Hims & Hers Health Prepares for Earnings Report on May 5, 2025

Hims & Hers Health (NYSE:HIMS) is set to announce its earnings report on Monday, May 5, 2025. The company’s stock has historically shown considerable volatility surrounding earnings announcements. Over the last five years, there has been a 56% occurrence of negative one-day returns post-earnings, with a median loss of -5.8% and a peak decline of -22.3%.

Analyst Expectations and Company Performance

This upcoming report is particularly significant, as analysts forecast earnings per share of $0.23 on revenue of $538.4 million. These estimates indicate a substantial increase from last year’s earnings of $0.10 per share on revenue of $278.2 million. Notably, the company is currently experiencing strong customer growth, a trend that is expected to continue.

Strategic Insights for Traders

For event-driven traders, historical performance can provide valuable insights. The market’s actual reaction will depend on how the reported results stack up against consensus expectations. Traders can take either of two approaches: they may choose to position themselves before the earnings release based on historical trends, or analyze the relationship between immediate and medium-term returns.

Current Financial Position

Fundamentally, Hims & Hers exhibits a market capitalization of $7.7 billion. The company’s revenue for the trailing twelve months is at $1.5 billion, alongside an operating profit of $62 million and net income of $126 million, indicating operational profitability.

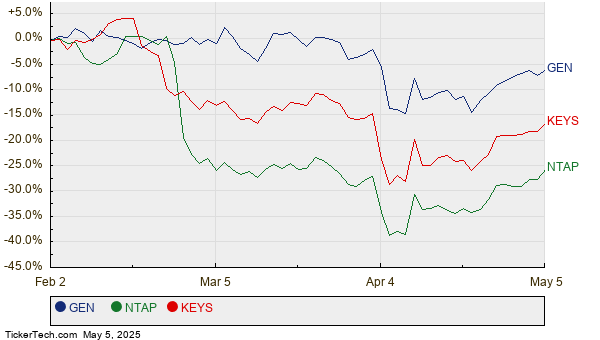

Assessing Historical Earnings Returns

Examining one-day (1D) post-earnings returns reveals:

- Over the last five years, there have been 16 earnings data points, yielding 7 positive and 9 negative returns.

- Positive returns were seen approximately 44% of the time, dropping to 42% when focusing on the last three years.

- The median of the positive returns is 13%, whereas the median of the negative returns is -5.8%.

Return Correlation Analysis

Understanding the correlation between short-term and medium-term returns post-earnings may offer a less risky trading strategy. Traders can examine historical correlations to determine trading positions. For instance, if a positive 1D return correlates highly with 5D returns, a trader could adopt a long position for the subsequent five days.

Image by hillside7 from Pixabay

Further Resources

For additional data on post-earnings returns, please refer to the accompanying analyses and tables.

HIMS 1D, 5D, and 21D Post earnings Return

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of any affiliated entities.