Prudential Financial Set to Report Earnings Amid Market Uncertainty

Prudential Financial (NYSE: PRU) is scheduled to announce its earnings on April 30, 2025. Analysts predict earnings of approximately $3.18 per share for the quarter, a slight increase from $3.12 in the same period last year. Recent performance indicates that the company has experienced robust momentum across its global investment, insurance, and retirement sectors. Notably, the asset management division has performed well, bolstered by increased assets under management and higher net inflows. As of Q4, assets under management reached $1.512 billion, marking a 4% year-over-year growth. However, potential challenges may arise due to the recent stock market correction and ongoing uncertainties related to the trade dispute between the U.S. and its key trading partners.

With a current market capitalization of $37 billion, Prudential reported revenue of $71 billion and a net income of $2.7 billion over the past twelve months.

Insights on Earnings Reactions

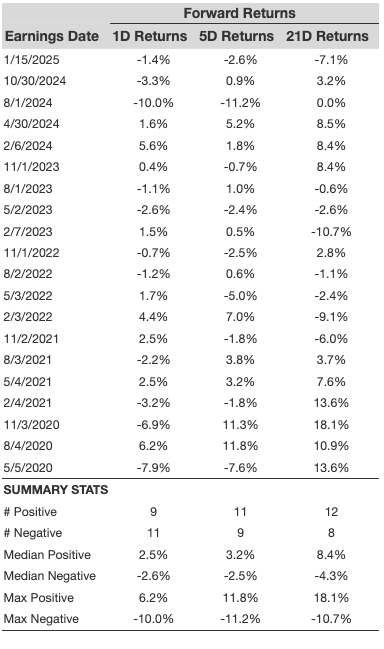

Understanding the stock’s historical performance post-earnings can provide valuable insights. Analysis of the last five years shows a total of 20 earnings data points, revealing 9 positive and 11 negative one-day (1D) returns. This indicates that positive returns occurred roughly 45% of the time. In contrast, this figure decreases to 42% when focusing on the last three years.

- The median return for the 9 positive instances was 2.5%, while the median for the 11 negative instances stood at -2.6%.

More detailed statistics regarding observed 5-day (5D) and 21-day (21D) returns following earnings are compiled in the table below.

Correlation of Returns

Examining the relationship between short-term and medium-term returns post-earnings can aid trading strategies. If a trader finds that the 1D and 5D returns show the highest correlation, they might opt to take a long position for the next five days following a positive 1D return. The correlation data is derived from both 5-year and 3-year historical analyses, noting the relationship between 1D post-earnings returns and subsequent 5D returns.

Influence of Peer Performance

Peer stock performance may also affect post-earnings reactions. Historically, stock pricing could reflect peer performance even before Prudential’s earnings announcement. Data comparing Prudential Financial’s post-earnings stock performance with its peers provides useful context for investors.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.