Comparing Innodata and BigBear.ai: Insights for Investors

As artificial intelligence (AI) continues to generate significant investor interest, two companies—Innodata (INOD) and BigBear.ai Holdings (BBAI)—are gaining attention for their distinct roles in the AI ecosystem. Both are small-cap firms, yet they feature different business models, risk profiles, and growth projections.

This analysis explores the strengths and weaknesses of each stock to determine potential upside as we approach the second half of 2025.

Assessing Innodata (INOD)

Innodata presents a promising opportunity at the intersection of generative AI, data engineering, and model safety. The company serves as a vital infrastructure partner for major tech players, positioning it strategically within the expanding global AI landscape. In 2024, Innodata posted record financial results, with revenue soaring nearly 100% year-over-year to $170.5 million, and adjusted EBITDA increasing by 250% to $34.6 million. Additionally, net income improved to a profit of $28.7 million from a loss in the previous year. Management anticipates continued revenue growth of over 40% in 2025, driven by strong deal flow and a solid pipeline of opportunities.

A key development is the launch of its Generative AI Test & Evaluation Platform, created in collaboration with Nvidia (NVDA). This platform provides vital tools for adversarial testing, model benchmarking, and vulnerability detection, addressing crucial enterprise and regulatory concerns regarding AI risks, biases, and transparency. Early adopters, such as MasterClass, underscore Innodata’s foresight and growing relevance in this essential sector.

Strategic partnerships also amplify Innodata’s strengths. The company works with five of the “Magnificent Seven” tech firms and three additional industry leaders. Its relationships with major companies like Microsoft Corp. (MSFT), Alphabet Inc. (GOOGL), and Amazon.com Inc. (AMZN) position it to benefit from the projected $325 billion in generative AI infrastructure investments in 2025. Innodata’s expertise in LLM data preparation, model fine-tuning, and safety evaluations aligns it well to capture these opportunities.

However, a notable concern is that nearly 48% of its 2024 revenues came from just one customer. Despite ongoing efforts to diversify, this concentration presents a significant risk should contract renewals falter or client priorities shift.

Evaluating BigBear.ai (BBAI)

BigBear.ai positions itself as a focused provider of decision intelligence solutions for government and enterprise clients. The company operates in higher-stakes sectors such as defense, logistics, and cybersecurity, where entry barriers are substantial and contracts often long-term.

The company’s contract backlog has grown significantly, from $168 million in 2023 to an anticipated $418 million by the end of 2024. This trend signals increasing confidence among key customers. A notable $13.2 million sole-source contract with the U.S. Department of Defense highlights trust in BigBear’s capabilities. Partnerships with Amazon Web Services and Palantir further affirm BigBear’s technological significance in critical applications.

Despite these strengths, BigBear faces immediate financial hurdles. In the fourth quarter of 2024, the company reported a significant net loss of $108 million, primarily driven by a $93 million non-cash charge related to convertible notes. Furthermore, rising SG&A expenses, linked to the acquisition of Pangiam and headcount increases, have negatively impacted EBITDA. Management forecasts adjusted EBITDA will remain in the low-single-digit millions in 2025, indicating that achieving profitability may still be a distant milestone.

BigBear’s reliance on U.S. government and defense contracts adds another layer of risk, especially in light of potential political gridlock and budget constraints. Its capital structure, including convertible debt maturing in 2029, complicates matters and demands careful management.

Comparing Estimates for INOD and BBAI

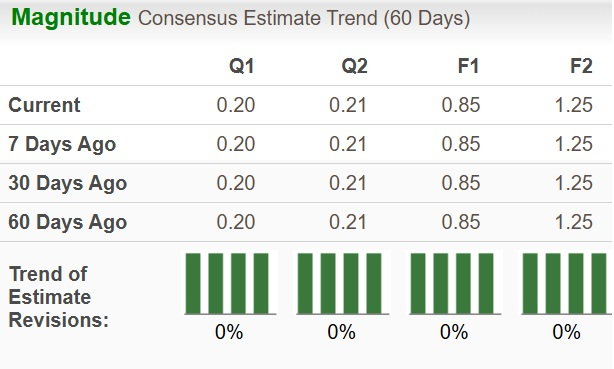

For Innodata (INOD), the Zacks Consensus Estimate for 2025 sales and EBITDA suggests a year-over-year growth of 44.38% in sales, while EPS is expected to decline by 4.49%. Notably, EPS estimates have remained stable over the past 60 days.

Image Source: Zacks Investment Research

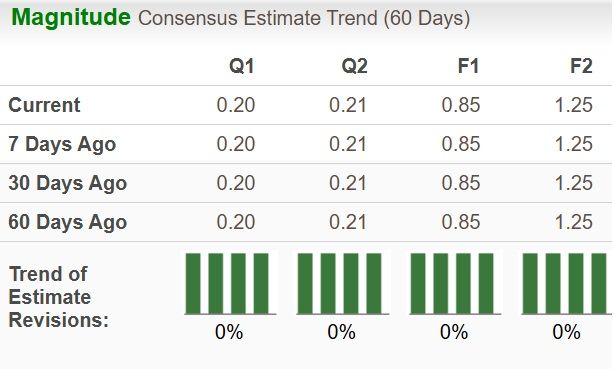

For BigBear (BBAI), the Zacks Consensus Estimate indicates a 5.67% increase in sales and a remarkable 80.91% increase in EPS for 2025. However, EPS estimates have been revised downward in the past 60 days, reflecting market adjustments. (Find the latest EPS estimates and surprises on Zacks earnings Calendar.)

Image Source: Zacks Investment Research

Stock Performance and Valuation of INOD & BBAI

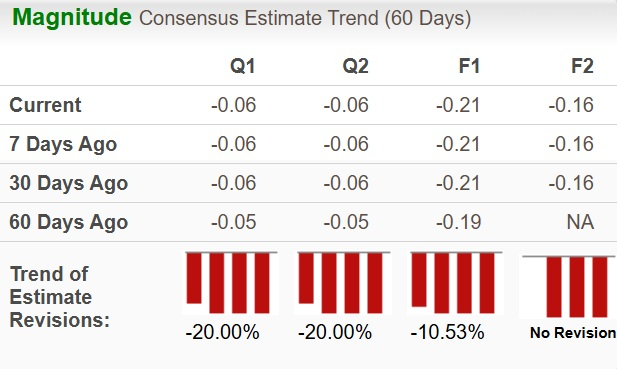

In the last six months, shares of BigBear.ai have increased by 125.2%, while Innodata shares have risen by 86.8%.

Image Source: Zacks Investment Research

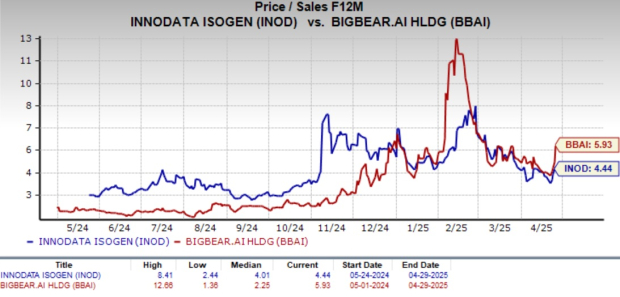

Currently, INOD trades at a forward 12-month price-to-sales (P/S) ratio of 4.44X, slightly above its one-year median of 4.01X. Conversely, BBAI appears to be trading at a premium, with a forward 12-month P/S multiple of 5.93X, significantly higher than its one-year median of 2.25X.

Image Source: Zacks Investment Research

Conclusion

Considering both companies, Innodata appears to be on a strong growth trajectory, bolstered by strategic partnerships and significant financial momentum in the generative AI sector. Its collaboration with Nvidia and the backing from major firms signal potential growth avenues. Existing shareholders may decide to hold their positions, while new investors could wait for more favorable pricing opportunities.

On the other hand, BigBear.ai’s unique positioning and expanding contract backlog provide a solid, though risky, profile focused on government and enterprise solutions. Balancing long-term potential against immediate financial challenges will be crucial for investor sentiment moving forward.

# Investors Weigh Potential in INOD vs. Financial Concerns for BBAI

Innodata Inc. (INOD) presents a strong strategic opportunity within a high-demand niche, appealing to investors seeking long-term growth. Nonetheless, the financial landscape is complicated by immediate losses, balance sheet risks, and reliance on government spending cycles. On the other hand, BigBear.ai Holdings, Inc. (BBAI) appears expensive, and downward revisions in earnings estimates underscore analysts’ cautious outlook.

Current Market Positions and Analyst Sentiment

In terms of Zacks Ranks, INOD holds a #3 (Hold) designation, indicating a neutral stance. Conversely, BBAI is rated #4 (Sell), which reflects a more negative assessment from analysts watching market trends.

Market Context

Investors are advised to consider both the potential long-term benefits of INOD and the broader financial implications tied to BBAI. Understanding these dynamics is crucial for making informed investment decisions.

Ultimately, as market conditions evolve, staying updated on these companies will be essential for investors looking to navigate the complexities of their portfolios.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.