Fermium Research Upgrades PPG Industries Outlook to Buy

Fintel reports that on May 1, 2025, Fermium Research upgraded their outlook for PPG Industries (WBAG:PPG) from Hold to Buy.

Current Fund Sentiment Surrounding PPG Industries

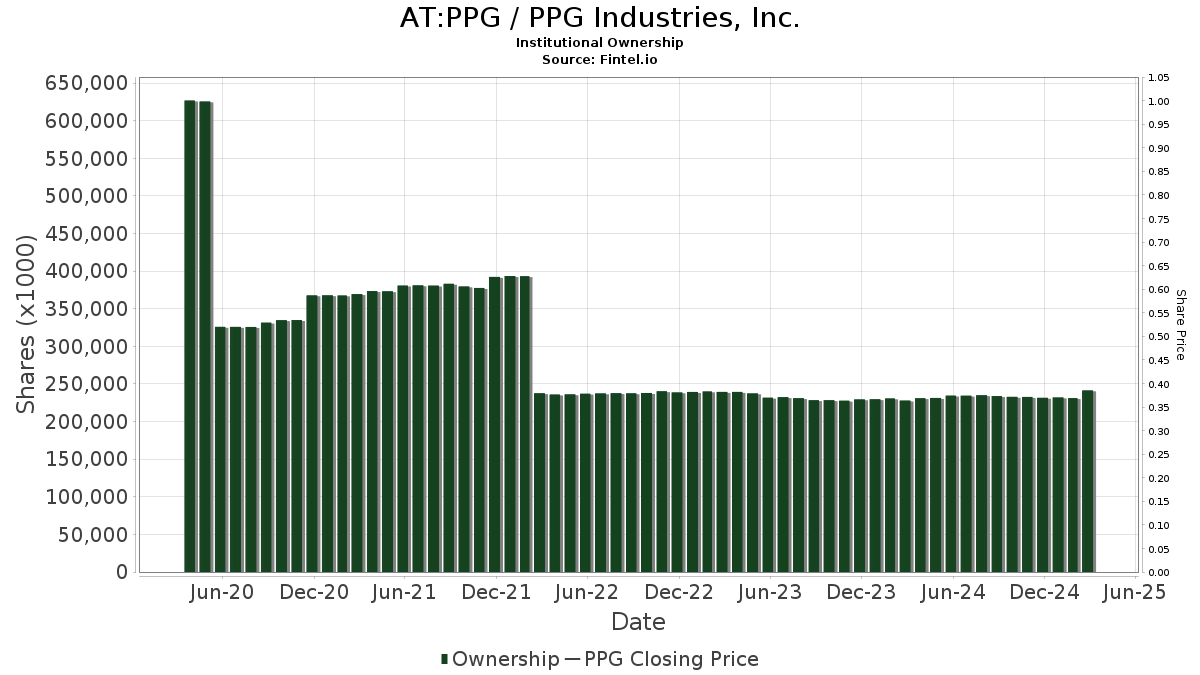

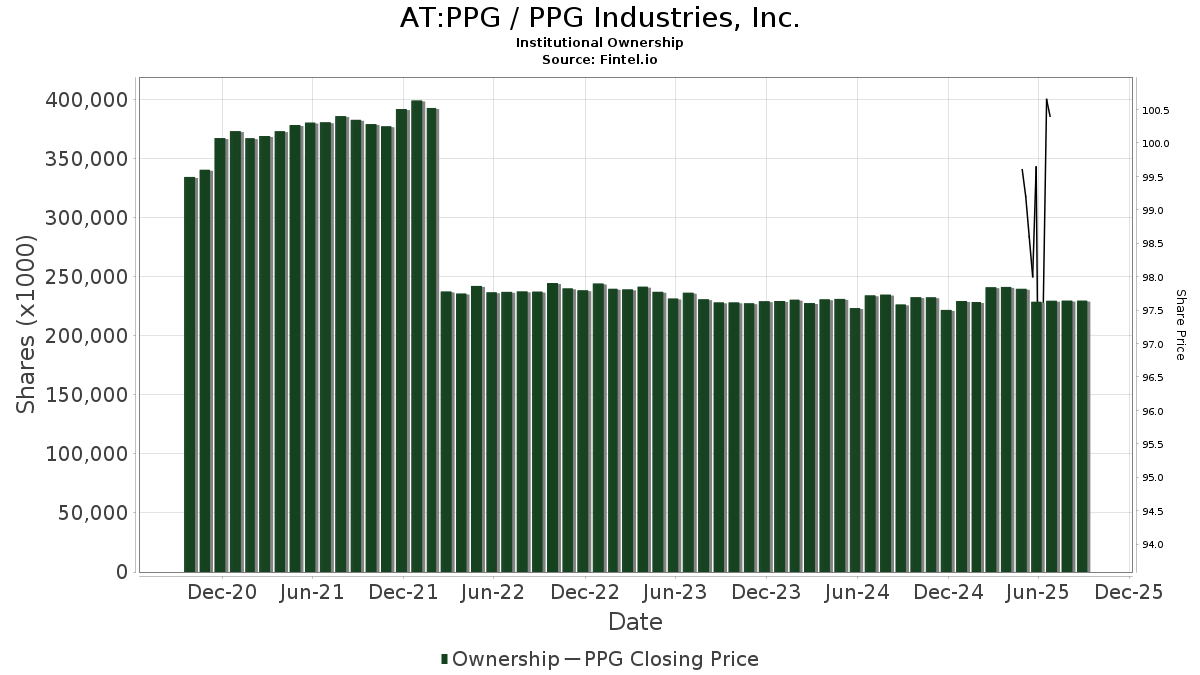

Currently, 1,891 funds or institutions are reporting positions in PPG Industries, reflecting an increase of 8 owners, or 0.42%, in the last quarter. The average portfolio weight allocated to PPG by all funds is now at 0.21%, an increase of 4.34%. Furthermore, total shares owned by institutions rose by 3.72% over the past three months, totaling 239,258K shares.

Updates from Major Shareholders

Wellington Management Group LLP holds 10,567K shares, representing 4.66% ownership of PPG. This marks an increase from their previous holding of 8,977K shares, a change of 15.05%. Consequently, the firm raised its portfolio allocation in PPG by 10.99% over the last quarter.

JPMorgan Chase, with a holding of 10,273K shares, represents 4.53% ownership. Previously, they owned 9,560K shares, indicating an increase of 6.93%. However, their portfolio allocation in PPG decreased by 5.05% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 7,270K shares, signifying 3.20% ownership. In its last filing, the firm reported a decrease from 7,391K shares, reflecting a decline of 1.67%. Their portfolio allocation in PPG has also declined by 12.59% in the recent quarter.

Meanwhile, the Vanguard 500 Index Fund Investor Shares (VFINX) holds 6,280K shares, representing 2.77% ownership. Previously, they reported owning 6,110K shares, an increase of 2.70%. Their allocation to PPG decreased by 12.32% over the last quarter.

Finally, Geode Capital Management holds 5,546K shares, reflecting a 2.44% ownership stake. In their last filing, they revealed ownership of 5,453K shares, marking an increase of 1.68%. However, they also decreased their portfolio allocation in PPG by 12.16% in the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.