Agilon Health Shares Surge Past $3.83 Analyst Target Price

Recently, shares of Agilon Health Inc (Symbol: AGL) have surpassed the average analyst 12-month target price of $3.83, trading at $3.90 per share. When a stock hits an analyst’s target, the analyst generally has two options: downgrade their rating due to valuation concerns or adjust their target price upwards. Their reaction may also hinge on recent fundamental developments that could explain the stock’s price increase. Positive changes in the company’s outlook might indicate it’s time to raise the target price.

The average target price for Agilon Health Inc is sourced from 15 analysts within the Zacks coverage universe. However, this average can be misleading; it represents a simple mathematical average. Some analysts project lower targets, with one predicting a price of $2.00, while another sets a target as high as $8.50. The standard deviation among these targets is $1.757.

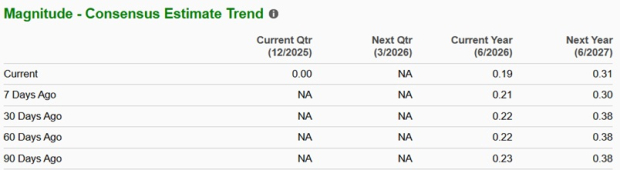

Examining the average price target of AGL allows investors to leverage a collective insight, combining the perspectives of multiple analysts rather than relying solely on a single expert’s forecast. With AGL recently trading above the $3.83 target, investors are encouraged to evaluate whether this figure is merely a checkpoint before reaching higher targets or if the valuation has become excessive, necessitating some profit-taking. Below is a table illustrating the latest insights from analysts covering Agilon Health Inc:

| Recent AGL Analyst Ratings Breakdown | ||||

|---|---|---|---|---|

| » | Current | 1 Month Ago | 2 Month Ago | 3 Month Ago |

| Strong buy ratings: | 4 | 2 | 2 | 2 |

| Buy ratings: | 1 | 1 | 1 | 1 |

| Hold ratings: | 15 | 18 | 18 | 18 |

| Sell ratings: | 1 | 1 | 1 | 1 |

| Strong sell ratings: | 1 | 1 | 1 | 1 |

| Average rating: | 2.73 | 2.91 | 2.91 | 2.91 |

The average rating shown in the last row corresponds to a scale from 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Strong Sell. This data is supplied by Zacks Investment Research via Quandl.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.