Is Palantir Technologies a Safe Investment Amid Economic Concerns?

Typically, tariffs focus on tangible goods rather than software products. This situation positions software firms like Palantir Technologies (NASDAQ: PLTR) as potential secure investments. However, a decline in corporate profits at other firms may lead to reduced spending on enterprise software, adversely affecting demand for Palantir’s offerings.

Despite this, the rising popularity of Palantir’s AI-driven data analytics platforms suggests continued strong demand. Could this make it a prime choice for cautious investors wary of tariff impacts?

Minimal Business Disruption Expected for Palantir

Since the market downturn began in mid-February, Palantir’s stock has dropped about 40% from its peak but currently stands over 10% below that high. This market response indicates that Palantir could be a solid investment as tariff concerns grow.

Additionally, government agencies are significant users of Palantir’s software. In the fourth quarter, $455 million of its $828 million in revenue came from government contracts, reflecting a robust balance between commercial and government segments.

Having government clients is advantageous during economic downturns, as these entities often maintain spending levels unlike commercial companies. Yet, some investors might worry about the potential impact of a federal government efficiency initiative on overall spending.

This initiative is unlikely to negatively affect Palantir’s government business, as its core mission focuses on using AI to enhance data-driven decisions. This aligns with the goals of the efficiency initiative, which aims to improve governmental operations.

Given these factors, Palantir could emerge as a valuable asset in current market conditions, especially as Wall Street analysts anticipate the company will grow its revenue by 31% this year.

Valuation Concerns for Palantir

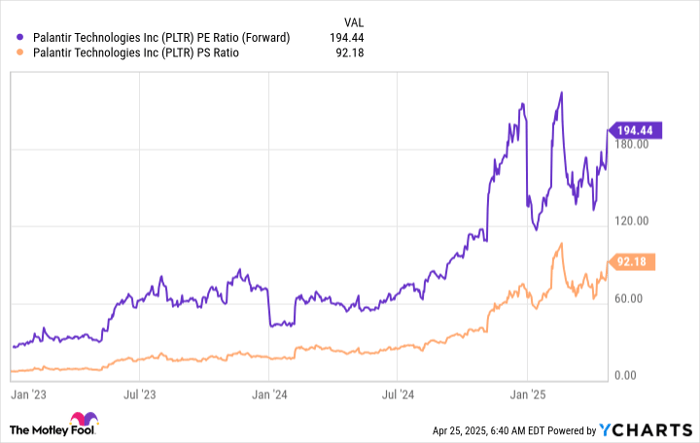

However, it’s vital to examine Palantir’s hefty valuation. The stock currently trades at 194 times forward earnings and 92 times sales—levels few firms can justify due to the high expectations these metrics suggest.

PLTR PE Ratio (Forward) data by YCharts; PE = price to earnings, PS = price to sales.

Typically, such high valuations are reserved for companies experiencing rapid revenue growth—often doubling or tripling YoY. However, Palantir’s growth is in the lower to mid-30% range. In contrast, Nvidia, with peak year-over-year revenue growth of 265% in 2024, has never exceeded 46 times sales or 50 times forward earnings.

The current valuation is excessive for Palantir, indicating it may be significantly overvalued. Justifying its current price is challenging.

If we assume a more optimistic scenario where revenue grows by 35% instead of the expected 32% in 2025, and project this growth over seven years while considering a leading profit margin of 30%, the resulting stock would then trade at 11 times sales and 36 times earnings—a more reasonable valuation for Palantir at maturity. This suggests that current prices already reflect significant future growth expectations.

Given the high success priced into Palantir’s stock, fulfilling market expectations will likely be challenging. Consequently, Palantir Technologies may not be the safe haven it once appeared, prompting investors to consider alternatives.

Should You Invest in Palantir Technologies Now?

Before making a decision to buy stock in Palantir Technologies, it’s essential to evaluate the following:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to invest in now. Notably, Palantir Technologies is not included in this list. The selected stocks have the potential for substantial returns in the upcoming years.

For instance, consider when Netflix was on this list on December 17, 2004… a $1,000 investment at that time would now be worth $594,046!* Alternatively, Nvidia was featured on April 15, 2005… a $1,000 investment would now total $680,390!*

Importantly, Stock Advisor boasts an overall average return of 872%—significantly outperforming 160% for the S&P 500. To explore the latest top 10 list, consider joining Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 28, 2025

Keithen Drury owns shares in Nvidia. The Motley Fool holds shares in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.