IonQ Prepares for First-Quarter 2025 Earnings Amid Mixed Outlook

IonQ is set to report its first-quarter 2025 results on Wednesday. The company has projected revenues between $7 million and $8 million for this quarter, which suggests a slower start compared to its full-year forecast of $75 million to $95 million. IonQ anticipates stronger earnings in later quarters as new technologies and acquisitions begin to yield returns.

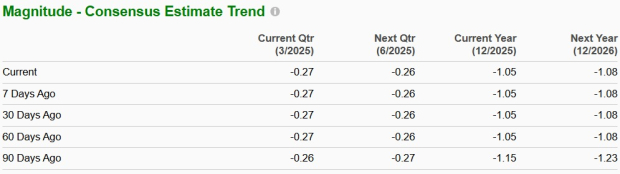

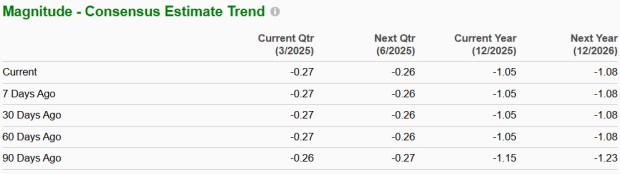

The Zacks Consensus Estimate for revenues stands at $7.5 million, reflecting a year-over-year decline of 1.06%. The consensus estimate includes a projected loss of 27 cents per share, wider than the loss of 19 cents reported in the same quarter last year.

Image Source: Zacks Investment Research

Estimate Trends for IonQ

In the previous quarter, IonQ reported a negative earnings surprise of 272%. The company beat the Zacks Consensus Estimate in two out of the last four quarters but missed twice, resulting in an average negative surprise of 57.81%.

IonQ, Inc. Stock Performance and EPS Surprise

IonQ, Inc. price-eps-surprise | IonQ, Inc. Quote

Earnings Outlook for IonQ

IonQ enters this earnings report with momentum from a record-setting 2024, experiencing a 95% year-over-year revenue increase. The company has been expanding into quantum networking through acquisitions and consistent innovation in quantum computing, which likely influenced its first-quarter performance.

The firm raised over $372 million through an at-the-market equity offering in early March, raising its cash balance to above $700 million. While this strengthens IonQ’s financial position, it also raises concerns about possible shareholder dilution. Management’s decision to terminate the ATM program early signals confidence in their funding strategy. IonQ’s aggressive acquisition strategy saw the completion of the Qubitekk deal in late 2024 and a controlling stake in ID Quantique in early 2025, expanding its quantum networking patent portfolio to nearly 400. However, these integrations may have affected short-term profitability.

A notable development this quarter was IonQ’s collaboration with Ansys, where quantum computing excelled over classical computing by 12% in blood pump design simulations. This represents one of the first significant demonstrations of quantum advantage and could foster wider enterprise adoption, enhancing future revenue opportunities. Additionally, the $21.1 million project with the U.S. Air Force Research Lab, along with a previous $54.5 million contract, reflects growing governmental interests in quantum technologies. The revenue recognition from these contracts may influence quarterly results.

Investors should look for updates on IonQ’s technological roadmap, particularly advancements in XHV technology introduced in February, aimed at reducing system size and energy consumption. Progress here could enhance IonQ’s market position. With a strong cash reserve and ongoing innovations, IonQ appears well-positioned for the long run. However, given traditional slowdowns in Q1 and potential integration costs, investors might consider waiting for clarity post-earnings before making any decisions.

On another note, the company faces intense competition from major tech firms like International Business Machines (IBM), Alphabet (GOOGL), and Microsoft (MSFT), which invest heavily in quantum computing. IonQ’s comparatively limited resources could challenge its ability to sustain technological leadership in the upcoming quarter.

IonQ Stock Performance and Valuation

Year-to-date, shares of IonQ have declined by 26%, underperforming against the Zacks Computer and Technology sector. Investor concerns about the company’s financial sustainability and valuation suggest a cautious approach—holding existing shares or waiting for a more favorable entry point before the first-quarter 2025 earnings announcement.

IONQ Underperforms Compared to Sector and Peers

Image Source: Zacks Investment Research

Given the elevated valuation amid ongoing losses, investors might find it beneficial to hold their current positions while closely monitoring IonQ’s execution of technological and commercial objectives.

IonQ Faces Valuation Challenges Ahead of Q1 2025 Results

IonQ (IONQ) is trading at a two-year high, currently at a forward 12-month price/sales ratio of 66.4, significantly above the Zacks Computer – Integrated Systems industry average of 2.98.

IONQ’s P/S Ratio Indicates High Valuation

Image Source: Zacks Investment Research

Risk and Reward in IonQ’s Investment Outlook

As IonQ approaches its first-quarter 2025 results, the investment outlook presents mixed signals. A recent technological advance in collaboration with Ansys reveals a 12% advantage over classical computing, marking a pivotal development. However, integration risks loom from recent acquisitions, including ID Quantique and Qubitekk. The company has raised $372 million, bolstering its existing $700 million capital reserves, yet this raises concerns about shareholder dilution.

Guidance for first-quarter revenues stands at $7-$8 million, falling short of full-year projections ranging from $75 to $95 million, suggesting that significant revenue may be back-loaded. Despite securing robust government contracts and an expanding patent portfolio, IonQ’s high valuation faces potential threats from execution issues and rising competition in the quantum computing sector. Investors may want to wait for a clearer picture following earnings reports to evaluate progress on acquisition integration and the technology roadmap.

Conclusion: Cautious Approach Recommended

IonQ’s advancements in quantum technology and a growing patent portfolio have notable potential, yet investors should tread carefully as the first-quarter 2025 results approach. The elevated valuation relies on effective execution amidst integration challenges from its recent acquisitions. Given the anticipated back-loaded revenue and intensifying competition, existing shareholders should consider maintaining their positions. Meanwhile, new investors might find it prudent to wait for post-earnings clarity regarding IonQ’s growth trajectory and any synergies from acquisitions before making investment decisions.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.