flow dynamics.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion

Both XPeng and Li Auto are notable contenders in China’s competitive NEV sector. Li Auto excels in profitability, cash flow stability, and product development. Conversely, XPeng stands out with its rapid growth trajectory, improving margins, and ambitious technological projects.

Currently, both stocks hold a Zacks Rank #3 (Hold) rating, indicating that neither is an immediate buy. However, if investors must choose one, XPeng has a slight advantage thanks to its explosive growth potential, AI-driven innovations, and favorable market sentiment. Those seeking high growth and technological leadership may find XPeng to be the preferred option at this time.