# Understanding the Potential of the Future AI Boom

Editor’s Note: The dot-com boom of the late 1990s transformed Wall Street and our way of life. The greatest wealth, however, was generated not during the initial frenzy but in the aftermath. This historical perspective informs current views on upcoming investment opportunities.

As the internet became integrated into everyday life, companies capitalized on this shift, seeing rises as high as 3,000%. As we look to the present, my colleague, Luke Lango, recognizes similar patterns emerging with the AI boom.

On May 7, Luke anticipates that the $7 trillion currently sidelined will prompt a buying spree, particularly benefiting a select group of stocks he brands the “MAGA 7” (Make AI Great in America). He will provide insights during The 2025 Summer Panic Summit tonight at 7 p.m. Eastern.

***************************

The Dot-Com Boom: A Historical Perspective

In late 1994, the launch of the Netscape browser opened the internet to the public. Although it initially went unnoticed, this event sparked one of the most significant investment booms in modern history. From 1994 to 1999, the Dot-Com Boom created numerous millionaires, proving that early entries weren’t the only way to profit.

Fortunes Made in the Second Half

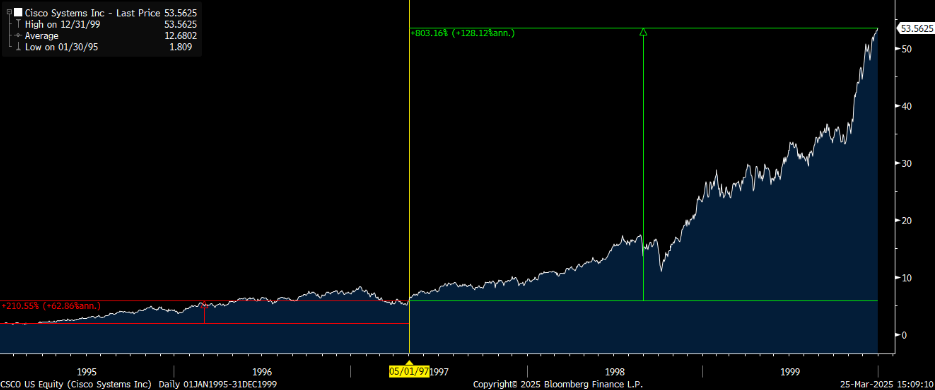

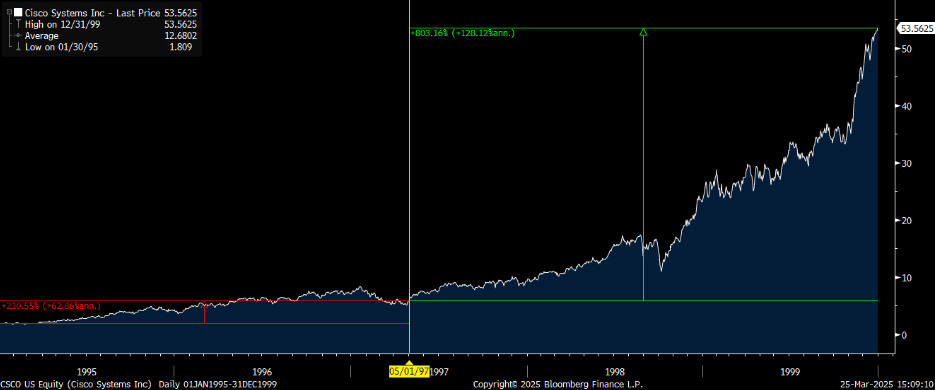

Remarkably, the largest gains occurred during the latter stages of this boom. For instance, Cisco Corp. (CSCO) saw its stock climb about 200% from early 1995 to mid-1997. However, from summer 1997 to late 1999, Cisco experienced a parabolic rise of 800%.

This means that while Cisco saw its stock triple in the first two years, it skyrocketed nearly ninefold in the subsequent two years:

Other Companies Follow Suit

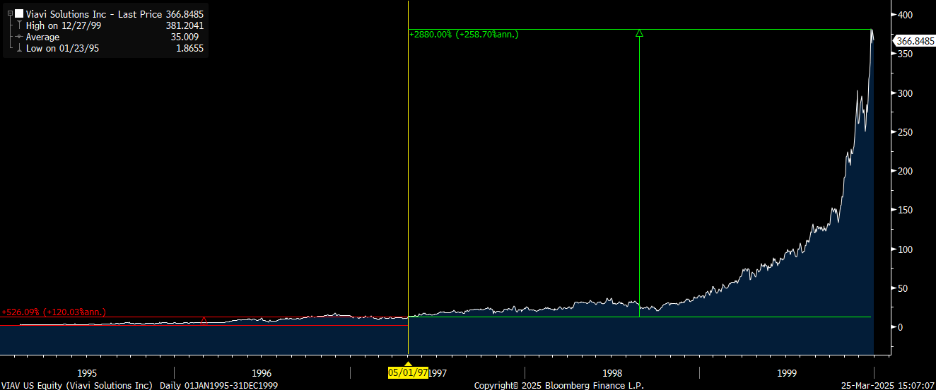

The trend wasn’t limited to Cisco. Similar patterns emerged for Viavi Solutions Inc. (VIAV), which surged approximately 500% in the boom’s first half and then exploded nearly 3,000% in the second half:

Other major players from the 1990s, such as Semtech Corp. (SMTC) and Applied Materials Inc. (AMAT), also witnessed their greatest gains after fear began to grip the market.

Understanding the Timing of Gains

This raises a crucial question: why did the most significant increases occur later in the boom rather than at the outset?

The answer lies in the technology that followed Netscape. Widespread acceptance of web browsers paved the way for critical applications such as Amazon, Google, and eBay to emerge.

These innovations profoundly changed consumer behavior and commerce.

The Dawn of the AI Boom

Presently, a similar scenario is unfolding, yet the focus is not solely on the internet. Instead, it revolves around advancements in artificial intelligence.

As we adapt to this next phase, investors would do well to observe patterns from the past to identify promising opportunities in the evolving landscape.

# Analyzing the Current AI Boom Through Historical Perspectives

In today’s discussion, we will explore three key charts that illustrate how the trajectory of the AI Boom closely resembles the Dot-Com Boom.

We’ll also examine the recent setbacks faced by the AI industry, the necessary catalysts for a recovery, and how to strategically position yourself ahead of potential market movements.

Let’s dive in.

Three Essential Charts to Examine Now

The origins of the AI Boom can be traced back to the launch of ChatGPT in 2022, marking a pivotal moment akin to the introduction of Netscape during the Dot-Com era. Since then, AI technologies have captured significant media attention, leading to substantial increases in AI-related stock values.

However, it is essential to recognize that we are not nearing the conclusion of this boom; rather, we are at a critical midpoint.

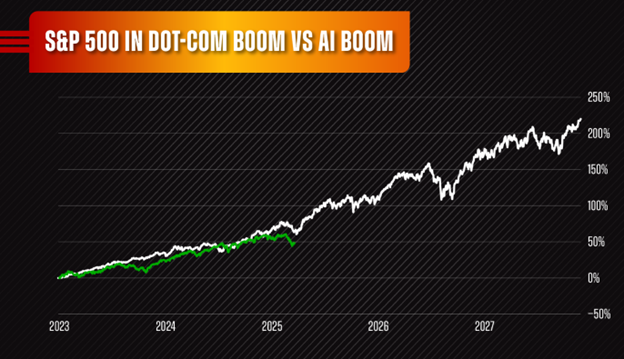

Drawing from historical trends, the next two years could present even more robust opportunities than the previous two—similar to how 1998 and 1999 surpassed 1995 and 1996 during the Dot-Com surge.

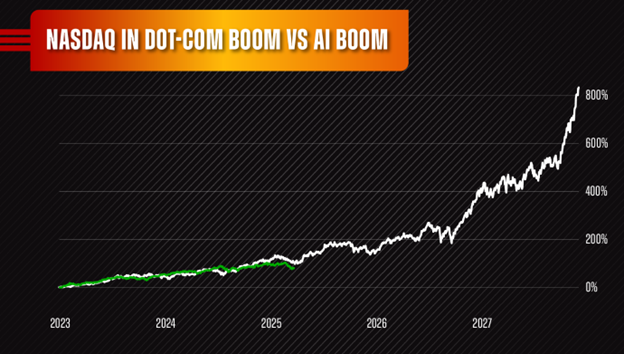

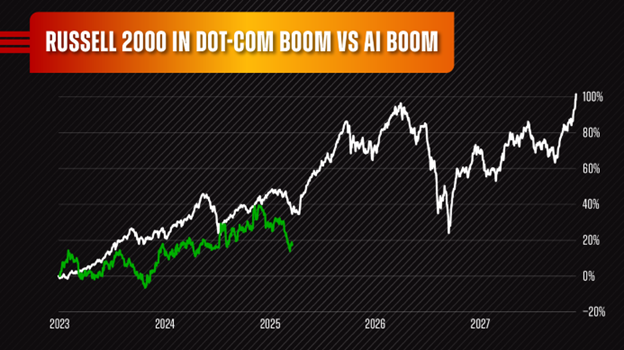

Our analysis includes tracking price movements of AI stocks from 2023 against the stock trajectories during the Dot-Com Boom from 1995 to its peak in 1999. The results reveal a strikingly similar pattern.

Consider the following:

First, the S&P 500…

Next, the Nasdaq Composite…

And finally, the Russell 2000.

This kind of market setup hasn’t been observed in nearly three decades.

As previously mentioned, unprecedented gains of 800%, 2,800%, and even 3,000% were possible during the Dot-Com Boom.

The correlation between the two eras is compelling and nearly identical across various sectors.

These findings suggest we are positioned for further upward momentum.

However, there are noteworthy differences this time around.

Recent months have witnessed a global trade war that has contributed to instability in the stock market.

We have seen both historic gains and significant drops in a short span, experiencing some of the highest one-, two-, and three-day performance spikes ever recorded. Additionally, we have encountered some notable downturns that have left investors apprehensive.

# Market Volatility: Is a Major Shift on the Horizon?

The S&P 500 has experienced significant fluctuations recently, particularly affecting tech stocks. The VIX, known as Wall Street’s “fear index,” has reached levels reminiscent of the COVID-19 pandemic crash and the global financial crisis.

This period marks one of the most turbulent three-month stretches in stock market history, prompting many investors to reconsider their stance on the AI boom.

But is the current market landscape truly different from past events?

Historical Context: The May 7 Catalyst

Reflecting on the Dot-Com Boom offers valuable lessons. In 1998, turmoil reigned with global currency crises, Russia’s default, and the collapse of Long-Term Capital Management. During this chaos, many proclaimed the end of the Dot-Com Boom.

Contrary to these fears, a monumental tech rally soon emerged.

As history suggests, we may be on the brink of a similar scenario. On May 7, significant statements from the White House, particularly from President Donald Trump, could instigate a $7 trillion market panic, catalyzing sidelined investors to re-enter the market.

This pivotal economic event links the current market fluctuations, trade war narratives, and the future of AI, impacting every investor’s portfolio.

The atmosphere mirrors 1997—driven by panic and apprehension—yet beneath it all lies a burgeoning opportunity.

If the economic powers in Washington act on May 7, it could ignite substantial market movement.

Tonight at 7 p.m. ET, I will lead a free briefing to discuss what I term The 2025 Summer Panic. This session will cover historical parallels, the ongoing AI boom, and potential market shifts on May 7—along with strategies for positioning yourself effectively.

Key factors surrounding an important economic event, which President Trump is advocating for, could trigger an upward trend in a select group of stocks as early as May 7.

All you need to do is RSVP here to participate in this informative session.

During the broadcast, I will highlight seven smaller companies I believe could emerge as significant beneficiaries of The 2025 Summer Panic.

Again, mark your calendar for tonight at 7 p.m. ET; what unfolds next may become a pivotal moment in market history.

Sincerely,

Luke Lango