Enphase Energy Faces Challenges Amid Market Decline and Analyst Adjustments

Enphase Energy, Inc. (ENPH), with a market capitalization of $6 billion, is recognized as a leader in energy technology. The company specializes in solar microinverters, energy storage solutions, and smart energy management systems. Headquartered in Fremont, California, Enphase has transformed the solar sector with its microinverter technology, which enhances performance, safety, and reliability by converting direct current (DC) to alternating current (AC) at each solar panel.

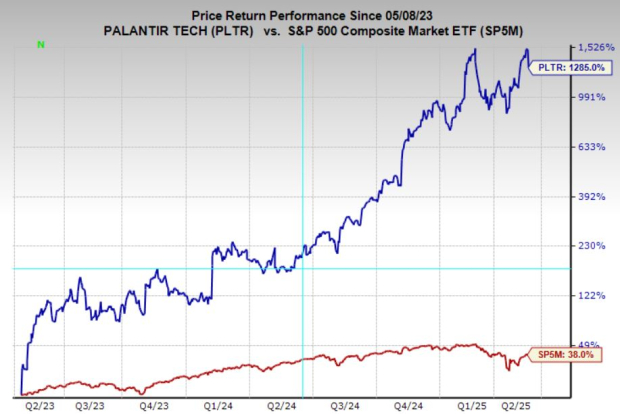

Over the past 52 weeks, ENPH shares have lagged significantly behind broader market trends. The stock has dropped 61.1%, contrasting with a 10.2% increase in the S&P 500 Index ($SPX). As for 2025, ENPH has seen a decrease of 35.3%, while the SPX is down 3.9% year-to-date.

Moreover, ENPH’s performance has been below that of the Invesco Solar ETF (TAN), which has declined 32.8% over the past year and 12.9% in 2025. Despite these challenges, there remains underlying interest in the company due to its innovative approach.

On April 22, Enphase’s shares fell by 14.2%, even as the broader market rallied. This decline came after the company reported Q1 figures that missed estimates and issued weaker guidance for Q2. Although Enphase demonstrated strong year-over-year revenue growth of 35% and nearly doubled its earnings per share (EPS), these results did not meet analyst expectations. Additionally, the company highlighted concerns over growing gross margin pressure from tariffs, projecting a 2% impact for Q2 and as much as 8% in the latter half of the year. Despite benefiting from the Inflation Reduction Act (IRA) in terms of margin improvements and tax incentives, uncertainties in the political landscape and a challenging macro environment are affecting its outlook.

For FY2025, ending in December, analysts anticipate a decline of 15.8% in ENPH’s EPS, projected at $1.17 per share. The company’s earnings surprise history has shown mixed results, beating consensus estimates in only one of the last four quarters while missing targets three times.

Among the 36 analysts following ENPH, the consensus rating holds as a “Moderate Buy.” This rating stems from 15 “Strong Buy” endorsements, 14 “Holds,” two “Moderate Sells,” and five “Strong Sells.”

This configuration is an improvement from three months ago, where there were only 14 “Strong Buy” ratings for the stock.

On April 25, Barclays plc (BCS) revised its price target for Enphase Energy from $58 to $51, following the company’s Q1 earnings miss, although it maintained an “Overweight” rating. Barclays noted that Enphase aims to improve battery margins by improving its supply chain, anticipating a 12% rise in average sales prices, a 20% increase in cell costs from sourcing outside China to avoid high tariffs, and a 10% rise in other material costs. The firm indicated that Enphase has likely been diversifying its cell supply since late last year.

The average price target of $61.03 suggests a potential upside of 37.4% based on current levels. The highest price target of $125 indicates a substantial upside potential of 181.4%.

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are intended solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.