Ford and GM: Navigating Challenges in a Competitive Market

Automakers operate in a capital-intensive industry facing intense competition. Recently, Ford Motor Company (NYSE: F) and General Motors (NYSE: GM) have seen their stocks decline due to uncertainty surrounding tariffs. However, both companies are investing billions to develop electric vehicles and are grappling with difficulties in the Chinese market.

Despite these challenges, there are compelling reasons to consider shares of either Detroit-based automaker. A key factor is their commitment to returning value to shareholders through dividends and buybacks.

General Motors’ Dedication to Share Buybacks

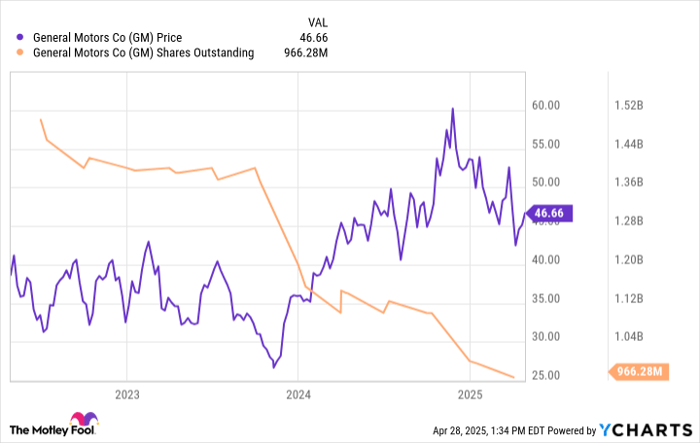

When share prices are undervalued, General Motors takes decisive action: it buys back shares. Currently, GM’s shares trade at a low price-to-earnings ratio of 7 times. In February, GM announced a significant increase in its quarterly dividend by 25% alongside a new $6 billion share buyback program. The company indicated that $2 billion will be repurchased quickly in the first half of the year, with the rest to be purchased at their discretion.

This trend highlights GM’s commitment to enhancing shareholder value. Previously, the company completed a $10 billion repurchase program, positively impacting its shares outstanding and the stock price.

Data by YCharts.

According to GM CFO Paul Jacobson, the company will continue to return excess capital to shareholders and reduce share count. While potential tariffs or a recession could pose risks, GM’s current buyback strategy has recently benefitted investors.

Ford’s Attractive Dividend Yield

Ford takes a different approach by offering a substantial dividend yield. The company recently declared a quarterly dividend of $0.15 per share and has issued supplemental dividends multiple times, including a recent payout of $0.15 per share.

Thanks to a depressed stock price, Ford’s dividend yield stands at an impressive 7.4%. This dividend focus indicates that much of Ford’s shareholder return is tied to its dividend policy. With a payout ratio just under 41%, the company is well-positioned to maintain, and potentially increase, its dividends year after year.

Data by YCharts.

While tariff impacts could challenge Ford, the company remains committed to its dividend strategy. The Ford family’s significant ownership stake helps ensure that dividends are a top priority, benefiting both the family and investors focused on yield.

Investment Insights for Shareholders

Currently, investing in automakers presents challenges. The threat of tariffs and the potential for an economic downturn pose real risks. Nonetheless, the primary reason to consider shares of General Motors or Ford is their commitment to shareholder returns through dividends and buybacks. Although these efforts might slow during downturns, they remain foundational for long-term investment strategies.

Evaluating a $1,000 Investment in Ford

Before investing in Ford Motor Company, consider recent analyses indicating other stocks may offer greater potential for returns. Staying informed on the best investment opportunities can guide strategic decisions in fluctuating markets.

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool recommends General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.