Jefferies Downgrades Apple to Underperform Amid Price Target Insights

Fintel reports that on May 2, 2025, Jefferies downgraded their outlook for Apple (XTRA:APC) from Hold to Underperform.

Analyst Price Forecast Indicates Potential Growth

As of April 24, 2025, the average one-year price target for Apple is 208.91 €/share. The forecasts range from a low of 123.36 € to a high of 272.86 €. This average target represents an increase of 11.12% from its latest reported closing price of 188.00 € / share.

Projected Revenue and EPS Growth

The projected annual revenue for Apple is 448,014MM, reflecting an increase of 11.90%. Additionally, the anticipated annual non-GAAP EPS stands at 7.23.

Institutional Fund Sentiment

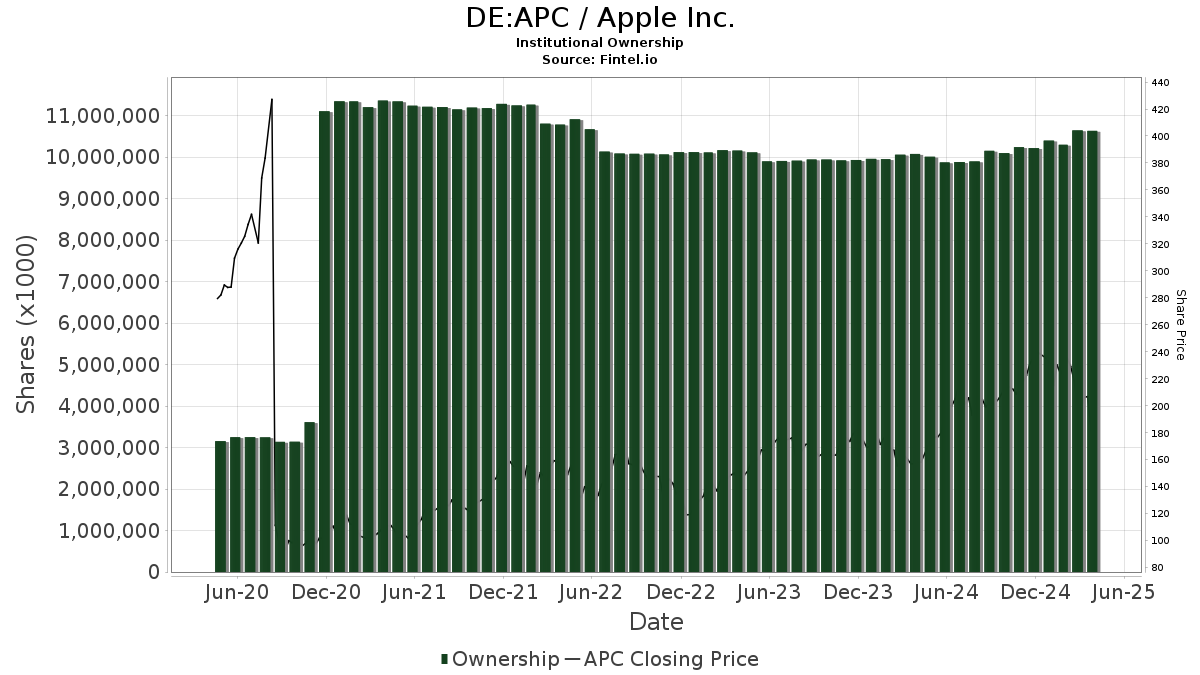

There are 7,665 funds or institutions reporting positions in Apple, showing an increase of 461 owners (6.40%) in the last quarter. The average portfolio weight of all funds dedicated to APC is 3.72%, marking an 8.73% increase. Over the past three months, total shares owned by institutions rose by 3.33% to 10,621,420K shares.

Shareholder Activity Among Major Investors

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 473,592K shares, representing 3.15% ownership of the company. This is an increase from their previous holding of 457,849K shares, a change of 3.32%. The firm raised its portfolio allocation in APC by 9.56% over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares retains 409,170K shares, equating to 2.72% ownership. Previously, the firm owned 398,082K shares, displaying a 2.71% increase. Its portfolio allocation in APC also increased by 4.51% in the last quarter.

Geode Capital Management possesses 340,165K shares, which is 2.26% ownership of Apple. They reported an increase from 333,858K shares, reflecting a growth of 1.85% in their allocation.

Berkshire Hathaway holds 300,000K shares, maintaining a 2.00% ownership with no change reported last quarter.

Price T Rowe Associates has 220,108K shares, contributing to 1.47% ownership. Their previous holding was 235,581K shares, indicating a decrease of 7.03%. Yet, they slightly raised their portfolio allocation in APC by 0.54% during the last quarter.

The views expressed here are those of the author and do not necessarily reflect the opinions of any institutional partner.