Analyzing Dividend Yields: UPS vs. Whirlpool Stocks

The current dividend yields of UPS (NYSE: UPS) at 6.8% and Whirlpool (NYSE: WHR) at 9.1% attract passive income-seeking investors. However, these high yields signal some market skepticism regarding the sustainability of these dividends. This leads us to compare the two stocks and pinpoint key risks before making any investment decisions.

Whirlpool Stock Analysis: 9.1% Dividend Yield

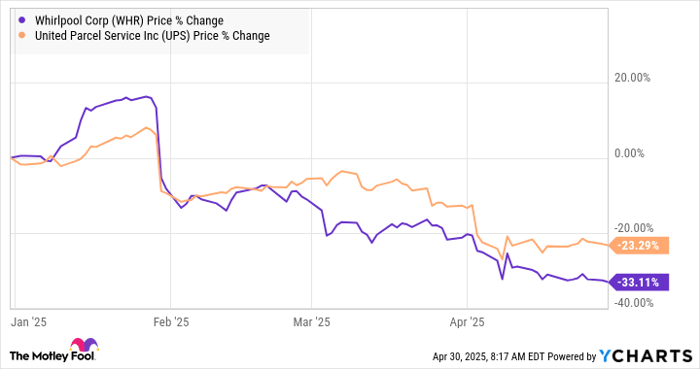

Both Whirlpool and UPS have experienced significant share price declines this year, indicating issues in their trading conditions.

For Whirlpool, a combination of persistently high interest rates and competitive pressures affects its performance. Elevated rates hinder the housing market and, consequently, discretionary spending on appliances—typically tied to home purchases. In the first quarter, Whirlpool’s organic sales increased only 2.2% year over year, while sales in its major North American appliance segment remained flat.

Additionally, Whirlpool has faced challenges from competitors who ramped up imports prior to the implementation of tariffs, as noted by CEO Marc Bitzer during a recent earnings call. He remarked, “Asian appliance producers significantly increased imports into the U.S. ahead of the tariffs, effectively flooding the market.” This disruption is expected to impact the second quarter as competition works to reduce their inventory.

Given the headwinds of high mortgage rates, which are still above 6.5%, along with economic uncertainties, questions arise regarding Whirlpool’s full-year projections. Their guidance suggests a sales target of $15.8 billion, with an EBIT margin of 6.8%, equating to ongoing EBIT of approximately $1.07 billion. The company anticipates a free cash flow (FCF) between $500 million and $600 million, which exceeds the $384 million in dividends paid last year.

However, Whirlpool carries significant risks. With long-term debt of $4.8 billion, and $1.85 billion maturing this year, management plans to pay down $700 million and refinance $1.1 to $1.2 billion. Should Whirlpool’s FCF outlook deteriorate, it may necessitate dividend cuts to strengthen its financial position.

UPS Stock Analysis: 6.8% Dividend Yield

Regarding dividend sustainability, UPS management has made its intentions clear:

- They aim to distribute 50% of earnings as dividends and are committed to maintaining and growing this figure.

- The current dividend of $6.56 per share is nearly matched by the 2025 earnings consensus of $7.11, creating a payout ratio of 92%.

- The company projects $5.7 billion in FCF in 2025, which only just covers the planned $5.5 billion dividend payout.

This landscape raises concerns about UPS’s dividend viability. Following a potential 50% decline in deliveries for Amazon.com by late 2026, UPS faces pressures alongside a weak demand environment, complicating earnings and cash flow prospects.

In its primary U.S. market, UPS has reported greater than anticipated declines in average daily volume during February and March, with projections for a 9% drop in ADV year-over-year for the second quarter. Furthermore, management refrained from updating their full-year guidance.

Choosing Between UPS and Whirlpool

Overall, UPS appears to offer a more sustainable dividend than Whirlpool. The company’s long-term debt of $19.5 billion is manageable relative to its 2025 FCF projection of $5.7 billion, compared to Whirlpool’s $4.8 billion debt against an estimated FCF of only $500 million to $600 million.

Nevertheless, there’s still a notable risk that both companies may reduce their dividends before the year ends. While this does not categorically make either stock unattractive, investors looking solely for dividends should remain cautious of potential disappointments.

Is Now the Time to Invest in UPS?

Before investing in United Parcel Service, keep the following in mind:

Recent evaluations have identified other stocks that may present higher growth potential than UPS. A careful examination of those options may reveal more promising investment opportunities.

Consider the historical context: stocks like Netflix and Nvidia have shown substantial returns from strategic investments, demonstrating the value of thorough research and timing.

Note: The views presented here reflect the author’s opinions and do not necessarily match those of any financial institution.