Experts Warn Trump’s Tariff Policies Could Fuel Inflation Risks

Concerns are growing among experts, including members of the Federal Reserve, that President Donald Trump’s tariff policies might trigger a rise in inflation. These tariff strategies remain uncertain, with reports indicating that trade agreements are currently being negotiated. Given the unprecedented nature of some proposals, predicting their impact on the Stock market and the broader U.S. economy is challenging.

Inflation reached a 40-year high in 2022, leading to a surge in the popularity of Series I Savings Bonds, commonly known as “I bonds.” As fears of inflation returning in 2025 loom, investors may want to consider them, especially after the Treasury Department’s recent interest rate increase for I bonds.

How I Bonds Can Shield Your Investments from Inflation

I bonds function similarly to other U.S. Treasury securities, but their yields change over time based on inflation.

Every six months, the Treasury Department announces new interest rates for I bonds, which consist of a fixed interest rate and an inflation adjustment. The fixed rate remains consistent throughout the bond’s life, while the inflation adjustment updates biannually from the purchase date.

The latest announcement states that I bonds purchased between May 1 and October 31 will now feature a total interest rate of 3.98%, an increase from the previous rate of 3.11%. This is composed of a 1.10% fixed rate and a 2.86% inflation adjustment. Regardless of when the bonds are bought during this period, holders are guaranteed this yield for the first six months, resetting to the current variable rate every six months afterward.

The key takeaway is this: If inflation increases due to tariff policies or other factors, the variable rate should correspondingly rise during the next adjustment. This means that higher inflation could yield higher returns from your I bonds.

Considerations Before Investing in I Bonds

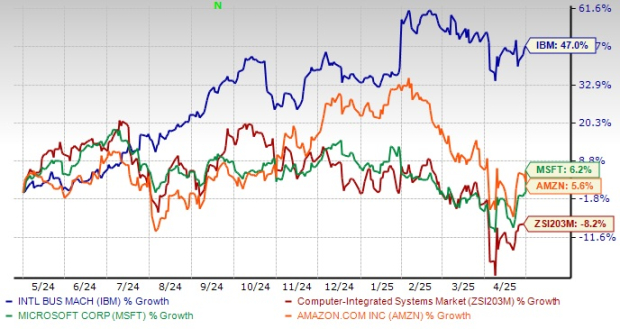

While I bonds may not outperform the Stock market over long periods, they serve a specific purpose. Their inflation protection can help mitigate adverse stock market responses during inflationary times. For instance, I bonds returned 9.62% in mid-2022, while the S&P 500 experienced a significant decline.

Despite their benefits, potential investors should be aware of a few drawbacks. First, I bonds cannot be redeemed within the first year, and cashing out before five years incurs penalties. This means they are best suited for individuals planning to hold them for at least that duration.

Another limitation is the maximum purchase limit of $10,000 per year. For high-net-worth investors, this cap can make it difficult to create a meaningful inflation hedge with solely I bonds.

Nonetheless, I bonds can be a valuable addition to your portfolio, whether or not inflation spikes in 2025. Given that the fixed rate component is currently historically high, it may be an opportune time to explore I bonds as a long-term fixed-income investment.

Exploring Investment Opportunities with $1,000

When it comes to stock tips, listening to analysts can yield positive results. Their insights have led to an impressive total average return of 880% for Stock Advisor compared to 161% for the S&P 500.

Recently, analysts have identified what they believe are the 10 best stocks for investors to consider right now, available through joining Stock Advisor.

*Stock Advisor returns as of April 28, 2025

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.