Apple’s Q2 Fiscal Results Anticipated Amidst Challenges

Apple (AAPL) is scheduled to report its second-quarter fiscal 2025 results on May 1.

Revenue Expectations and Earnings Forecast

Apple anticipates that revenues for the March quarter in fiscal 2025 will witness growth in the low to mid-single digits compared to the previous year. Particularly for the Services segment, a low double-digit growth rate is expected.

The Zacks Consensus Estimate for fiscal second-quarter revenues is currently at $93.56 billion, which reflects a year-over-year increase of 3.09%.

As for earnings, the consensus is set at $1.60 per share, down by a penny in the last 30 days. This figure indicates a 4.58% rise compared to the same quarter last year.

AAPL has exceeded the Zacks Consensus Estimate for earnings across all four previous quarters, with an average earnings surprise of 4.39%.

Apple Inc. Price and EPS Surprise

Apple Inc. Price and EPS Surprise

Anticipated Decline in iPhone Sales

The company’s fortunes hinge significantly on the iPhone, which remains its largest revenue source. This device represented 55.6% of net sales in the first quarter of fiscal 2025, even as sales dipped 0.8% year-over-year to $69.14 billion.

iPhone sales likely faced challenges from strong competition in China, particularly from local rivals like Huawei and Xiaomi. Additionally, delays in launching Apple Intelligence to a substantial portion of Apple’s customer base have raised concerns.

The Zacks Consensus Estimate for iPhone net sales in the fiscal second quarter stands at $45.674 billion, indicating a potential decline of 0.6% year-over-year.

Steady Growth in Apple’s Services Segment

On the other hand, the Services business is benefiting from a growing number of paid subscribers, fueled by the increasing popularity of the App Store and a larger installed base of devices. Currently, Apple has over 1 billion paid subscribers using services such as Apple TV+, Apple Arcade, Apple News+, Apple Card, Apple Fitness+, and the Apple One bundle.

The consensus revenue estimate for the Services segment is currently at $26.176 billion, reflecting a growth rate of 12% year-over-year.

Growth in Mac Sales Expected

Apple’s robust Mac lineup contributed to a rise in market share during the first quarter of 2025. According to IDC, Apple’s market share rose to 8.7%, benefiting from a 14.1% year-over-year increase in shipments, totaling 5.5 million units. Gartner observed a smaller increase of 7% in shipments but noted a 20-basis point rise in market share.

Apple’s shipment growth surpassed competitors, with ASUS and Lenovo reporting increases of 11.7% and 4.8%, respectively. Dell Technologies (DELL) and HP (HPQ) experienced growth rates of 3% and 6.1%, respectively. According to Gartner, ASUS held the top position with a shipment growth of 9.1%, followed by Lenovo’s 9.6% and Apple’s 7% growth.

The consensus estimate for Mac revenues is currently at $7.791 billion, suggesting year-over-year growth of 4.6%.

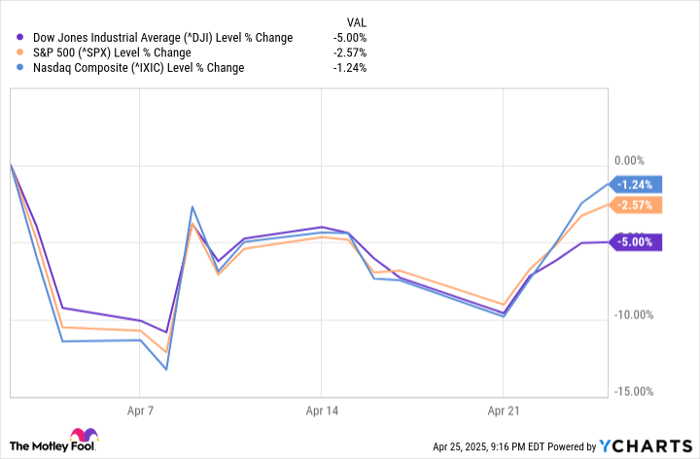

AAPL Shares Underperforming the Sector

Year-to-date, Apple shares have returned 16.4%, underperforming the Zacks Computer & Technology sector, which has seen a return of 11.1%. Nevertheless, AAPL has outperformed shares of Dell Technologies and HP, which have dropped 17.6% and 22.5%, respectively.

Apple Stock Performance

Image Source: Zacks Investment Research

Current valuations suggest that Apple stock is not particularly cheap. The Value Score of F indicates a potentially stretched valuation. AAPL is trading at 27.77X forward 12-month Price/earnings, above the sector average of 23.41X.

Price/Earnings (F12M)

Image Source: Zacks Investment Research

AI Expansion Bolsters AAPL’s Prospects

With the recent updates to iOS 18.4, iPadOS 18.4, and macOS Sequoia 15.4, Apple has broadened the availability of Apple Intelligence in various languages. This expansion includes French, German, Italian, Portuguese, Spanish, Japanese, Korean, and simplified Chinese, alongside localized English for regions like Singapore and India.

Users in the European Union can now utilize Apple Intelligence features on iPhones and iPads, and the Apple Vision Pro now offers these features in U.S. English.

This emphasis on artificial intelligence is expected to encourage the introduction of consumer-focused AI-enabled PCs, ultimately aiding PC shipment growth in the future.

Risks Influencing Apple’s Stock Performance

However, Apple may face short-term challenges due to weakened performance in China. Delayed launches of Apple Intelligence are expected to impact fiscal second-quarter results, adding to concerns regarding valuation.

Currently, Apple holds a Zacks Rank #3 (Hold), suggesting that investors should consider waiting for a better opportunity to accumulate shares.

This article was originally published on Zacks Investment Research. The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.