Netflix’s Recent Performance and Future Projections Analyzed

Netflix (NFLX) has recently captured the attention of financial analysts and investors alike. A look at its performance metrics reveals key indicators that may influence its stock trajectory in the near term.

Over the past month, Netflix shares have surged by +23.6%, in stark contrast to the Zacks S&P 500 composite’s decline of -0.5%. Additionally, the Zacks Broadcast Radio and Television industry, which includes Netflix, experienced an 8.6% gain during the same period. The pivotal question now is: What is the future direction of the stock?

Investor sentiment often shifts with media reports or rumors about a company’s business changes, leading to immediate stock price impacts. However, fundamental factors often dictate long-term investment decisions.

Earnings Estimates Revisions

At Zacks, we place great importance on changes in a company’s earnings projections. We believe that the present value of future earnings streams is pivotal in assessing a stock’s fair value.

Our analysis focuses on how sell-side analysts adjust their earnings estimates based on the latest business trends. Rising earnings estimates typically boost a stock’s fair value, attracting investors and prompting price increases. Studies have shown a strong link between changes in earnings estimate revisions and subsequent stock price movements.

For the current quarter, Netflix is projected to report earnings of $7.05 per share, reflecting a year-over-year increase of +44.5%. The Zacks Consensus Estimate has increased by +13.1% over the last 30 days.

Looking ahead to the current fiscal year, the consensus earnings estimate stands at $25.33, indicating a +27.7% change from the previous year. Over the past month, this estimate has been adjusted upwards by +3%.

For the following fiscal year, analysts expect Netflix to report earnings of $30.52, which signifies a +20.5% increase from prior-year projections. This estimate has likewise seen a +2.9% increase over the past month.

With a solid record of externally audited performance, our proprietary stock rating tool—Zacks Rank—provides a clear insight into a stock’s near-term price performance by leveraging earnings estimate revisions. The recent changes, accompanied by other earnings-related factors, have earned Netflix a Zacks Rank of #2 (Buy).

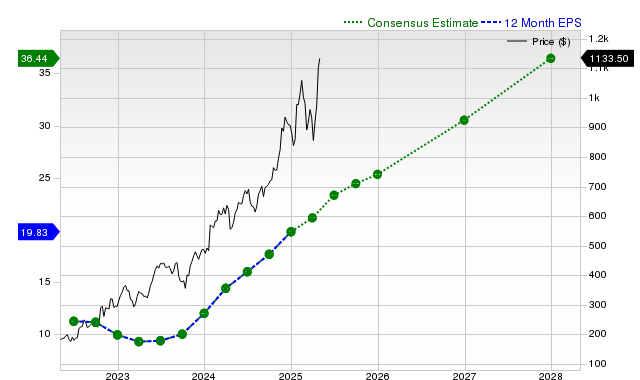

The chart below outlines the evolution of the company’s forward 12-month consensus EPS estimate:

12-Month EPS

Projected Revenue Growth

While earnings growth offers critical insights into a company’s fiscal well-being, revenue growth is essential for sustained earnings increases. A business must grow its revenues to maintain long-term profitability.

For Netflix, the consensus revenue estimate for the current quarter is $11.05 billion, indicating a +15.6% year-over-year growth. For the current and next fiscal years, estimates of $44.47 billion and $49.63 billion suggest growth rates of +14% and +11.6%, respectively.

Last Reported Results and Surprise History

In its most recent quarter, Netflix reported revenues of $10.54 billion, showcasing a year-over-year growth of +12.5%. The EPS was $6.61, compared to $5.28 a year ago.

When compared to the Zacks Consensus Estimate of $10.55 billion, the revenue reported represented a slight surprise of -0.04%, while the EPS surprise was +16.17%.

Notably, Netflix has exceeded consensus EPS estimates in each of the last four quarters and surpassed revenue projections three times during this period.

Valuation

Consideration of a stock’s valuation is crucial when making investment decisions. Accurately assessing whether the current price reflects the intrinsic value and growth potential of the business is essential.

To evaluate the current valuation, metrics such as the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-cash flow (P/CF) are compared against historical values. These comparisons help determine if a stock is fairly valued, overvalued, or undervalued. Relative assessments against peers provide additional context on valuation appropriateness.

The Zacks Style Scores system assigns a Zacks Value Style Score, ranging from A to F, to assess whether stocks are overvalued, correctly priced, or undervalued. Netflix currently holds a D rating, suggesting it is trading at a premium compared to its peers.

Conclusion

In summary, the insights provided herein may assist investors in evaluating the market discussion surrounding Netflix. Its Zacks Rank of #2 suggests potential for outperformance relative to the broader market in the short term.