Analysts Predict Upside for SPDR Portfolio S&P 1500 ETF

At ETF Channel, we analyzed the underlying holdings of the ETFs we track. We assessed the trading prices of each holding against the average analyst target price for the next 12 months, calculating the weighted average implied target for the ETF itself. For the SPDR Portfolio S&P 1500 Composite Stock Market ETF (Symbol: SPTM), the implied target price is $79.72 per unit.

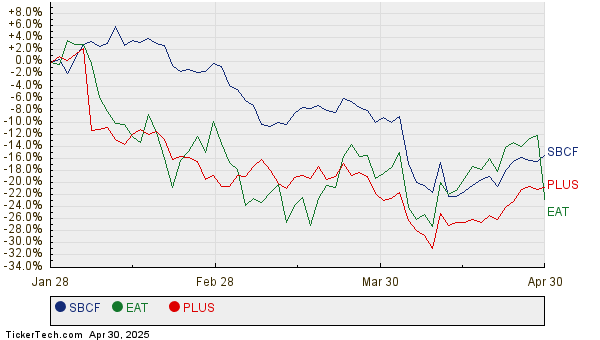

Currently, SPTM trades around $67.29 per unit. This indicates that analysts predict an 18.47% upside for the ETF based on the average target prices of its underlying assets. Noteworthy holdings with significant upside include Seacoast Banking Corp. of Florida (Symbol: SBCF), Brinker International, Inc. (Symbol: EAT), and ePlus Inc. (Symbol: PLUS). Specifically, SBCF recently traded at $24.05 per share, while the average target price is 23.35% higher at $29.67 per share. Meanwhile, EAT shows potential for 23.20% upside from its recent price of $136.89, with an average target of $168.65. Analysts anticipate that PLUS may reach a target price of $77.00 per share, presenting a 22.46% increase from its recent price of $62.88. Below is a twelve-month price history chart comparing the stock performance of SBCF, EAT, and PLUS:

Here is a summary table of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Portfolio S&P 1500 Composite Stock Market ETF | SPTM | $67.29 | $79.72 | 18.47% |

| Seacoast Banking Corp. of Florida | SBCF | $24.05 | $29.67 | 23.35% |

| Brinker International, Inc. | EAT | $136.89 | $168.65 | 23.20% |

| ePlus Inc | PLUS | $62.88 | $77.00 | 22.46% |

Are analysts justified in these target prices, or are they overly optimistic about where these stocks will stand in 12 months? Understanding the basis for these targets is critical. A high target price compared to a stock’s current trading price may signal future optimism. However, targets that are unrealistic may lead to future downgrades. Investors will need to conduct further research to evaluate these analyst predictions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Seth Klarman Stock Picks

• Top Ten Hedge Funds Holding RNER

• AA Price Target

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.