“`html

AMD Stock Shows Potential for Recovery Amid Market Volatility

Advanced Micro Devices (NASDAQ: AMD) has seen its stock price fully retrace the AI-driven bubble, presenting what many analysts consider a technical and fundamental entry point worth examining. Currently, the stock is trading below the levels from the end of April, placing it at the lower end of the analysts’ target range without any premium reflecting the developments of the past two years.

Market Conditions and Growth Opportunities

Factors contributing to this situation include the normalization of legacy markets alongside rapid growth within data centers. While AMD may not replicate the revenue surges seen by competitors like NVIDIA, it remains a considerable player in the AI data center semiconductor industry, facing strong demand and actively planning for its long-term viability.

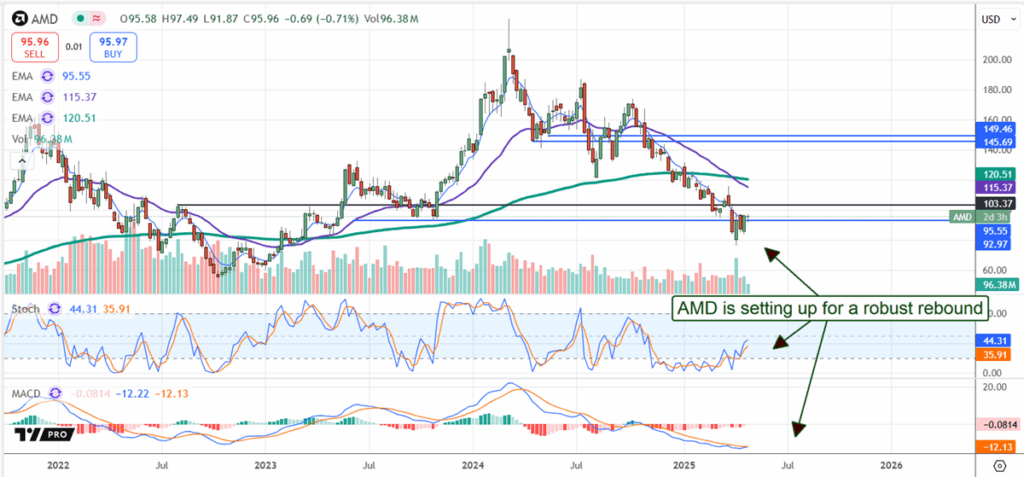

Technical indicators suggest strong potential for AMD as it has reached deep value levels. Current market conditions appear overextended, with significant support observed at the lower end of its long-term trading range. Key indicators, such as the MACD and stochastic oscillators, are positioned to signal clear entry points, with the stochastic already delivering solid signals.

Though the MACD is slightly lagging, it seems on the verge of achieving a bullish crossover before the earnings release, hinting at the possibility of a strong rally following the report.

Analysts Set Low Expectations, Potential for Upside

Upcoming earnings reports could serve as critical catalysts for AMD. Analysts have readjusted their revenue and earnings growth forecasts downward, potentially setting expectations too low. They anticipate a sequential decline in revenue, despite favorable demand trends in the data center segment and AMD’s recent achievements in gaming.

The company recently launched the Ryzen 9950X3D, which quickly sold out, leading to increased production plans. AMD’s EPYC and Instinct processors remain in high demand for data centers and AI applications, given their performance, scalability, and cost-effectiveness. This trend is likely to support stronger-than-expected results in the upcoming quarter.

Analysts maintain a bullish outlook for AMD, forecasting a substantial 45% upside from current levels. Despite negative sentiment affecting the stock price in early 2023, a solid earnings report and favorable guidance could drive upward revisions in analyst price targets, acting as additional catalysts for stock prices.

Valuation Insights and Future Projections

AMD’s stock appears fairly valued compared to the S&P at approximately 22 times current-year earnings forecasts made in late April. Yet, this seems undervalued given the company’s growth trajectory.

Forecasts indicate that AMD is likely to grow earnings at a high-teens rate in 2024, with growth continuing to accelerate through this year and next. Projections suggest that by 2030, the stock could decline to below a 9x valuation, with current estimates possibly underestimating future performance.

Market Share Gains Ahead

Current estimates may be conservative due to AMD’s potential to regain market share, particularly after losing a significant portion to NVIDIA. Despite this setback, AMD’s processor performance, cost advantages, and partnerships—such as the recent alliance with Rapt.ai—position it well for recovery and growth.

Rapt.ai specializes in optimizing GPU workloads for AI, which will improve the efficiency and effectiveness of AMD’s computing power. This collaboration aims to unlock significant capabilities for AMD in AI markets.

Nonetheless, risks remain. The most pressing concern for AMD in 2025 is potential tariffs that could be imposed on semiconductor materials and products. This issue has largely gone unnoticed, but if tariffs materialize, they could increase costs for AMD’s customers.

However, there is optimism for a trade deal in the near future, and AMD is proactively addressing supply chain challenges. Recent announcements indicate plans to initiate production of crucial processors, including EPYC GPUs, at Taiwan Semiconductor’s new facility in Arizona.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`