United States Steel Expected to Report Decrease in Earnings

United States Steel (NYSE:X) is scheduled to release its earnings report on May 1, 2025. Trefis anticipates sales of $4 billion, a decrease from $4.2 billion during the same period last year. This decline is attributed to ongoing pressures in the sector, including lower selling prices and postponed tariff impacts.

Current Financial Position

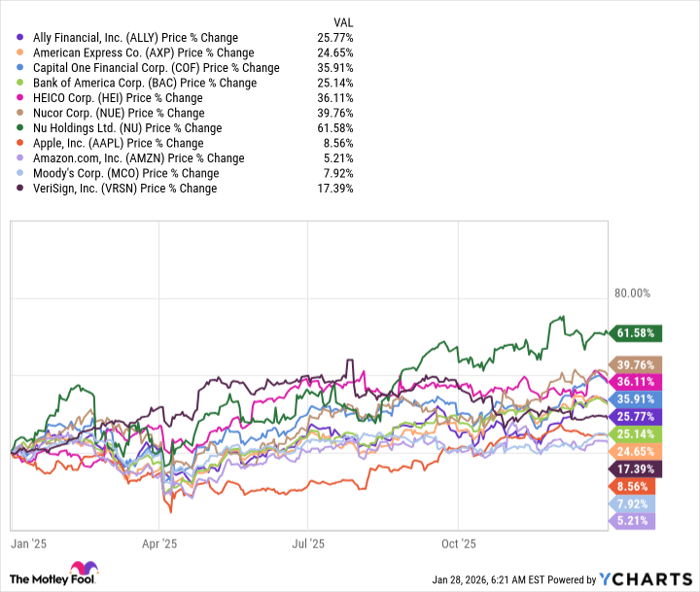

The company’s market capitalization stands at $9.6 billion. Over the past twelve months, U.S. Steel generated $16 billion in revenue, maintaining operational profitability with $155 million in operating profits and a net income of $384 million. For investors seeking lower volatility, Trefis offers a High Quality Portfolio, which has outperformed the S&P 500 and provided returns exceeding 91% since its inception.

Post-Earnings Return Analysis

Explore earnings reaction history of all stocks

Analyzing one-day (1D) post-earnings returns reveals interesting trends:

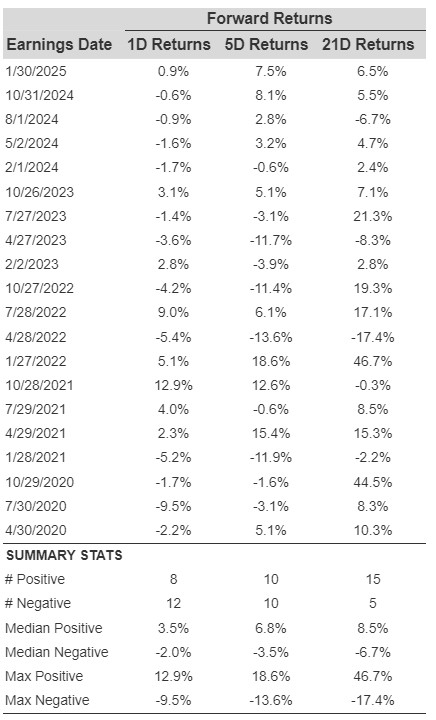

- In the last five years, U.S. Steel reported a total of 20 earnings data points, yielding 8 positive and 12 negative one-day returns. This represents a 40% rate of positive returns.

- However, in the last three years, the positive return rate has dropped to 33%.

- The median for the 8 positive returns is 3.5%, while the median for the 12 negative returns is -2.0%.

Further analysis of returns over 5-day (5D) and 21-day (21D) periods post earnings is presented in the table below.

Correlation Between Short-Term and Medium-Term Returns

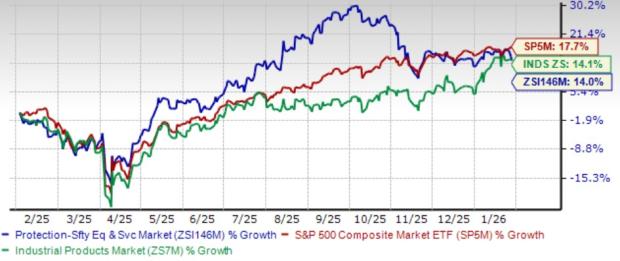

A lower-risk strategy involves assessing correlations between short-term and medium-term returns following earnings announcements. Identifying pairs with high correlation can guide trading decisions. For instance, if 1D and 5D returns correlate strongly, traders might consider a “long” position over the next five days following positive 1D earnings results. Correlation data from both 5-year and 3-year periods is available below. Notably, 1D_5D indicates the correlation between 1D post-earnings returns and subsequent 5D returns.

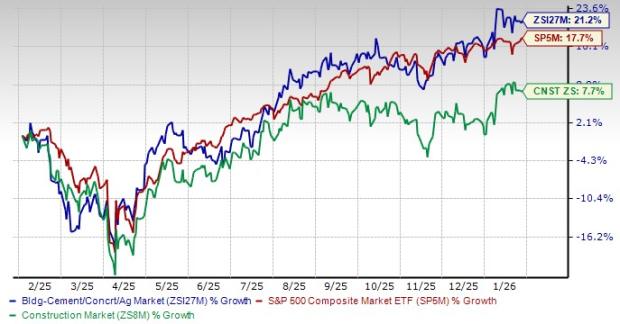

Impact of Peer Earnings on U.S. Steel

Peer performance can potentially influence how stocks react post-earnings. Historical data shows how U.S. Steel’s stock performance aligns with that of peers reporting earnings shortly before it does. For accurate benchmarking, peer returns are also measured by post-earnings one-day (1D) returns.

For a comprehensive investment strategy, consider Trefis’ RV strategy, which has outperformed the overall all-cap stocks benchmark, combining the S&P 500, S&P mid-cap, and Russell 2000 to deliver strong returns for investors.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.