Analysts See Upside Potential for DGRW and Key Holdings

In a recent analysis by ETF Channel, the trading prices of ETFs were compared to their underlying holdings’ average analyst 12-month forward target prices. For the WisdomTree U.S. Quality Dividend Growth Fund ETF (Symbol: DGRW), the calculated implied analyst target price is $91.17 per unit.

DGRW is currently trading at approximately $78.48 per unit. This indicates a 16.18% upside potential based on analyst targets for the ETF’s underlying holdings. Notably, three underlying holdings demonstrate significant upside potential: KBR Inc (Symbol: KBR), Littelfuse Inc (Symbol: LFUS), and Herc Holdings Inc (Symbol: HRI). KBR, trading at $51.57 per share, has an average analyst target price of $67.43, suggesting a potential increase of 30.75%. Similarly, LFUS, priced at $195.90 per share, has a target price of $254.75, translating to a 30.04% upside. Analysts expect HRI, currently valued at $113.90, to reach a target price of $145.86, an increase of 28.06%.

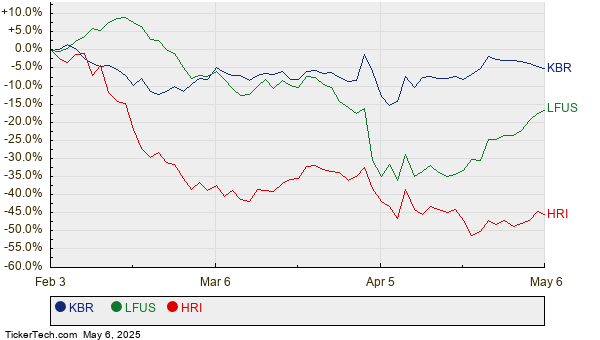

Below is a historical price performance chart comparing KBR, LFUS, and HRI:

Here is a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| WisdomTree U.S. Quality Dividend Growth Fund ETF | DGRW | $78.48 | $91.17 | 16.18% |

| KBR Inc | KBR | $51.57 | $67.43 | 30.75% |

| Littelfuse Inc | LFUS | $195.90 | $254.75 | 30.04% |

| Herc Holdings Inc | HRI | $113.90 | $145.86 | 28.06% |

This raises questions about whether analysts are accurate with their targets or overly optimistic regarding potential stock performance over the next year. Assessing whether the targets reflect current industry trends or are outdated is crucial for investors. A high price target compared to a stock’s trading price can indicate optimism but may also lead to future downgrades if targets prove unrealistic. These considerations warrant further analysis by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Insights:

• Funds Holding DOCN

• AVCO YTD Return

• Funds Holding FTCB

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.