Piper Sandler Downgrades Becton, Dickinson Outlook to Neutral

Fintel reports that on May 2, 2025, Piper Sandler downgraded their outlook for Becton, Dickinson and Company (LSE: 0R19) from Overweight to Neutral.

Analysts Expect Price Increase

As of April 24, 2025, the average one-year price target for Becton, Dickinson is 275.66 GBX/share. The estimates range from a low of 247.65 GBX to a high of 337.85 GBX. This average price target indicates a potential increase of 65.50% from the latest reported closing price of 166.56 GBX/share.

Projected Revenue Gains

Projected annual revenue for Becton, Dickinson is 21,727 million, representing a 4.12% increase. The expected annual non-GAAP earnings per share (EPS) stands at 15.17.

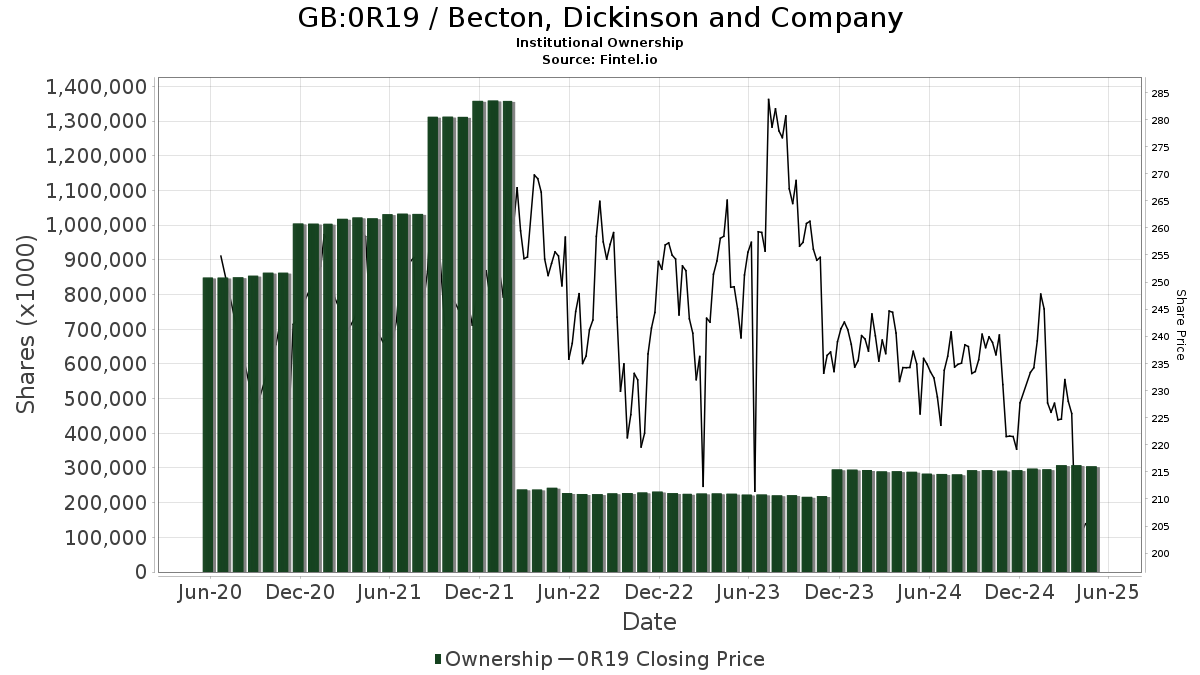

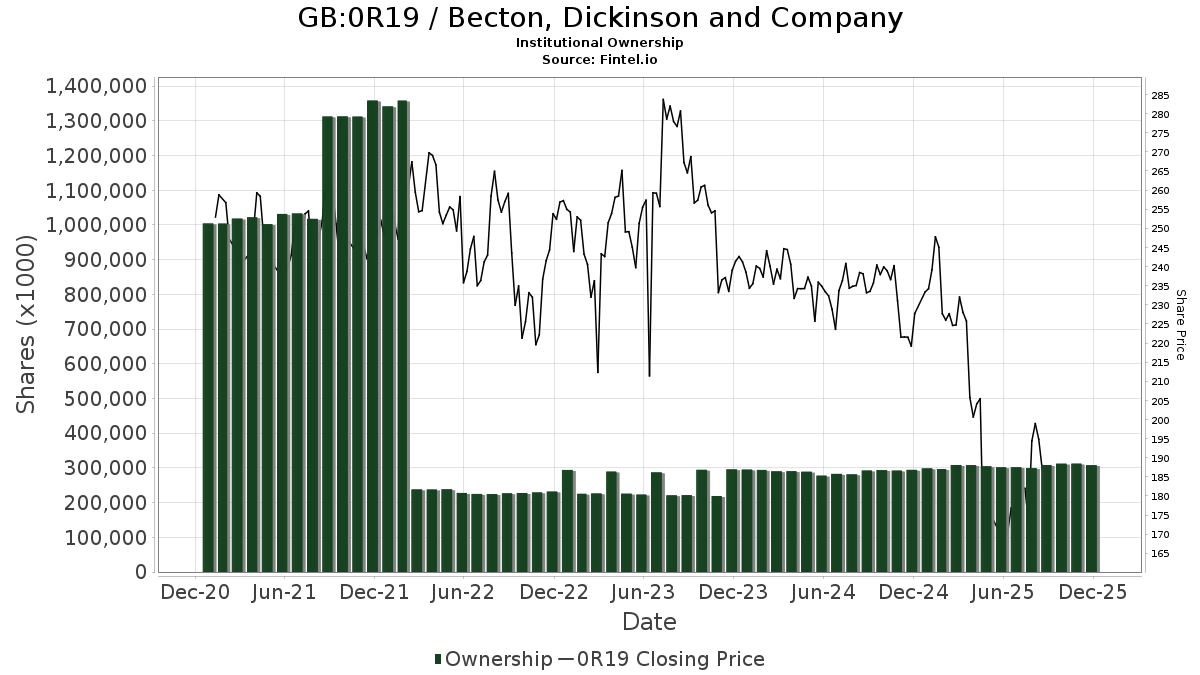

Fund Sentiment Analysis

Currently, there are 2,549 funds or institutions reporting positions in Becton, Dickinson. This marks a 76 owner (3.07%) increase in the last quarter. The average portfolio weight of all funds dedicated to 0R19 is 0.39%, up by 1.75%. Total shares owned by institutions rose by 2.64% in the last three months, totaling 305,221K shares.

Shareholder Movements

Price T Rowe Associates holds 12,347K shares, representing 4.30% ownership of the company. Their previous filing indicated ownership of 13,598K shares, showing a decrease of 10.14%. The firm has reduced its portfolio allocation in 0R19 by 14.46% over the last quarter.

T. Rowe Price Investment Management currently owns 12,127K shares, equivalent to 4.22% ownership. In its last filing, it reported 8,907K shares, an increase of 26.55%. The firm has raised its portfolio allocation in 0R19 by 31.05% in the last three months.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 9,058K shares, amounting to 3.15% ownership. Their prior filing indicated 9,160K shares, a decrease of 1.13%. The portfolio allocation in 0R19 dropped by 8.31% over the last quarter.

PRWCX – T. Rowe Price Capital Appreciation Fund possesses 7,982K shares, representing 2.78% ownership. Previous reports showed 5,911K shares, reflecting an increase of 25.95%. The portfolio allocation in 0R19 increased by 28.94% over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares has 7,824K shares, which is 2.72% ownership. Their prior filing showed 7,570K shares, indicating an increase of 3.25%. The portfolio allocation in 0R19 has decreased by 7.99% in the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.