Market Turbulence Pushes Investors Toward Tobacco Stocks Like BTI

One month has passed since President Donald Trump’s “Liberation Day” announcement, which rolled out a series of tariff policies affecting countries worldwide. During this period, the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average each dropped by as much as 11%.

While capital markets have shown some recovery, the economic outlook remains uncertain. Growth stocks are losing their appeal, leading investors to seek safer, more reliable options.

Let’s analyze why British American Tobacco (NYSE: BTI) may be an attractive buy amid ongoing tariff impacts.

Tobacco Industry Faces Challenges but Holds Potential

Historically, the tobacco industry revolved around cigarettes. However, in recent years, many companies, including British American Tobacco, have diversified into vaping and oral nicotine products.

This shift is largely due to declining cigarette sales. Data from the Centers for Disease Control and Prevention (CDC) shows that U.S. cigarette sales fell by 27% from 2015 to 2021.

Despite these challenges, British American Tobacco still generates a significant portion of its revenue from cigarettes. In 2024, it reported £27.1 billion ($36 billion) in revenue, nearly unchanged from 2023. Of that total, £21.7 billion was from combustible products, while £5.4 billion came from smokeless tobacco and other categories.

Given its heavy reliance on cigarette sales, some may view investing in British American Tobacco as unwise. However, this might be a unique opportunity to consider investing in the tobacco giant.

Image source: Getty Images.

Market Conditions Could Favor Tobacco Investments

The table below shows revenue growth trends for British American Tobacco over recent years.

| Category | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue growth (YOY) | 3.3% | 6.9% | 2.3% | 1.6% | (0.5%) |

Data source: British American Tobacco. YOY = year over year. All figures in constant currency.

Notably, British American Tobacco saw robust growth during the peak COVID-19 pandemic, but this growth has significantly slowed as fears surrounding the pandemic have diminished over recent years.

The recent volatility in the stock market reflects public sentiment regarding tariff policies. Analysis from the Bureau of Economic Analysis (BEA) revealed that U.S. real gross domestic product (GDP) declined at an annualized rate of 0.3% in the first quarter.

While it is difficult to predict if the U.S. is heading for a recession, trends suggest that “sin stocks” like British American Tobacco often find resilience during economic uncertainties.

Dividend Income Makes BTI an Enticing Choice

Currently, British American Tobacco trades at a forward price-to-earnings (P/E) ratio of 9, considerably lower than the S&P 500’s average forward P/E multiple of 20. This disparity implies that investors are not anticipating much growth for the company.

Yet, it’s possible that consumers will turn to their vices more frequently during challenging economic times, which may lead to growth not seen since the early pandemic. Nevertheless, the key to investing in British American Tobacco lies in its long-term performance rather than short-term speculations.

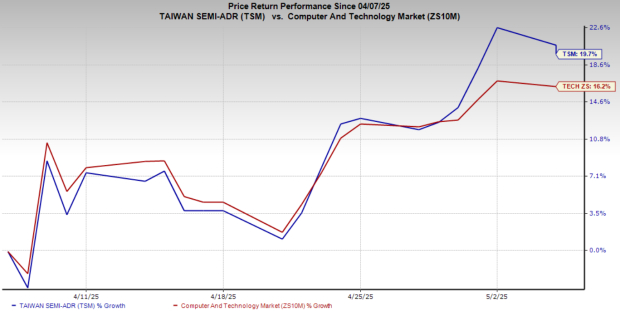

BTI Total Return Level data by YCharts

Over the past five years, British American Tobacco has delivered a total return of 70%. While this lags behind the S&P 500’s total return, the comparison does not tell the full story. The recent surge in AI stocks has overshadowed sectors like tobacco, leading to inflated valuations in technology.

Currently, the S&P 500 heavily relies on a limited number of volatile tech stocks, making British American Tobacco appear potentially safer than the concentrated index.

Even though British American Tobacco may not be a growth stock, it has historically provided solid returns for patient investors, primarily driven by dividend reinvestment. With a current dividend yield of 7%, long-term growth potential, and appealing valuation, British American Tobacco is compelling right now.

Should You Invest $1,000 in British American Tobacco Now?

Before investing in British American Tobacco, it is essential to consider the following:

The Motley Fool analyst team has highlighted 10 stocks that they consider top investments right now, and British American Tobacco is not included. The identified stocks have the potential for significant returns in the coming years.

For instance, when Netflix joined the list on December 17, 2004, a $1,000 investment would now be worth $623,685! Likewise, if you had invested $1,000 in Nvidia when it appeared on April 15, 2005, you’d have $701,781!

Notably, the average return of Stock Advisor is an impressive 906%, compared to the 164% return of the S&P 500.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.