Benchmark Downgrades Block’s Stock Outlook Amid Increasing Institutional Interest

Fintel reports that on May 2, 2025, Benchmark downgraded their outlook for Block (BRSE:SQ3) from Buy to Hold.

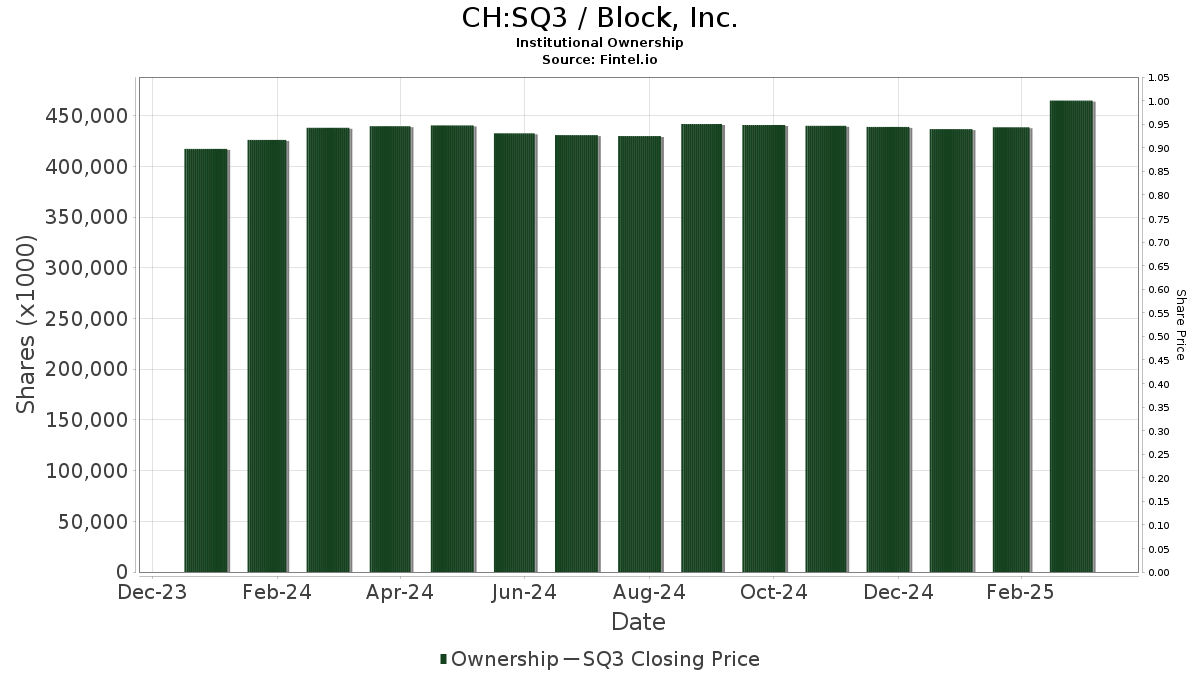

Institutional Fund Sentiment Analysis

Currently, there are 1,813 funds or institutions reporting positions in Block, marking an increase of 126 owners or 7.47% in the last quarter. The average portfolio weight of all funds allocated to SQ3 is 0.34%, reflecting a notable increase of 105.68%. Over the past three months, total shares owned by institutions rose by 4.52%, reaching 457,389K shares.

Actions of Key Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 17,548K shares, translating to 3.14% ownership of Block. In its previous filing, VTSMX reported 17,637K shares, indicating a decrease of 0.51%. However, the firm has increased its portfolio allocation in SQ3 by 24.14% in the last quarter.

JPMorgan Chase owns 17,237K shares, equating to 3.08% ownership. Previously, the firm reported owning 15,888K shares, which represents a 7.82% increase. They have also boosted their portfolio allocation in SQ3 by 34.59% this past quarter.

The Vanguard Mid-Cap Index Fund Investor Shares (VIMSX) holds 12,028K shares, amounting to a 2.15% ownership stake. In the earlier filing, the firm reported 11,757K shares, indicating a 2.25% increase. VIMSX also expanded its portfolio allocation in SQ3 by 28.54% over the last quarter.

Baillie Gifford has 11,168K shares, representing 2.00% ownership. Their prior filing indicated ownership of 10,233K shares, marking an 8.37% increase. The firm has increased its portfolio allocation in SQ3 by 41.87% in the last quarter.

Sands Capital Management holds 10,340K shares, amounting to 1.85% ownership. Previously, they reported 11,228K shares, which indicates a decrease of 8.59%. Nonetheless, Sands Capital increased its portfolio allocation in SQ3 by 13.67% this past quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.