Dimensional US Real Estate ETF Shows Potential Analyst Upside

In our analysis of ETFs at ETF Channel, we evaluated the trading prices of underlying holdings against average 12-month analyst target prices. For the Dimensional US Real Estate ETF (Symbol: DFAR), the estimated target price based on its holdings is $26.45 per unit.

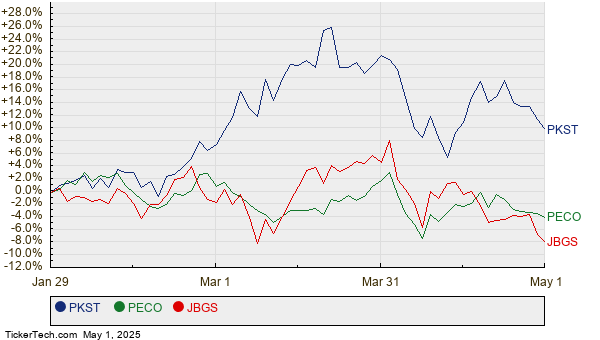

Currently, DFAR trades at approximately $23.30 per unit, suggesting that analysts see a 13.52% upside based on the target prices of its underlying holdings. Three notable holdings with significant upside potential include Peakstone Realty Trust (Symbol: PKST), Phillips Edison & Co Inc (Symbol: PECO), and JBG SMITH Properties (Symbol: JBGS). Recently priced at $11.51 per share, PKST has an average analyst target of $13.67, projecting an upside of 18.73%. Similarly, PECO holds a recent price of $34.68, with analysts targeting $39.90, indicating a 15.05% upside. For JBGS, the target price is $16.00, which is 14.45% above its recent price of $13.98.

Below is a twelve-month price history chart comparing the stock performance of PKST, PECO, and JBGS:

Here is a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Dimensional US Real Estate ETF | DFAR | $23.30 | $26.45 | 13.52% |

| Peakstone Realty Trust | PKST | $11.51 | $13.67 | 18.73% |

| Phillips Edison & Co Inc | PECO | $34.68 | $39.90 | 15.05% |

| JBG SMITH Properties | JBGS | $13.98 | $16.00 | 14.45% |

These targets raise important questions: Are analysts justified in their projections, or are they overly optimistic? It’s essential to consider whether analysts have valid reasoning for these targets or if they are lagging behind recent developments in the market. As high price targets compared to current trading prices can reflect optimism, they may also signal a risk of downgrades if expectations prove to be outdated. Investors should conduct thorough research to navigate these insights.

![]() 10 ETFs With Most Upside to Analyst Targets

10 ETFs With Most Upside to Analyst Targets

Additional Insights:

• SPNT Videos

• NLST Options Chain

• BSV YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.