Netflix Aims for $1 Trillion Valuation by 2030

Netflix (NASDAQ: NFLX), valued at $466 billion, aims to achieve a valuation of $1 trillion. According to co-CEO Ted Sarandos, the internal goal is to reach this benchmark by 2030. This objective suggests significant growth potential from its current stock price.

Doubling its value in under five years would require exceptional performance. As the leading streaming service worldwide, the question remains: how much more can Netflix expand its subscriber base?

International Growth as a Key to Valuation

Netflix has a clearly defined path towards its ambitious revenue goal of $78 billion by 2030, which requires a compound annual growth rate (CAGR) of 12.2%. As of the end of 2024, Netflix’s revenue stood at $39 billion.

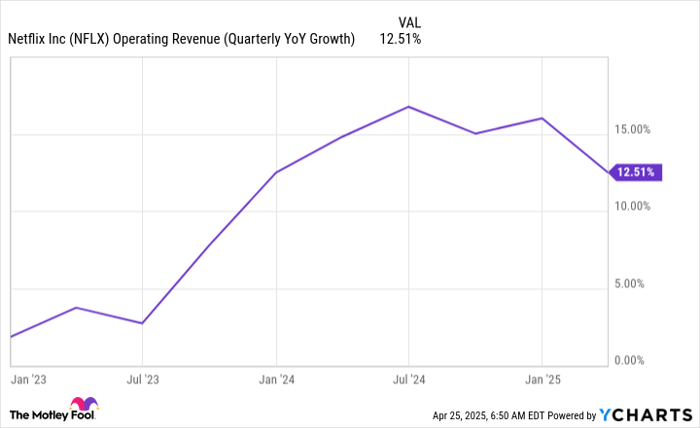

In the first quarter of this year, Netflix experienced a revenue growth of 12.5%, although this marked its slowest increase since Q4 2023. Nevertheless, management remains optimistic, predicting a revenue growth of 15.4% for Q2.

NFLX Operating Revenue (Quarterly YoY Growth) data by YCharts

Two crucial markets for Netflix’s growth are EMEA (Europe, Middle East, and Africa) and APAC (Asia-Pacific). The revenue growth in these regions saw increases of 15% and 23% year over year, respectively. In contrast, revenue growth in the U.S. and Canada was only 9%. This discrepancy highlights the necessity for Netflix to concentrate on EMEA and APAC to reach its $1 trillion valuation.

One strategic development is Netflix’s launch of an advertising platform in the EMEA region during Q1. By leveraging detailed audience analytics, Netflix can deliver more targeted advertisements on its ad-supported tier, enhancing effectiveness and driving ad prices upward. This feature is set to launch in the APAC region in Q2, further bolstering revenue potential.

Although Netflix offers ad-free options for a premium, its ad-supported tier presents an opportunity for growth, allowing it to reach broader audiences even in economically challenging times.

Evaluating Netflix’s Stock Price Realism

Netflix’s stock is currently not inexpensive. While many major tech stocks have seen declines of 20% to 30%, Netflix has reached new all-time highs. However, this comes at a steep price, with the stock trading at 43 times forward earnings, suggesting that substantial growth expectations are already factored in.

NFLX PE Ratio (Forward) data by YCharts

Despite a more optimized profit structure compared to the pandemic period, Netflix’s growth rates suggest that a much lower valuation of forward earnings would be more reasonable. A potential reduction in its valuation could mean Netflix would have to double its revenue merely to maintain its current stock price.

While Netflix’s goal of doubling revenue by 2030 seems achievable, reaching a $1 trillion market cap may be overly ambitious, given its current high valuation relative to peers.

Investment Considerations for Netflix

Before investing in Netflix, consider this:

The Motley Fool Stock Advisor recently listed what they believe are the top 10 stocks to buy, excluding Netflix. These alternatives may promise greater returns in the years ahead.

Reflect on Netflix’s past; an investment of $1,000 when it was first recommended on December 17, 2004, would have grown to $594,046! Or an investment in Nvidia from April 15, 2005, would now be worth $680,390.

It’s essential to note that Stock Advisor reports an 872% average return, vastly outpacing the S&P 500’s 160% return.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix. The Motley Fool has a disclosure policy.

The views and opinions expressed herein do not necessarily reflect those of Nasdaq, Inc.