Tech Stocks Show Potential for Long-Term Growth Despite Current Slumps

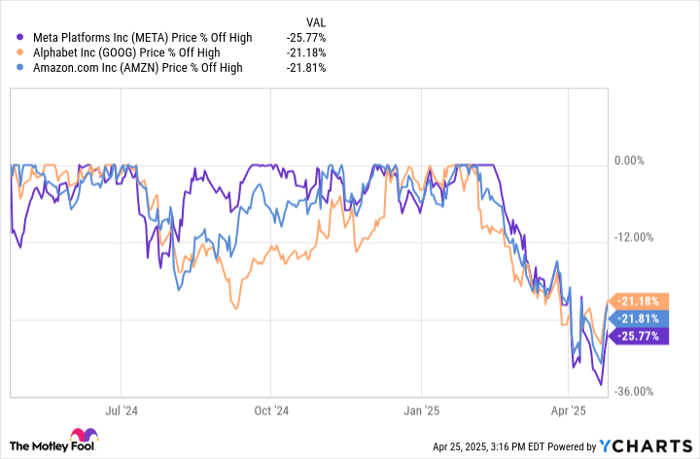

While the stock market has seen a rebound since “Liberation Day” three weeks ago, 2023 has not favored technology investors. Many “Magnificent Seven” stocks, including Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Meta Platforms (NASDAQ: META), remain down over 20% from their all-time highs. Concerns about tariffs and their implications for 2025 earnings loom large over Wall Street.

Despite this, investors focused on long-term potential may find attractive buying opportunities amid market volatility. Below are three technology stocks worth considering for investment during this downturn.

Meta’s Strong Market Position

Meta Platforms operates the world’s leading social media networks: Facebook, Instagram, and WhatsApp. In the last quarter, 3.35 billion users engaged with a Meta service daily. This figure represents over half of the globe’s population if excluding China, where Meta is not available. Such vast reach closely rivals Alphabet.

Other platforms like Snapchat and Pinterest boast hundreds of millions of users, but only TikTok competes closely with Meta in terms of user engagement and advertising capacity. Meta’s revenue grew by 21% year over year last quarter, totaling $48 billion, while operating margins increased from 41% to 48%. This growth reflects one of the highest rates among large technology firms globally.

Meta continues to invest heavily in artificial intelligence (AI), virtual reality, and other innovative projects. CEO Mark Zuckerberg is committed to capturing market segments in AI and has dedicated substantial resources towards mixed-reality hardware. Even while increasing research expenditures, Meta maintains an impressive operating margin of 48%, showcasing its robust business model.

Currently down 26% from its all-time high, Meta’s trailing price-to-earnings (P/E) ratio is at 22. Despite potential challenges in 2025 due to tariffs, Meta’s solid business foundation and commitment to innovation make it a compelling choice for investors.

META data by YCharts

Alphabet’s Diverse Growth Strategy

Alphabet potentially has the largest daily user base across its services, including Google Search, YouTube, and Google Cloud. Despite being down 21% from all-time highs, Alphabet saw a positive boost from a strong earnings report this week.

Even amidst competitive pressures in AI, Alphabet’s revenue remains strong. Google Search revenue rose 10% year over year to $51 billion, while YouTube advertising revenue also grew by 10%, reaching $8.9 billion. Google Cloud experienced accelerated growth of 28%, generating $12.3 billion. Notably, Alphabet’s operating margin expanded, reaching 34%, a notable increase from 32% in the same quarter last year.

Looking ahead, Alphabet’s future appears promising. Its Gemini AI tools continue to expand, and its autonomous vehicle service, Waymo, recently achieved a milestone of 250,000 weekly rides, up fivefold from a year ago. With a P/E ratio of 20, Alphabet presents an attractive investment opportunity that aligns well with long-term growth prospects.

Amazon’s Path to Profitability

Amazon is another technology giant currently down 20% from its peaks. Unlike its peers, Amazon does not yet yield high profit margins but is expected to enhance profitability over the next five years, justifying its P/E ratio of 34.

The evolution of Amazon’s e-commerce model has shifted towards third-party transactions instead of direct sales. This shift has opened doors for a high-margin advertising segment worth $56 billion and subscription services generating $44 billion annually. As a result, e-commerce margins are expected to improve significantly from 6.4% in 2024 to over 10% in the coming years.

Amazon Web Services (AWS), the cloud services powerhouse, reported over $100 billion in revenue, with an operating margin of 37% in 2024. Just as e-commerce margins are beginning to rise, AWS’s strong performance suggests that Amazon could see consolidated profit margins jump from 11% last year to between 15% and 20% soon.

As revenues climb alongside profit margin growth, Amazon’s earnings are poised for significant improvements. If Amazon’s revenue reaches $750 billion—up from $638 billion last year—its annual income could hit $150 billion at a 20% profit margin. Currently valued at $2 trillion, this earnings growth would lower its P/E ratio to 13.3, positioning Amazon as an appealing buy-and-hold investment opportunity.

Is Now the Time to Invest in Meta Platforms?

Before making any investment in Meta Stock, consider the following:

The Motley Fool Stock Advisor analyst team has identified their top 10 stocks for investors to consider right now, and Meta is not among them. The stocks that made the list could yield substantial returns in coming years.

For instance, when Netflix was recommended on December 17, 2004, a $1,000 investment would now be worth $594,046!* Similarly, an investment in Nvidia recommended on April 15, 2005, would have grown to $680,390!*

It’s worth noting that Stock Advisor has an average return of 872% compared to 160% for the S&P 500. For more insights, check out the latest top 10 list when you join Stock Advisor.

*Stock Advisor returns as of April 28, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director at Facebook, is also on the board. John Mackey, former CEO of Whole Foods Market, and Brett Schafer hold positions in Alphabet and Amazon. The Motley Fool recommends several technology stocks, including Alphabet, Amazon, Meta Platforms, and Pinterest. All disclosures can be found on their policy page.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.