Digital Advertising Giants TTD and MGNI: A Comparative Analysis

The Trade Desk, Inc. (TTD) and Magnite, Inc. (MGNI) are prominent players in the digital advertising technology industry. TTD operates a leading demand-side platform that enhances advertisers’ focus on data-driven strategies. Conversely, Magnite serves as a supply-side platform (SSP), assisting publishers in managing and selling their ad inventory across various formats including streaming, online video, display, and audio.

Growth in digital advertising spend is anticipated to be fueled by rising mobile usage, the expansion of social media, and advances in programmatic advertising. According to a report by Grand View Research, the global digital advertising market is projected to grow at a compound annual growth rate (CAGR) of 15.4% from 2025 to 2030. The report further stated that video content will dominate digital advertising as brands increasingly leverage visual storytelling.

This upward trend in spending benefits both TTD and MGNI, prompting investors to consider which stock might represent a better investment opportunity in the digital advertising space.

Why TTD Might Be the Better Choice

TTD is experiencing notable growth due to increased digital spending in critical sectors, particularly Connected TV (CTV) and retail media. In the fourth quarter of 2024, The Trade Desk reported record spending exceeding $12 billion, reflecting strong advertiser demand. Moreover, TTD launched its Ventura Operating System for CTV, aimed at enhancing efficiency and transparency in CTV advertising. This system improves data management, a crucial element for scaling targeting capabilities as the CTV market expands.

The acquisition of Sincera, a prominent digital advertising data company, is expected to elevate TTD’s programmatic advertising platform by integrating valuable insights on data quality.

Additionally, The Trade Desk is simplifying its platform to enhance user experience without sacrificing functionality, thereby improving client onboarding and retention. The company is also aggressively adopting AI across various operations, catering to the evolving needs of clients during the ongoing AI revolution.

However, TTD’s transition to the Kokai platform by the end of 2025 could pose challenges, as the company currently operates with two platforms, leading to operational complexities. Any delays in adopting Kokai may impact performance and reduce upsell opportunities. While there remains strong demand for its ad-buying platform, TTD faces headwinds from shifting market conditions and competitive pressures. Increased macroeconomic uncertainty and escalating trade tensions could constrict advertising budgets. Major players like Google and Amazon add additional competitive pressure, complicating TTD’s market positioning.

Reasons to Consider MGNI

Magnite is seeing robust growth in CTV, with contributions excluding Traffic Acquisition Costs (ex-TAC) rising 19% year-over-year for 2024. For the entire year, MGNI reported ex-TAC contributions of $607 million and processed ad spending exceeding $6 billion. This growth is supported by escalating ad spend and programmatic adoption from prominent partners like Walmart, Disney, and Fox.

During its latest earnings call, MGNI referenced Netflix’s (NFLX) ad offerings as a significant business opportunity. Netflix aims to expand its global ad tier and revenue streams, and MGNI expects to become a key programmatic partner as the ad platform rolls out in 2025. The company forecasts ex-TAC growth of over 10% to mid-teens for 2025, excluding political factors.

The growth of live sports has also become a key contributor. MGNI’s expanded deal with Disney now incorporates live sports, international markets, and podcasts, while enhancing its international sports sector by adding new partners such as FIFA and Sky New Zealand. Additionally, the inclusion of generative AI tools in 2025 is anticipated to accelerate operational efficiencies and unlock new revenue streams.

MGNI’s SpringServe ad server and streaming SSP platform are instrumental in its growth strategy. By not reselling inventory, MGNI has established direct relationships with most major streaming platforms—except YouTube—allowing access to 92 million households in the U.S. and 75 million in EMEA. The ClearLine and SpringServe platforms are enhancing MGNI’s agency marketplaces, utilized by firms like GroupM and Horizon, resulting in more efficient media spending and stronger agency relationships. The company’s tech advancements have contributed to significant reductions in ad request costs in 2024, with costs for DV+ decreasing by 26% and for CTV by 45%.

Nonetheless, MGNI also faces intense competitive pressures from larger tech companies and macroeconomic uncertainties that may jeopardize ad budgets. Additionally, its DV+ (display, video, and mobile) segment underperformed in Q4 2024 due to unusual post-election spending patterns. Although MGNI reported recovery across its verticals, volatility remains a concern. Furthermore, heavy reliance on its CTV segment may elevate business risks, and increased expenses could dampen profitability.

Stock Performance of TTD and MGNI

Both TTD and MGNI stocks have been affected by a tech sell-off amid escalating trade tensions. Over the past three months, MGNI has experienced a decline of 28.5%, while TTD’s stock has seen a much steeper drop of 54%.

Image Source: Zacks Investment Research

Valuation Insights for TTD and MGNI

From a valuation perspective, TTD appears overvalued, receiving a Value Score of F, whereas MGNI holds a Value Score of B.

Image Source: Zacks Investment Research

In terms of the forward 12-month price/earnings ratio, TTD shares are trading at 28.37X, notably higher than MGNI’s 12.83X.

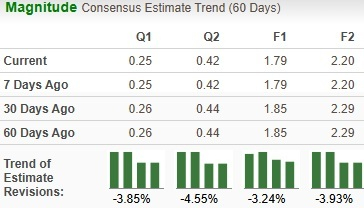

Analysts’ Earnings Estimates for TTD and MGNI

Analysts have significantly lowered their earnings forecasts for TTD, reflecting a shift in expectations related to the company’s future performance.

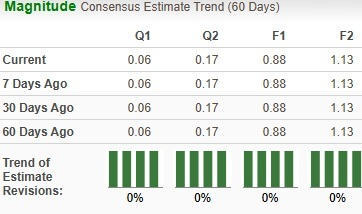

Assessing Investments: Magnite vs. The Trade Desk

While there are no revisions for Magnite, Inc. (MGNI), current data continues to illustrate notable differences in performance when contrasted with The Trade Desk (TTD).

Image Source: Zacks Investment Research

Investment Rankings: A Closer Look

Magnite holds a Zacks Rank of #3 (Hold), making it a more favorable choice compared to TTD, which currently has a Zacks Rank of #5 (Strong Sell). Magnite stands out due to its robust valuation and diverse partnerships. Additionally, its expanding presence in the Connected TV (CTV) sector with notable clients such as Netflix and Disney enhances its appeal.

Long-Term Growth Potential

Investors interested in artificial intelligence technology stocks may find MGNI as a smarter pick for long-term growth. Its strategic partnerships and solid market position provide a strong foundation for future development.

For those looking for valuable stock insights, Zacks offers a detailed list of today’s Zacks #1 Rank (Strong Buy) stocks.

This article summarizes insights from Zacks Investment Research. The views presented reflect the author’s perspectives and may not necessarily align with those of Nasdaq, Inc.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.