“`html

PDD Holdings Faces Challenges Amid Market Pressures in 2025

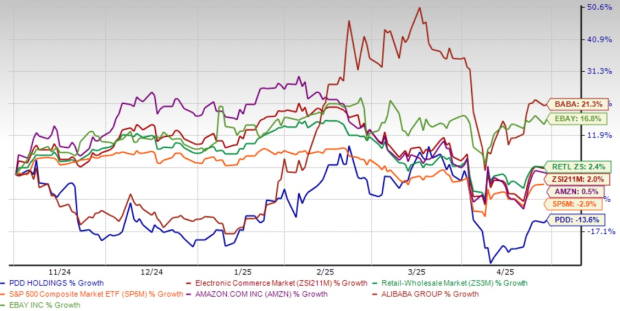

PDD Holdings Inc. (PDD), the parent company behind Pinduoduo and Temu, has had a rocky start to 2025. Shares have dropped 13.6% in the past six months, raising investor concerns about the company’s near-term prospects. This downturn is particularly surprising given PDD’s notable growth in previous years. As the stock continues its downward trend, investors are evaluating whether the current price represents a buying opportunity or warrants caution.

PDD Holdings has made significant strides in global e-commerce, capturing market share with its innovative social commerce strategies and competitive pricing. According to the company’s recent 20-F filing, PDD has been successful in growing its user base both in China and internationally, with Temu particularly gaining traction in North America and Europe.

Intensified Competition and Market Saturation

The competitive landscape is becoming more challenging. Major players like Amazon (AMZN), eBay (EBAY), and Alibaba (BABA) have ramped up their efforts in response to PDD’s growth. In China, the e-commerce market has reached saturation, compelling companies to engage in aggressive pricing and promotions, putting pressure on margins. Over the same period, shares of Amazon, eBay, and Alibaba returned 0.5%, 16.8%, and 21.3%, respectively.

6-Month Performance

Image Source: Zacks Investment Research

Financial Health and Future Projections

Despite market headwinds, PDD’s financial fundamentals remain solid. As of December 31, 2024, the company had a strong cash position of RMB331.6 billion (approximately $45.4 billion) in cash and short-term investments. This financial cushion provides PDD with flexibility to navigate market turbulence and continue investing in growth initiatives.

The Zacks Consensus Estimate for PDD’s revenues in 2025 is $64.94 billion, signaling an 18.74% increase from the previous year’s figure. Earnings are projected to be $11.99 per share, reflecting a growth rate of 5.92% from 2024.

Image Source: Zacks Investment Research

However, there are concerning trends. In the fourth quarter of 2024, cash generated from operating activities fell to RMB29.5 billion, down from RMB36.9 billion in the same quarter of 2023. This decline may suggest efficiency challenges or mounting competitive pressures. Management has indicated a focus on long-term ecosystem investments, which could affect short-term financial results.

Temu’s international expansion has necessitated substantial spending on marketing, logistics, and customer acquisition, which, while successful in growing the user base, has impacted short-term profitability. PDD’s increased research and development expenses also highlight its commitment to technological advancement, further straining margins.

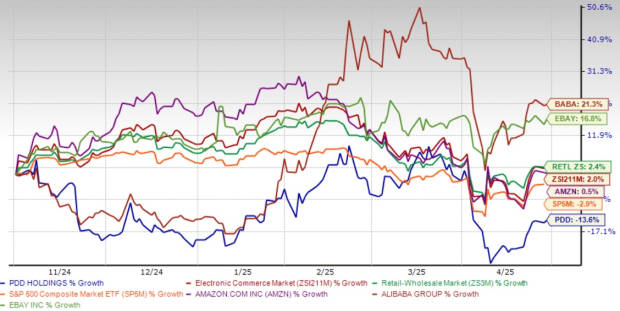

Valuation Insights: Opportunity or Warning Sign?

Currently, PDD trades at a forward P/E ratio of 8.33x, significantly lower than the Zacks Internet – Commerce industry average of 20.95x. This substantial discount may seem to present an attractive entry point for value investors.

However, this valuation disparity likely reflects genuine market concerns rather than an overlooked opportunity. Factors such as increasing competition, regulatory uncertainties in China and abroad, and a management focus on long-term growth may justify the discounted valuation.

Particular attention should be paid to the regulatory landscape affecting Chinese tech firms like PDD. Recent government actions have contributed to an unpredictable operating environment. While PDD has managed these challenges reasonably well thus far, regulatory risks could continue to weigh on its stock price.

PDD’s P/E F12M Ratio: Understanding Discounted Valuation

Image Source: Zacks Investment Research

Investment Outlook: Hold or Wait?

For current shareholders, it may be wise to hold positions given PDD’s strong market standing, ample cash reserves, and long-term growth outlook. Their commitment to innovation and international expansion could pay off, particularly if investments in logistics and technology create sustainable advantages.

On the other hand, investors considering entry into PDD may wish to wait. The current valuation discount, though seemingly appealing, accurately reflects tangible challenges the company faces. A more advantageous entry point may arise if PDD showcases enhanced efficiency or clearer regulatory dynamics, along with signs that international pursuits are nearing profitability.

Until those conditions are evident, prospective investors should closely track quarterly earnings for indications that PDD’s long-term investments are yielding competitive advantages and improved financial health. With current technical weaknesses, market sentiment appears negative, suggesting patience might yield better entry points in subsequent quarters. PDD currently holds a Zacks Rank of #3 (Hold).

“`