UPS Faces Challenges Amid Rising Trade Tensions and Cost Cuts

Rising trade tensions present difficulties for companies reliant on transporting goods.

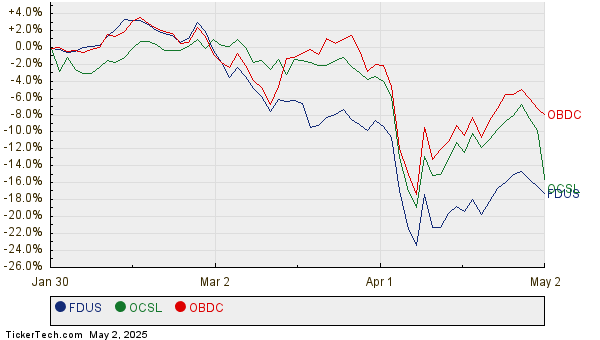

Shares of United Parcel Service (NYSE: UPS) plummeted as much as 18% following the U.S. tariff announcement in early April and struggled to recover in subsequent weeks. In April, UPS experienced a decline of 13.4%, according to S&P Global Market Intelligence data.

Ongoing Headwinds Through 2025

Transportation companies, including UPS, have been facing significant headwinds lately. In less than three years, UPS’s stock has lost over half its value.

Initially, macroeconomic concerns prompted large corporations to reduce inventory, leading to decreased demand for shipping services. Additionally, UPS has been streamlining its operations, focusing on its most profitable business segments and divesting from lower-margin clients like Amazon. While this may benefit UPS in the long run, it currently results in a revenue decline.

The potential for a trade war adds further uncertainty for investors. Although tariffs were anticipated, their scale surprised many. As UPS navigates this slowdown, it may take over a year for conditions to improve, keeping the stock under pressure.

Is UPS Stock a Buy?

UPS is actively addressing its challenges. Recently, the company announced a target of $3.5 billion in cost reductions by 2025, which includes closing over 100 less productive facilities. This year, about 20,000 positions are also slated for reduction.

In addition, UPS is expanding into higher-margin sectors, including shipping for healthcare and services for small to mid-sized businesses. In April, UPS planned a $1.6 billion acquisition of Andlauer Healthcare Group to boost its capabilities in Canada.

Despite being in a difficult cycle, the demand for transportation services remains strong. As one of the few firms with national reach and scale, UPS is well-positioned to capitalize on long-term trends.

For investors with patience, UPS offers an appealing dividend yield of nearly 7% at current prices. Those looking for a blend of growth and income might find this a favorable moment to consider investing in UPS shares.

Should You Invest $1,000 in United Parcel Service Now?

Before investing in United Parcel Service, consider this:

Analysts from The Motley Fool have highlighted a different set of investment opportunities, identifying the 10 best stocks for investors to consider, with UPS not included among them.

For context, when Netflix was recommended back in December 2004, a $1,000 investment would now be worth approximately $610,327. Similarly, Nvidia, recommended in April 2005, would yield about $667,581.

Notably, Stock Advisor boasts a total average return of 882%, far exceeding the S&P 500’s 161% over similar periods. Their current top 10 list is accessible for those interested.

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.