Wells Fargo Upgrades iRhythm Technologies Outlook to Overweight

On May 2, 2025, Wells Fargo increased its outlook for iRhythm Technologies (LSE:0A7L) from Equal-Weight to Overweight.

Current Fund Sentiment

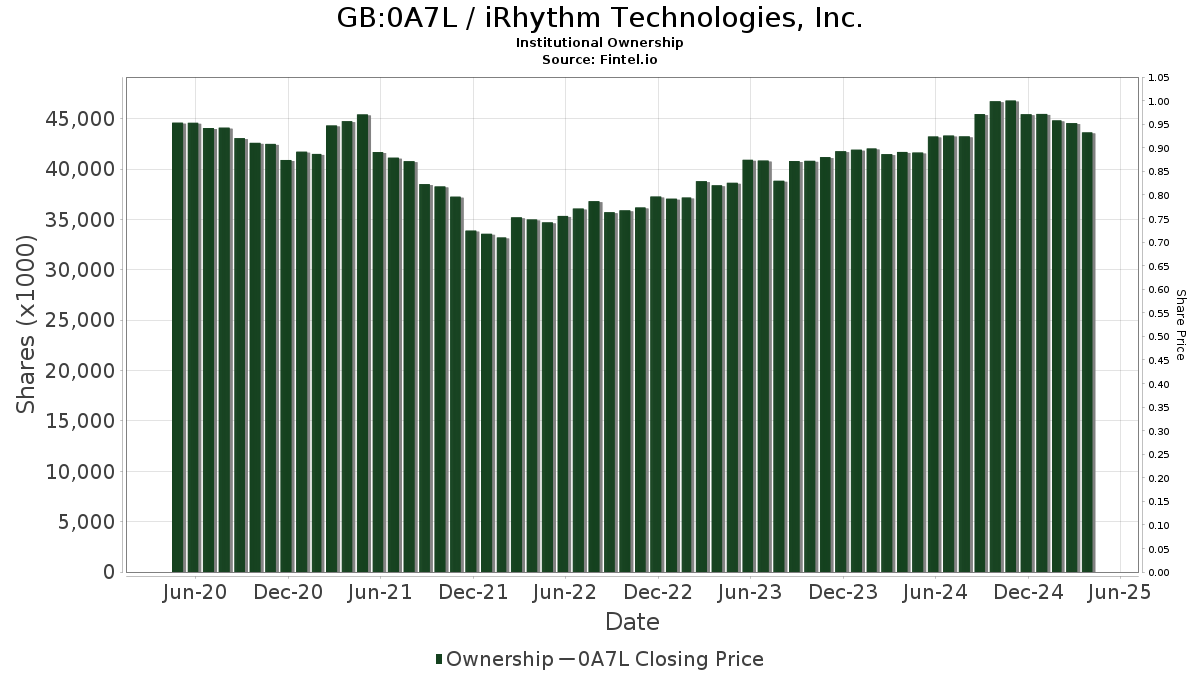

A total of 483 funds and institutions are reporting positions in iRhythm Technologies. This marks a decrease of 4 owners or 0.82% in the last quarter. The average portfolio weight of all funds invested in 0A7L is 0.21%, reflecting an increase of 14.68%. Over the past three months, total shares owned by institutions fell by 2.99% to 43,451K shares.

Activity Among Major Shareholders

Sands Capital Management now holds 3,177K shares, equating to 9.95% ownership of the company. Previously, the firm reported ownership of 2,123K shares, representing a 33.17% increase in holdings. Sands Capital also raised its portfolio allocation in 0A7L by 77.19% over the last quarter.

Artisan Partners Limited Partnership contributes 2,763K shares, or 8.66% ownership. In its last filing, it reported 2,780K shares, showing a decrease of 0.63%. However, the firm increased its portfolio allocation in 0A7L by 22.18% during the last quarter.

Capital Research Global Investors holds 1,637K shares, representing 5.13% ownership. Previously, the firm reported ownership of 1,955K shares, indicating a decrease of 19.42%. It also increased its portfolio allocation in 0A7L by 0.61% over the last quarter.

Mackenzie Financial owns 1,382K shares, accounting for 4.33% ownership. The firm’s previous filing noted 1,420K shares, marking a decrease of 2.74%. Mackenzie increased its portfolio allocation in 0A7L by 15.72% over the last quarter.

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 975K shares, representing 3.06% ownership. In its previous filing, it reported 1,008K shares, signifying a decrease of 3.38%. The fund increased its portfolio allocation in 0A7L by 15.78% in the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.