Wayfair Reports Strong Q1 Earnings Surpassing Estimates

Wayfair W announced its first-quarter 2025 non-GAAP earnings of 10 cents per share, significantly better than the Zacks Consensus Estimate, which predicted a loss of 18 cents. This marks an improvement from a loss of 32 cents per share reported in the same quarter last year.

Net revenues reached $2.7 billion, surpassing the consensus target by 0.7%. The slight year-over-year increase of $1 million was mainly attributed to solid performance in the U.S. market.

The Last Twelve Months (LTM) net revenues per active customer rose by 4.7% year over year to $562, beating the Zacks Consensus Estimate by 7.68%. (Find the latest EPS estimates and surprises on Zacks earnings Calendar.)

However, the active customer base shrank by 5.4% year over year, totaling 21.1 million, which fell short of the consensus estimate by 5.8%.

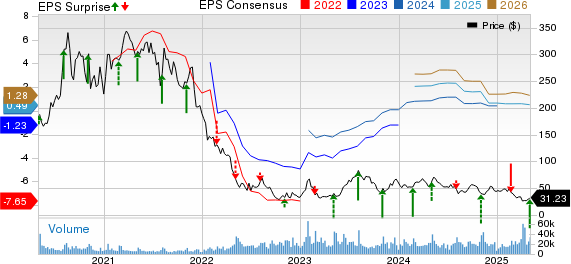

Wayfair Inc. Price, Consensus and EPS Surprise

Wayfair Inc. price-consensus-eps-surprise-chart | Wayfair Inc. Quote

Details of Wayfair’s Q1 Performance

In the U.S. segment, which accounts for 88.9% of total net revenues, revenues climbed 1.6% year over year to $2.4 billion, exceeding the Zacks Consensus Estimate by 1.55%.

Conversely, international net revenues, representing 11.1% of the total, fell 10.9% year over year to $301 million, missing consensus expectations by 2.77%.

Orders per customer were 1.85, slightly up from 1.84 in the previous year, outperforming the Zacks Consensus Estimate by 3.35%.

The average order value increased from $285 to $301, surpassing the consensus figure by 4.89%.

Wayfair delivered a total of 9.1 million orders during the quarter, marking a 5.2% decline from the previous year.

Meanwhile, repeat customers accounted for 7.3 million orders, or 80.5% of total deliveries, also down 5.2% year over year.

Notably, 63.4% of all delivered orders were placed via mobile devices, increasing from 63.1% in the year-ago quarter.

Wayfair’s Operating Results

The gross margin for the first quarter stood at 30.7%, improving from 30% a year earlier, driven by strategic reinvestments.

Adjusted EBITDA rose to $106 million, up from $75 million during the same period last year.

Customer service and merchant fees decreased by 8.5% year over year, totaling $107 million.

In contrast, advertising expenses grew by 6.2% to $344 million, while selling, operations, technology, and general and administrative expenses dropped significantly by 19.7% to $429 million.

Wayfair registered a GAAP operating loss of $122 million for the quarter, an improvement compared to the $235 million loss reported a year ago.

Balance Sheet & Cash Flow Overview

As of March 31, 2025, Wayfair’s cash, cash equivalents, and short-term investments remained at $1.4 billion, unchanged since December 31, 2024.

The company’s long-term debt rose to $3 billion from $2.882 billion at the end of 2024.

In the first quarter, net cash used in operations was $96 million, a considerable drop compared to $162 million in the previous quarter.

Wayfair also reported a free cash flow of negative $138 million during this quarter.

Guidance for Q2 2025

Wayfair anticipates revenues to remain flat compared to the previous year.

For the second quarter of 2025, the company projects gross margin to range from 30% to 31%, along with adjusted EBITDA expected to fall between 4% and 5%.

Zacks Rank & Investment Considerations

Currently, Wayfair holds a Zacks Rank #3 (Hold).

Other well-ranked stocks to consider in the sector include Carvana CVNA, Alibaba BABA, and On Holding ONON, all of which hold a Zacks Rank #2 (Buy).

Looking at year-to-date performance, Carvana shares have increased by 23.8%, while Alibaba has seen a rise of 42.2%. In contrast, shares of On Holding have dropped by 12.9%.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.