Fox Corporation Poised for Q3 Earnings Report Amid Mixed Analyst Sentiment

With a market capitalization of $20.7 billion, Fox Corporation (FOX) specializes in producing and distributing news, sports, and entertainment content. The New York-based company utilizes its popular brands, including FOX News, FOX Sports, the FOX Network, and the FOX Television Stations, to reach its audience. FOX is set to announce its fiscal Q3 earnings for 2025 before the market opens on Monday, May 12.

Analysts’ Earnings Expectations

Ahead of this earnings release, analysts anticipate that FOX will report a profit of $0.92 per share. This forecast reflects a decline of 15.6% compared to last year’s $1.09 per share. Notably, the company has exceeded Wall Street’s earnings estimates in each of the last three quarters. In Q2, FOX recorded an EPS of $0.96, surpassing projections by an impressive 57.4%.

Fiscal 2025 and Beyond

For the entirety of fiscal 2025, analysts expect FOX to achieve a profit of $4.49 per share, which marks a 30.9% increase from the $3.43 recorded in fiscal 2024. However, projections for fiscal 2026 suggest a slight decline of 4.5% to $4.29 in EPS.

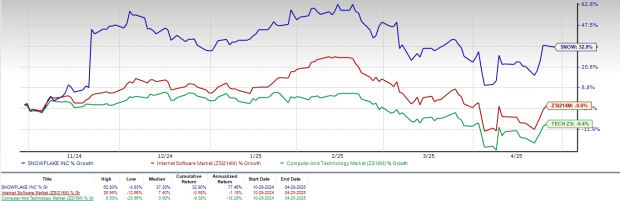

Stock Performance and Market Comparison

In the past 52 weeks, FOX shares have increased by 56.6%, significantly outpacing the S&P 500 Index’s ($SPX) 9.4% gain and the Communication Services Select Sector SPDR Fund’s (XLC) 21% rise during the same period.

Recent Earnings and Analyst Ratings

On February 4, FOX shares jumped 4.8% following the release of Q2 earnings that exceeded expectations. The company reported revenue of $5.1 billion, a 19.9% increase from the previous year, surpassing Wall Street estimates by 3.9%. Additionally, its adjusted earnings soared 182.4% year-over-year to $0.96 per share, exceeding consensus estimates by 57.4%. This strong performance was bolstered by a 123.1% increase in adjusted EBITDA.

Wall Street analysts remain moderately optimistic about FOX’s stock, giving it a “Moderate Buy” rating overall. Among 13 analysts monitoring the stock, six recommend a “Strong Buy,” while seven suggest a “Hold.” The average price target for FOX is set at $54.50, indicating a potential upside of 19% from current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.