Sterling Infrastructure to Report Q1 2025 Financial Results Soon

Sterling Infrastructure, Inc. (STRL) is set to reveal its financial results for the first quarter of 2025 on May 5, right after market close. In its last quarter, the company reported adjusted earnings per share (EPS) at $1.46, surpassing the Zacks Consensus Estimate by 9% and marking a 13.2% increase year over year. Total revenues rose by 3% from the previous year, reaching $498.8 million. Although it slightly missed revenue guidance, Sterling excelled in key profitability measures, underscoring its dedication to margin improvement. For the quarter, the gross margin exceeded 21%, and both adjusted EBITDA and operating income showed solid growth, highlighting the firm’s focus on disciplined cost management and execution.

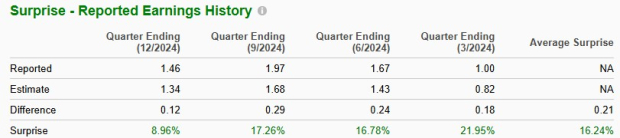

Sterling serves as a key player in the U.S. market, specializing in transportation, civil construction, and e-infrastructure solutions. The firm has consistently exceeded earnings expectations, achieving a positive surprise in each of the last four quarters with an average surprise rate of 16.2%, as depicted in the accompanying chart.

Image Source: Zacks Investment Research

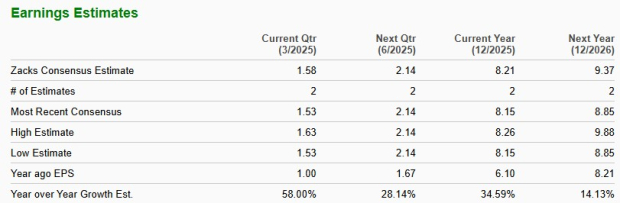

Current EPS Estimates for STRL

The Zacks Consensus Estimate for the third-quarter EPS remains steady at $1.58, reflecting a significant 58% increase compared to the same period last year. Revenue expectations also indicate a slight decline, with a consensus estimate of $415.6 million, which suggests a decrease of 5.6% year over year.

For the year 2025, STRL is projected to achieve a remarkable 34.6% growth in EPS compared to the previous year.

Image Source: Zacks Investment Research

Zacks Model Insights for Sterling

Currently, the Zacks model does not predict an earnings beat for Sterling this upcoming quarter. A company needs both a positive earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) for this to occur. Unfortunately, Sterling does not meet these criteria.

Earnings ESP: STRL currently has an earnings ESP of 0.00%. You can explore stocks that might outperform based on our earnings ESP Filter.

Zacks Rank: At present, the company holds a Zacks Rank of #3.

Factors Impacting Q1 Results

Sterling has positioned itself as a leader in the expanding e-infrastructure and transportation sectors. Its strategy of concentrating on high-margin projects, along with effective execution, has resulted in impressive earnings growth. With a healthy backlog and increasing federal infrastructure investments, Sterling seems well-prepared for a robust quarter ahead.

However, as is typical for this time of year, the first quarter is anticipated to be Sterling’s lowest revenue quarter due to seasonal factors.

Regarding performance by segment, the E-Infrastructure Solutions division, which is STRL’s largest segment, made up 47% of revenues in the fourth quarter of 2024. Key customers include Amazon.com, Inc. (AMZN), Meta Platforms, Inc. (META), Walmart Inc. (WMT), and Hyundai Motor Group. This segment is poised to gain from long-term capital investments in data centers and advanced manufacturing. Improved supply chain dynamics and a focus on large-scale projects are also expected to uplift revenues and margins. Notably, data centers constitute 50% of STRL’s E-Infrastructure backlog, driven by growing demand for AI technology.

The Transportation Solutions segment, accounting for 35% of total revenues in the last quarter, should see benefits from an uptick in demand and margin growth across various regions. This segment is expected to receive a boost from strong state and local funding, propelled by the Infrastructure Bill’s allocation of $643 billion for transportation initiatives and a dedicated $25 billion investment for airport enhancements over the next five years.

Sterling’s Building Solutions division, which contributed 18% to revenue in the fourth quarter, is focused on providing concrete foundations for residential and commercial projects. While the overall outlook is positive, the residential construction landscape is facing challenges due to affordability issues and elevated interest rates, limiting market activity. Additionally, weather-related disruptions in Dallas and Fort Worth hindered operations at the start of the quarter.

Strategic acquisitions have fueled STRL’s growth by broadening its operational scope and enhancing revenue streams. Ongoing investments aimed at profitability and operational efficiency are expected to contribute to substantial growth in the fourth quarter.

STRL Stock Performance Overview

STRL stock has seen a positive trajectory in the past month, outperforming both the Zacks Engineering – R&D Services industry and the broader construction sector, as indicated in the chart below.

Sterling’s 1-Month Price Performance

Image Source: Zacks Investment Research

Moving Averages for STRL Stock

Image Source: Zacks Investment Research

Sterling’s stock is currently trading above its 50-day and 200-day simple moving averages (SMAs), indicating positive price momentum in both short and long terms.

Let’s evaluate the value STRL may offer to investors in the coming weeks.

# Sterling Infrastructure Positioned for Continued Growth Amid Industry Challenges

Sterling Infrastructure, Inc. (STRL) has shown solid performance recently, even though it is currently trading at a slight discount compared to the industry average. As reflected in the chart below, STRL has a forward 12-month price-to-earnings (P/E) ratio of 17.4, which is lower than the Zacks Engineering – R&D Services industry average of 17.73. However, it is notably higher than its five-year median of 11.33.

Sterling’s Forward 12-Month P/E Ratio vs. Industry

Image Source: Zacks Investment Research

Reasons to Consider Holding STRL Shares

The infrastructure sector is poised for growth, and Sterling’s strong reputation, along with its deep experience with leading clients, positions it well to capitalize on this trend. Currently, the demand for data centers significantly exceeds supply, fueled by advancements in artificial intelligence and emerging technologies.

Strong earnings performance and effective margin management have enhanced Sterling’s market position, especially with its focus on growth areas such as data centers and infrastructure spending. Although the company anticipates seasonal challenges in the first quarter, full-year earnings per share (EPS) is projected to rise over 34% in 2025, supported by a solid backlog and strategic acquisitions.

The stock’s upward trend, as it trades above its 50- and 200-day moving averages, reflects positive investor sentiment. With its forward P/E of 17.4—slightly below the industry average—the current valuation appears reasonable. STRL presents a balanced risk-reward profile at this time.