Market Rally May Fade as Traders Eye Potential Rate Cuts

Assessing Market Trends Amid Profit-Taking and Rate Speculations

For traders, now might be the right moment to secure some profits, while also seeking new buying opportunities for a potential market rebound.

This perspective comes from seasoned trader Jeff Clark.

As outlined in previous Digest issues, Jeff suggests that we may have entered a bear market with significant declines still ahead.

He views the ongoing strength in the market as a bear-market rally approaching its peak. Therefore, short-term traders might consider taking profits or positioning for a downward shift.

Revisiting Jeff’s Recent Market Predictions

For those unfamiliar, Jeff Clark is a veteran trader with over 40 years in the financial markets. Through his service, Jeff Clark Trader, he employs various indicators and chart patterns to navigate market movements, whether bullish, bearish, or sideways.

Currently, Jeff asserts we have likely reached the year’s highs in a bear market. Back in early April, he outlined his outlook:

Ultimately, if this is indeed a bear market, we could see levels around 4,150 to 4,100 for the S&P as we had in late 2023.

I anticipate a generational buying opportunity this year akin to those in 2008, where stock valuations hit remarkably low points.

The 4,100 to 4,150 range marks a potential drop of approximately 27% from current S&P levels as of Monday morning.

Jeff plans to navigate this downturn through two strategies:

- Capitalize on oversold spikes, even amid downward trends,

- Utilize profits from these trades to seize the “generational buying opportunity” as conditions stabilize.

He predicts the ideal moment for a buy-and-hold strategy may occur around October or November:

We can trade until then, but often, a final market washout in October or November will present an excellent entry point at greatly reduced prices.

Analyzing the Current Market Rally’s Sustainability

His stance remained that the relief rally would ultimately subside, leading to another downward phase. The strategy: Sell off dips and buy into subsequent upticks.

He previously stated:

Stocks may rise in the short term…

The closer the S&P approaches 5,750, the more favorable the conditions for adding short positions.

On Friday, the S&P briefly touched 5,700, nearing Jeff’s threshold for increasing short exposure.

In his update from last Thursday, he noted:

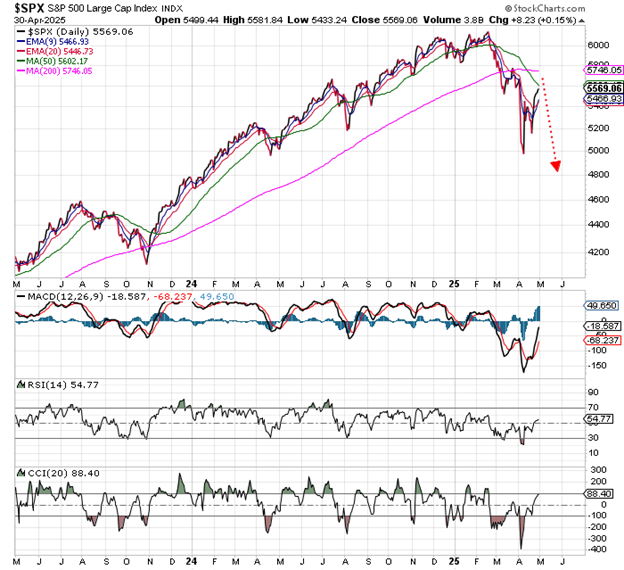

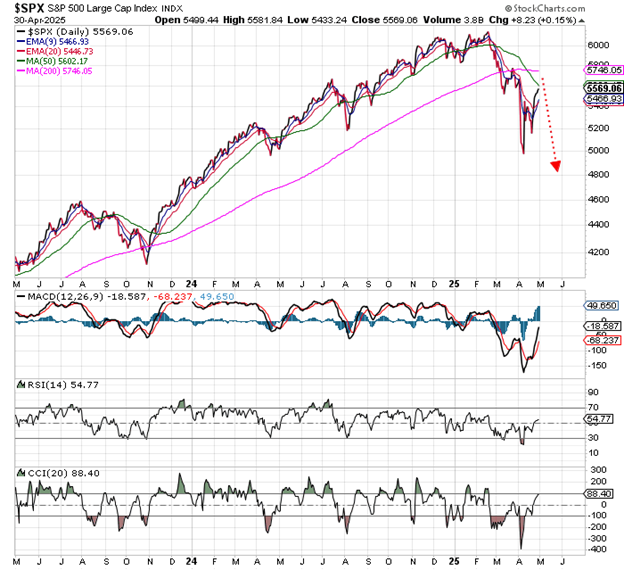

Examine this chart of the S&P…

Source: StockCharts.com

Notice how momentum indicators at the bottom of the chart lack any positive divergence. The MACD, RSI, and CCI indicators hit lower lows alongside the S&P.

While I suggested a rebound was possible due to oversold conditions, the intent was to elevate momentum indicators sufficiently for positive divergence during the next decline.

This current rebound has served its purpose.

The S&P 500 is now challenging its 50 and 200-day moving averages as obstacles. Momentum indicators have returned to neutral territory and are sufficiently elevated to avoid new lows if the S&P drops below its early-April low.

This setup could facilitate a summer rally. However, a retest of the early-April low remains a possibility.

Consequently, Jeff added some short exposure last week, stating, “The closer the S&P approaches its 200-day MA at 5,750, the better the risk/reward scenario for this trade.”

Assessing Friday’s Market Movements

Stocks experienced significant gains on Friday, buoyed by a strong jobs report and encouraging developments in the U.S.-China trade relations.

Regarding the market’s conditions, Jeff remarked on Friday afternoon:

Overbought conditions have intensified.

Just as it was unwise to sell during oversold conditions in early April, it may also prove unwise to buy following nine consecutive days of market gains.

A buying frenzy is underway.

He advises traders to monitor the VIX and VIX options for early warnings of a shift from bullish to bearish momentum.

If the VIX begins to rise while stocks continue their ascent, that would signal caution. Additionally, should VIX calls trade at a considerably higher premium than VIX puts, a reversal may be imminent.

Importantly, Jeff does not anticipate an abrupt market crash; rather, he expects a gradual decline interspersed with rallies that he intends to capitalize on.

In his latest update this morning, he noted:

At minimum, we should prepare for at least a brief pullback. In the worst scenario, a retest of last month’s lows could occur…

I plan to consider long exposure during weak market phases but will proceed cautiously. We likely face several days of declining stock prices ahead…

No actions are anticipated from the Fed, yet the market may remain on edge until after Wednesday’s announcement.

The Fed’s Rate Decisions and Trade Deal Uncertainties Ahead

Fed Meeting Insights

This Wednesday, the Federal Reserve wraps up its May FOMC meeting. Speculation abounds regarding potential rate cuts or signals to the market. Some experts argue for a rate reduction, while others predict stability.

Among proponents of a rate cut is notable investor Louis Navellier. Recently, he stated:

We’re going to get a Fed rate cut in May. If we don’t, [the Fed members are] clinically insane – they’re not looking at the data. And the cause for them to cut will get louder as market rates collapse.

Conversely, many traders anticipate the Fed will maintain its current target rate. The CME Group’s FedWatch Tool indicates a 99.0% probability for this outcome.

A stronger than expected jobs report [on Friday] has prompted a rally. There’s now zero chance of a rate cut next week when the FOMC meets, and the odds of a June cut have likely decreased following this report.

To illustrate this, last Thursday, traders estimated a 55% chance of a quarter-point cut in June. However, in light of the strong payrolls report, these probabilities have dropped to 30%.

Just a month ago, the likelihood of at least one June rate cut stood at 94.5%, with the odds of two cuts at 30.6%.

Despite these diminishing odds, the market seems unaffected. Some may wonder why the financial environment remains stable amid falling cut expectations.

As highlighted by Jeff:

The market no longer seems to be reacting to rate-cut expectations. Instead, investors are relieved that recession fears appear to be diminishing.

Trade War Developments and Economic Impact

In a recent conversation with a guitar shop owner, the impact of proposed tariffs on China emerged. These tariffs may increase the wholesale cost of a popular guitar model from about $1,000 to $2,400. The manufacturer is contemplating halting sales to the U.S., raising concerns for small-business owners.

Could this situation foreshadow similar challenges for other businesses if trade agreements do not materialize soon?

Commerce Secretary Howard Lutnick made headlines last Tuesday with reports of a trade agreement with an unspecified country, prompting a rush to revise our publication. He stated:

I have a deal done, done, done, done, but I need to wait for their prime minister and parliament to approve, which I expect shortly.

Since then, however, there has been little communication on the status of this deal.

This lack of follow-through raises questions about Lutnick’s use of “done” as he awaited additional approvals.

Speculation indicates he may have been referring to India. Positive news did emerge, as Bloomberg reported:

India has proposed zero tariffs on steel, auto components, and pharmaceuticals in trade negotiations with the U.S., pending approval for specific import quantities.

Trade officials from India were reportedly in Washington last month to expedite discussions on a bilateral trade agreement anticipated by fall.

Nevertheless, it is essential to note that despite these developments, no formal trade deal has been signed.

Evaluating the Landscape of Trade Agreements

Understanding the current state of trade agreements is vital, especially considering the recent market rally heavily relied on the expectation of imminent deals.

According to an article from Politico:

White House officials have claimed that more than a dozen countries have submitted offers to mitigate the biting tariffs set to take effect in just over two months — suggesting that President Trump’s trade strategy is making headway.

However, sources indicate that these documents are merely preliminary outlines for discussion rather than final offers, highlighting a disconnect between expectations and reality.

Some trading partners remain hesitant to present terms until they receive clearer guidance from the U.S. on specific demands.

In our April 25 discussion, we noted:

The market’s rebound suggests that investors are placing their bets on the likelihood of beneficial trade deals being announced soon.

However, there are risks associated with these bets, including:

- The deals not materializing as expected

- The deals that do occur may disappoint Wall Street

The uncertainty surrounding Lutnick’s announcement and insights from Politico reinforce the caution investors should exercise in the current environment.

Recently, President Trump hinted that finalized trade deals might occur this week. A prompt to revise our release would be welcomed, but for now, all that exists are claims of “progress.”

Eventually, merely discussing advancements may not suffice for market expectations. What will follow if tangible agreements do not emerge?

This leads back to Jeff Clark’s bear market forecast and his advice for investors to consider taking profits off the table.

Wishing you a good evening,

Jeff Remsburg