“`html

IonQ Stock Decline Presents Opportunity for Strategic Investors

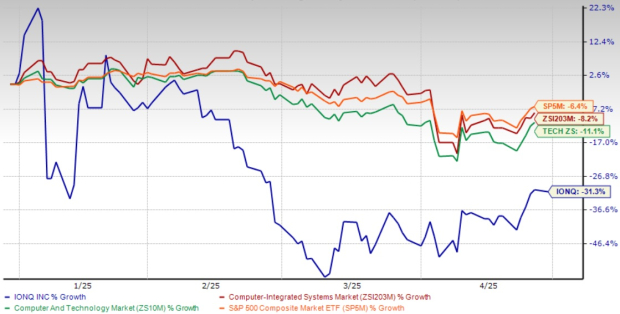

IonQ, a leader in quantum computing, has experienced a significant stock decline of 31.3% year-to-date, compared to an 11.1% drop in the broader Zacks Computer and Technology sector. This downturn may offer a compelling buying opportunity for forward-thinking investors. Despite recent challenges, the company’s strong fundamentals, expanding global presence, and impressive partnerships indicate substantial upside potential through 2025 and beyond.

IonQ is actively executing a global expansion strategy, establishing itself as the premier pure-play quantum computing firm. Recent developments highlight considerable momentum, especially in the lucrative Asia-Pacific region.

A significant distributor partnership with Toyota Tsusho Corporation enables IonQ to tap into Japan’s multi-billion-dollar quantum market, with the first local deal already secured. This venture builds on existing strategic collaborations with Hyundai Motors, Sungkyunkwan University, and Seoul National University.

Additionally, IonQ has solidified its position by signing a Memorandum of Understanding with AIST’s Global Research and Development Center for Business via Quantum-AI Technology, bolstering its integration into Japan’s research ecosystem.

Year-to-date Performance

Image Source: Zacks Investment Research

Technological Advancements Enhance IonQ’s Competitiveness

Recently, IonQ reached a milestone with Ansys by demonstrating quantum computing capabilities that outperform classical computing in designing critical medical devices, achieving processing speeds up to 12% faster. This achievement marks a pivotal moment for the practical deployment of quantum technology.

IonQ’s inclusion in the first stage of DARPA’s Quantum Benchmarking Initiative further underscores its technological edge. This initiative aims to define utility-scale quantum performance, with IonQ’s insights contributing significantly to establishing industry standards.

Strategic Acquisitions Expand Market Reach

IonQ has gained controlling interests in ID Quantique and acquired Qubitekk, placing the company at the forefront of quantum networking and communications. These strategic moves have broadened IonQ’s total addressable market and fostered synergies in secure quantum communication technologies.

With these acquisitions, IonQ now holds nearly 900 patents across quantum computing, networking, and sensing, creating a robust intellectual property portfolio. This extensive portfolio includes applications ranging from secure satellite communications to quantum-safe networking solutions.

Impressive Financial Growth and Increasing Adoption

IonQ’s financial trajectory showcases accelerating commercial momentum. The company reported $43.1 million in revenues for 2024, reflecting a remarkable 95% increase year-over-year, surpassing the high end of its guidance range. Full-year bookings reached $95.6 million, up 46% year-over-year.

For 2025, management anticipates continued robust growth, projecting revenues between $75 million and $95 million. The company expects to surpass the nine-figure revenue mark by 2026, signaling strong commercial adoption of its quantum technologies.

The Zacks Consensus Estimate for 2025 stands at $85 million, indicating year-over-year growth of 97.34%. The consensus for 2025 also predicts a loss of $1.05 per share, narrower than the loss of $1.56 reported in the previous year.

Image Source: Zacks Investment Research

The global launch of IonQ Forte Enterprise through Amazon Braket and IonQ Quantum Cloud marks another significant milestone, enhancing the accessibility of IonQ’s flagship quantum computer featuring #AQ36 performance. This development is fostering real-world applications across various sectors, including finance, pharmaceuticals, logistics, and artificial intelligence.

Navigating Competitive Dynamics and Stock Valuation

The quantum computing sector is intensively competitive, with formidable players like International Business Machines (IBM), Alphabet (GOOGL), and Microsoft (MSFT) making considerable investments in the technology. Newer entrants such as Baidu, Amazon, and Rigetti Computing are also competing for market share, which presents factors that investors must weigh when evaluating IonQ.

Currently, IonQ’s shares trade at a premium valuation of 62.17x two-year forward price-to-sales (P/S) ratio, significantly surpassing the Zacks Computer – Integrated Systems industry average of 2.88x. However, this premium reflects IonQ’s unique position as a leading player in quantum computing with evident technological advantages. Although traditional metrics might indicate overvaluation, they often overlook the exponential growth potential in transformative industries, particularly for companies like IonQ employing a trapped ion approach.

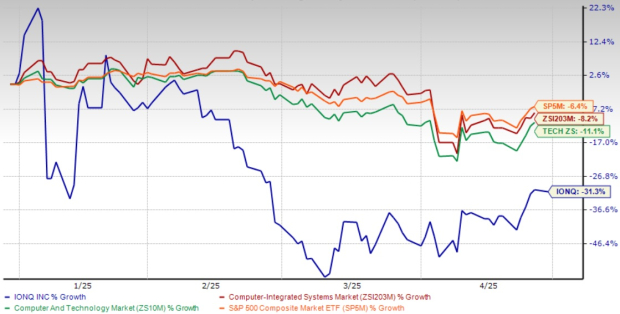

IONQ’s P/S Ratio Illustrates Premium Valuation

Image Source: Zacks Investment Research

Investment Strategy: Consider Buying for Long-Term Growth

Though IonQ commands a premium valuation compared to conventional tech companies, this reflects its pioneering role in a revolutionary technology with substantial growth potential. The company boasts a strong cash position of $363.8 million, bolstered by a recently established $500 million at-the-market facility, equipping it with resources for growth initiatives while maintaining its technological advantage.

The recent stock dip presents a strategic entry point for investors looking to capitalize on the quantum computing evolution. As IonQ consistently demonstrates quantum advantages in commercial applications and expands its global reach, the gap between its current valuation and future potential could narrow significantly.

“`

IonQ Offers Unique Investment Opportunity in Quantum Computing

IonQ, Inc. (IONQ) is an intriguing option for long-term, growth-oriented investors. The stock presents a chance to engage in a sector that may reshape the future of computing. Current valuations suggest this is a favorable entry point for those looking to capitalize on what could be one of the most noteworthy technological transformations of our time. Notably, IonQ holds a Zacks Rank of #2 (Buy).

Zacks Highlights Top Semiconductor Stock

Despite its size being just 1/9,000th that of NVIDIA, which has seen a remarkable rise of over 800% since its recommendation, IonQ’s potential remains significant. The semiconductor sector is set to benefit from escalating demand in key areas like Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is anticipated to increase from $452 billion in 2021 to $803 billion by 2028.

IonQ’s strong earnings growth and expanding customer base position it well to take advantage of this surge. Investors seeking insights can refer to additional Zacks resources for further information on various stocks in this evolving market.

This article originally published on Zacks Investment Research (zacks.com).

The views expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.