Cloudflare’s Strong Performance: Is Now the Right Time to Hold?

Cloudflare’s Recent Stock Movement

Image Source: Zacks Investment Research

Growth Fueled by AI and Security

Over the past month, Cloudflare Inc. (NET) saw its stock rise 7.3%, significantly outpacing the 0.8% increase in the Zacks Internet – Software industry. This performance raises a critical question for investors: Is it time to hold onto NET?

Cloudflare’s commitment to artificial intelligence (AI) and enhancements to its Zero Trust security platform position the company for substantial long-term growth. The robust adoption of its Zero Trust platform, designed to guard businesses against cyber threats, underlines its potential.

A significant win for Cloudflare was a three-year Secure Access Service Edge contract worth $4 million with a major U.S. investment firm in Q4 2024, further solidifying its standing in the enterprise security sector.

In the AI domain, Cloudflare’s Workers AI and AI Gateway platforms are experiencing high adoption rates, acting as key growth drivers. These innovations allow businesses to optimize both performance and security for their AI operations.

According to management, these AI solutions offer up to ten times the price performance compared to traditional hyperscalers. As AI adoption accelerates, NET’s multi-cloud and edge computing capabilities position it as an essential infrastructure provider in this swiftly expanding market.

Strong Financial Position

Cloudflare’s strategic market approach has led to enhanced sales effectiveness. In Q4, a significant number of customer conversions occurred, with 80% of new sales personnel concentrating on enterprise clients. This strategic focus is expected to facilitate larger contracts in 2025.

High-profile contracts reported in the last quarter include a $20 million five-year agreement with a Fortune 100 technology firm, along with a $13.5 million deal with a leading AI company to expand an existing partnership. Such contracts underscore Cloudflare’s increasing reliance on enterprise clients and validate its aspirations for long-term growth.

Cloudflare’s profitability metrics also reflect strength. The company’s operating income reached $67.2 million in Q4, marking a 69% year-over-year increase. Furthermore, the operating margin grew by 360 basis points to 14.6%, demonstrating improved operational efficiency and prudent cost management.

For 2025, NET anticipates non-GAAP earnings per share to range between 79 and 80 cents. The Zacks Consensus Estimate for Cloudflare’s 2025 earnings stands at 79 cents per share, representing a projected growth of 5.33% year over year.

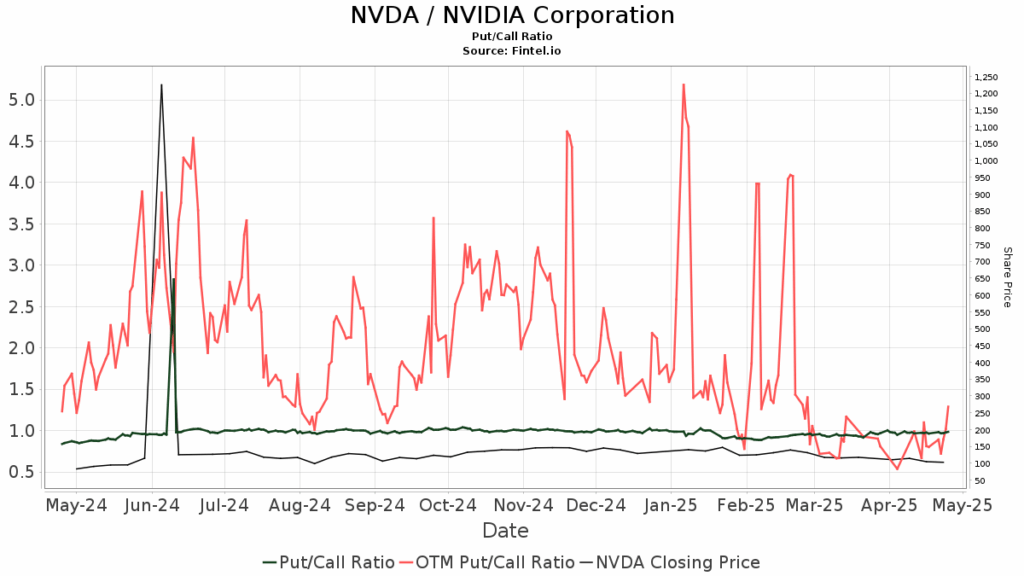

Price Trends and Earnings Outlook

Cloudflare, Inc. price-consensus-eps-surprise-chart | Cloudflare, Inc. Quote

Competitive Landscape Intensifies

Cloudflare operates in a highly competitive market for web infrastructure and security services, facing rivals such as Akamai Technologies, Inc. (AKAM), Fastly, Inc. (FSLY), and Amazon.com, Inc. (AMZN) through its Amazon Web Services.

Akamai offers a broad suite of infrastructure services, including content delivery network solutions and security features. Fastly, on the other hand, caters to similar needs, providing services like Compute@Edge and a robust security portfolio.

Amazon’s offerings include Amazon CloudFront and numerous security solutions, compounding the competition Cloudflare faces. The presence of emerging and niche players also adds to the competitive pressure in the sector.

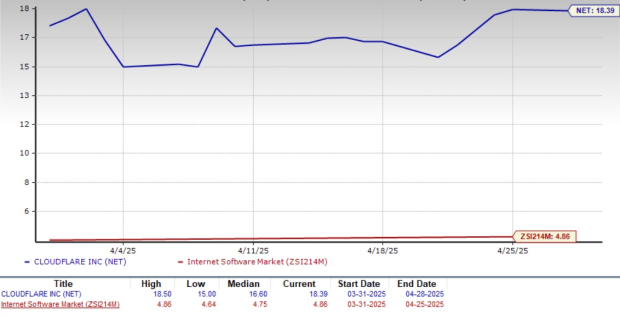

Valuation Concerns

Currently, Cloudflare is trading at a forward sales multiple of 18.39X, significantly higher than the Internet – Software industry’s valuation of 4.86X. This suggests that investors might find the stock overvalued at this time.

Cloudflare Valuation Chart

Image Source: Zacks Investment Research

Final Thoughts: Hold Cloudflare Stock for Now

While Cloudflare demonstrates robust growth prospects, its current overvaluation raises caution for investors. The expanding enterprise client base, strong financials, and innovation driven by AI are indicative of sustained growth potential.

For those willing to wait, holding Cloudflare stock appears to be a reasonable strategy. Currently, NET holds a Zacks Rank of #3 (Hold).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.