Super Micro Computer Stock Split: Analyzing Market Impact and Recovery

Super Micro Computer (NASDAQ: SMCI), commonly referred to as Supermicro, executed its first stock split on Oct. 1, 2024. The 10-for-1 split decreased its trading price from $416.40 to about $41.64 per share; however, its market cap remained relatively stable at approximately $24 billion.

As of now, Supermicro trades at about $37, with a market cap of $22 billion. This article will explore the reasons behind the stock’s decline post-split and whether it has the potential for future growth.

Reasons Behind Supermicro’s Stock Decline Post-Split

Supermicro manufactures servers used in data centers. This particular market is highly commoditized and typically dominated by major players like Dell and Hewlett Packard Enterprise. Nevertheless, Supermicro has carved out a niche by focusing on liquid-cooled artificial intelligence (AI) servers.

Image source: Getty Images.

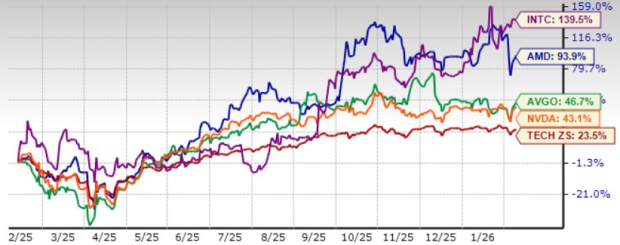

Supermicro’s early position in the AI server market, bolstered by a strong partnership with Nvidia, propelled the company into the spotlight as a leading AI stock. Its revenue rose significantly: 46% in fiscal 2022, 37% in fiscal 2023, and an impressive 110% in fiscal 2024. The stock reached a pre-split peak of $1,188.07 on March 13, 2024.

When the company announced its 10-for-1 stock split on Aug. 6, 2024, its stock price had already declined to $616.94. Before the split took effect, it fell another 33%.

Supermicro’s troubles began in August 2024 when a prominent short-seller accused the company of inflating its revenue figures. Although Supermicro initially denied the allegations, it postponed its 10-K filing for fiscal 2024 to evaluate its “internal controls over financial reporting.”

In October, its auditor Ernst & Young resigned, citing a “lack of willingness” to be associated with Supermicro’s financial statements. Furthermore, Nasdaq issued a warning about potential delisting if the missing 10-K was not filed promptly. Subsequent subpoenas from the Securities and Exchange Commission (SEC) and Department of Justice (DOJ) regarding its financial documents further diminished investor confidence. As a result, the stock plummeted to a one-and-a-half-year low of $18.01 on Nov. 14.

Assessing Supermicro’s Recovery

Despite a troubled late 2024, Supermicro’s stock value has more than doubled as the company has navigated these challenges. The firm hired a new auditor and successfully avoided delisting by filing its overdue 10-K this February. Notably, the SEC and DOJ have not initiated formal investigations or lawsuits against the company.

For fiscal 2025, Supermicro anticipates revenue growth of 74% to 101% as the AI market continues to expand, surpassing analysts’ projections of 60% growth. Furthermore, adjusted earnings per share (EPS) are poised to rise by 17%. Analysts predict a continued strong outlook for fiscal 2026, with expected revenue and adjusted EPS growth rates of 39% and 40%, respectively. These figures are particularly promising for a stock trading at just 10 times its forward earnings.

However, ongoing uncertainties such as the unpredictable tariffs from the Trump administration, stricter export limitations on AI chips, and increasing competition in the AI server market could impact valuations moving forward.

Will Another Stock Split Occur Soon?

While there is potential for Supermicro’s stock to double or triple in the next two years, significant challenges remain. A future stock split may not be justifiable unless valuations rise considerably. For long-term investors, the importance of a stock split diminishes. A stock split merely divides shares without altering the underlying value; market cap and key valuation metrics will remain unchanged.

In an era of commission-free trading and fractional shares, the stock price—whether $10 or $1,000—becomes less relevant. A stock split would mainly benefit options traders and employees who rely on options compensation.

Overall, investors should focus on three critical aspects: Supermicro’s robust growth strategy in the AI server niche, its recent recovery, and its current valuation which may appear attractive. For those who trust its management and believe the company has resolved prior regulatory and accounting issues, now might be a good time to consider purchasing stock.

Should You Invest $1,000 in Super Micro Computer Right Now?

Before investing in Super Micro Computer, it’s important to consider that other analysts have identified various stocks as the best options right now, indicating that Supermicro may not currently be on the top of the list.