Seaport Global Downgrades Block Outlook Amid Shifting Analyst Sentiment

Fintel reports that on May 2, 2025, Seaport Global downgraded their outlook for Block (XTRA:SQ3) from Buy to Neutral.

Analyst Price Forecast Indicates Significant Upside Potential

As of April 24, 2025, the average one-year price target for Block stands at 75.73 €/share. The estimates vary, with a low of 45.17 € and a high of 112.88 €. This average price target suggests a 47.16% increase from its most recent closing price of 51.46 €/share.

Projected Revenue and Earnings

The anticipated annual revenue for Block is 27,352 million €, reflecting a 14.27% growth. Additionally, the expected annual non-GAAP EPS is 3.27.

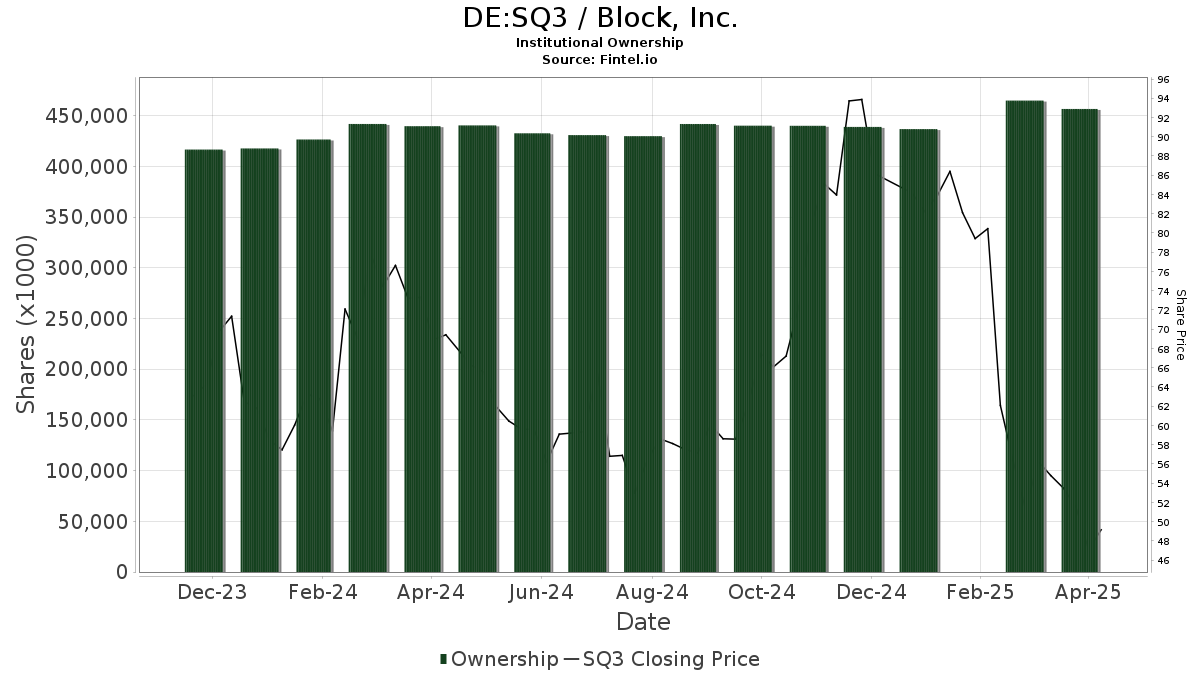

Fund Sentiment Overview

Currently, 1,813 funds or institutions have reported positions in Block. This marks an increase of 126 owners, or 7.47%, in the last quarter. The average portfolio weight of all funds invested in SQ3 is now 0.34%, up by 105.68%. In the past three months, total shares held by institutions rose by 4.68% to 458,094K shares.

Activity Among Major Shareholders

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 17,548K shares, representing 3.14% of Block. In its previous filing, the firm reported 17,637K shares, indicating a decrease of 0.51%. However, it increased its allocation in SQ3 by 24.14% last quarter.

JP Morgan Chase holds 17,237K shares, equating to 3.08% ownership. Previously, they reported owning 15,888K shares, marking a 7.82% increase. Their portfolio allocation in SQ3 was raised by 34.59% in the last quarter.

Vanguard Mid-Cap Index Fund Investor Shares (VIMSX) retains 12,028K shares, or 2.15% ownership. The firm’s previous filing indicated 11,757K shares, representing a 2.25% increase. They also boosted their portfolio allocation in SQ3 by 28.54% over the last quarter.

Baillie Gifford owns 11,168K shares, translating to 2.00% of Block. In the prior filing, they reported 10,233K shares, showing an increase of 8.37%. The firm increased allocation in SQ3 by 41.87% recently.

Sands Capital Management holds 10,340K shares, accounting for 1.85% ownership of the company. Previously, they owned 11,228K shares, reflecting a decrease of 8.59%. Nevertheless, they raised their portfolio allocation in SQ3 by 13.67% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.