“`html

Microsoft Earnings Strengthen Its Position Among Tech Giants

Over the past two weeks, the Magnificent 7 have reported earnings, showing overall positive trends that underline the dominance of these market leaders. Last week included reports from Amazon (AMZN), Apple (AAPL), Meta Platforms (META), and Microsoft (MSFT). The previous week, Alphabet (GOOGL) and Tesla (TSLA) also released their results.

Notably, Microsoft stood out during this reporting cycle.

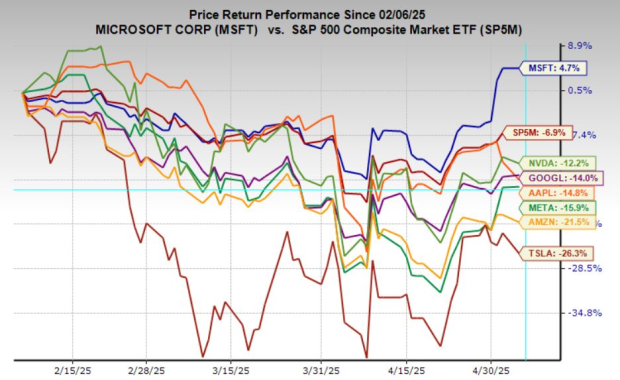

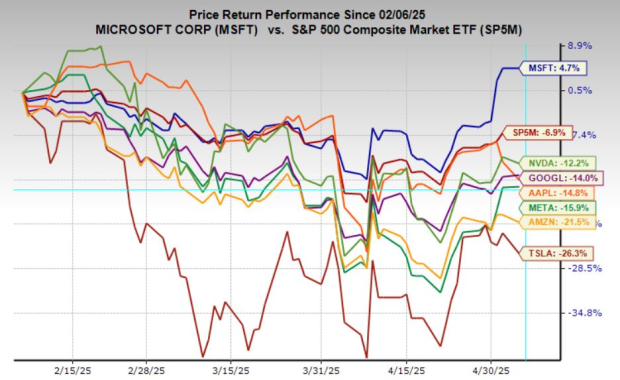

Microsoft’s recent earnings report highlights its performance. MSFT not only holds the highest Zacks Rank among the Magnificent 7 with a Zacks Rank #2 (Buy), but it has also been the leading performer over the last month, three months, and year-to-date within the group.

Image Source: Zacks Investment Research

Microsoft’s Cloud Business Outpaces Competitors

This quarter, Microsoft’s cloud division was particularly impressive. Azure revenue grew 33% year-over-year, the fastest among the three major cloud players. AI services contributed 12 percentage points to this growth. The overall Intelligent Cloud segment reported $26.8 billion in revenue, reflecting a 21% rise from the previous year, with operating income of $11.1 billion.

In comparison, Amazon Web Services (AWS) generated revenue of $29.3 billion, maintaining its leading position but growing at a slower rate of just 17%, the lowest growth rate in five quarters. While AWS remains highly profitable with a 39.5% operating margin, this slowdown raises concerns about its growth potential compared to competitors.

Google Cloud also showed strong results, achieving a 28% year-over-year revenue increase to $12.3 billion. Operating income increased to $2.2 billion, up from $900 million a year ago, indicating solid progress toward profitability.

These results underscore Microsoft’s leadership in the enterprise cloud space and its increasing advantage in AI infrastructure, critical components for long-term growth. Azure’s rapid expansion not only affirms Microsoft’s competitive position but also highlights its strategic focus in a vital sector of tech spending.

MSFT Faces Less Tariff Risk Compared to Peers

As tensions between the US and China rise, understanding tariff exposure is vital for investors in large-cap tech. Microsoft is in a favorable spot, with strong fundamentals and limited exposure to China and related disruptions.

In contrast, Apple is notably vulnerable due to its dependence on Chinese manufacturing for products like iPhones and iPads. This makes Apple sensitive to rising import costs and supply chain issues, as a significant portion of its revenue comes from Chinese consumers, a market potentially impacted by retaliatory actions.

Amazon also faces challenges; although its North American business is strong, it relies on cost-effective manufacturing in China for its global retail supply chain. Increased tariffs on imports could squeeze margins and complicate logistics.

Meta Platforms has a different set of risks. While it is less exposed to supply chain issues, it faces geopolitical and macroeconomic challenges. Restricted in China, Meta still relies on global advertising revenue from brands that have interests in the region. A declining trade environment could impact overall ad spending and hinder growth.

Conversely, Microsoft’s business model focuses on software, cloud infrastructure, and enterprise services, making it more resilient to tariffs or other localized trade disruptions. With limited supply chain exposure to China, its revenue is broadly diversified, driven mainly by growth in the US, Europe, and emerging AI markets.

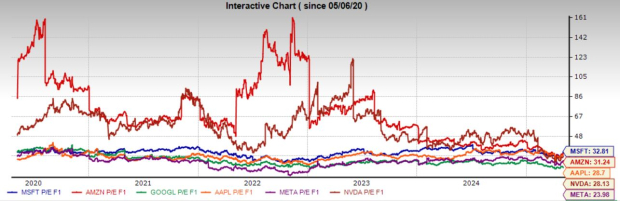

Valuations of the Magnificent 7 Appear Reasonable

Currently, Microsoft has the highest earnings multiple among the Magnificent 7, which may be justified given its performance. Although MSFT trades above its peers, it aligns with its five-year median earnings multiple — a trend similarly observed in Apple and Meta, suggesting fair valuations historically.

Other companies in the group are trading below their five-year averages, a positive sign for valuation-conscious investors.

“`# Microsoft Maintains Strong Position Amid Investor Confidence Surge

Investors are witnessing a significant shift in market dynamics following substantial valuation increases over recent years. Notably, these valuations coincide with optimistic earnings growth projections, ranging from an impressive 12.8% annually for Apple to a striking 24.7% for Nvidia. Microsoft anticipates a steady earnings growth rate of 14.6% per year over the next three to five years.

Due to Microsoft’s solid market positioning, sustainable growth, and relatively low exposure to economic downturns, its premium valuation seems well-founded. Most of the stocks in the Magnificent 7, however, show appealing value as well.

Image Source: Zacks Investment Research

Is Microsoft a Smart Investment for Your Portfolio?

As a leading player among the Magnificent 7, Microsoft continues to demonstrate robust cloud growth, strong earnings momentum, and minimal exposure to macroeconomic and geopolitical uncertainties. Given its leadership role in AI and enterprise solutions, the current premium valuation appears justified, reflecting an increase in investor confidence.

While many competitors also present attractive valuations following recent market corrections, Microsoft stands out as a notable holding for long-term investors focused on stability, growth, and resilience amid a changing economic landscape.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.