“`html

Q1 Earnings Show Growth Amid Macro Concerns for 2025

Note: The following is an excerpt from this week’s earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods.

Key Highlights

- Total Q1 earnings for the 419 S&P 500 members that have reported results are up +12.2% from the same period last year on +4.1% higher revenues, with 73.7% beating EPS estimates and 61.8% beating revenue estimates.

- This earnings season focuses less on first-quarter results and more on assessing the earnings impact of current macroeconomic uncertainties. This concern is reflected in declining estimates for upcoming periods.

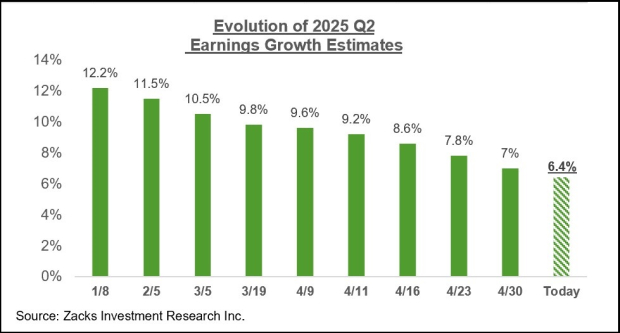

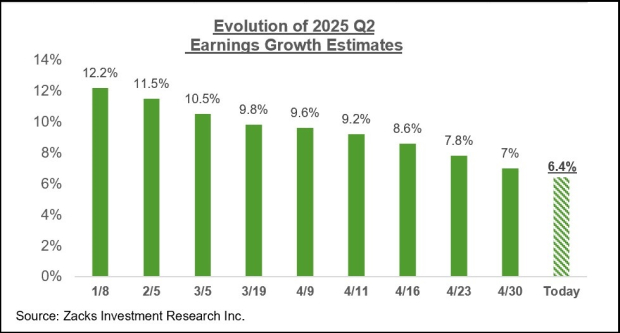

- For Q2 2025, total S&P 500 earnings are projected to increase by +6.4% year-over-year, supported by +3.9% higher revenues. However, estimates have been revised downward more significantly than in previous quarters.

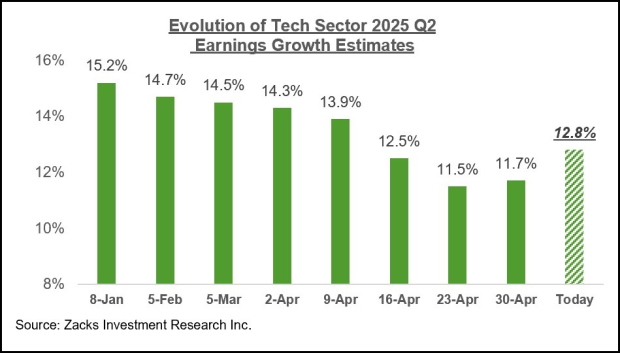

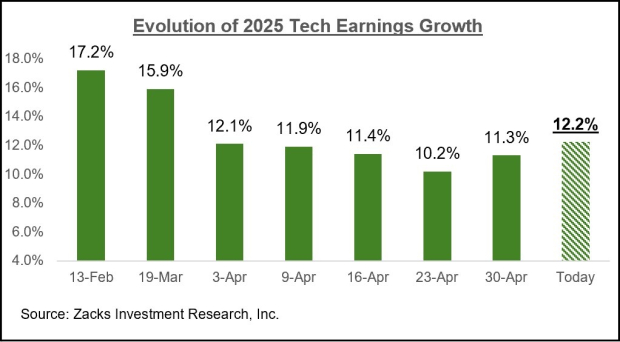

- Q2 earnings estimates for the Tech sector have shifted recently, rising after a period of decline.

Current Status of Q2 Earnings Estimates

As Q2 begins, a backdrop of tariff uncertainties has impacted estimates following the April 2nd tariff announcements. Initially delayed by three months, the tariffs have added to the cautious outlook for current and future quarters.

The expectation is that Q2 earnings for the S&P 500 will rise by +6.4% compared to last year, with revenues up by +3.9%. The chart below illustrates how these expectations have changed since the start of the year.

Image Source: Zacks Investment Research

While lower estimates are typical, the extent and range of Q2 cuts exceed what we’ve seen in comparable timeframes in recent quarters. Since the quarter began, estimates have declined for 13 of the 16 Zacks sectors. The Transportation, Autos, Energy, Construction, and Basic Materials sectors experienced the steepest declines.

Notably, estimates for the top two earnings contributors, Tech and Finance, have also declined since the quarter’s start.

Tech sector earnings are projected to grow +12.8% for Q2, with revenues up +9.9%. Although these growth expectations are significantly below initial April figures, they have rebounded recently, indicating a favorable shift in estimates. This trend is evident in companies such as Microsoft (MSFT), Alphabet (GOOGL), and Meta (META).

Image Source: Zacks Investment Research

Last week, we observed this reversal in the Tech sector’s revisions trend. The updated chart captures these changes.

Image Source: Zacks Investment Research

While it’s uncertain how sustainable this positive shift in Tech estimates will be, recent adjustments demonstrate that growth isn’t solely influenced by strong Q1 earnings from major players.

The Overall Earnings Landscape

The chart below provides an overview of 2025 Q1 expectations compared to results from the preceding four quarters, along with projections for the next three quarters.

Image Source: Zacks Investment Research

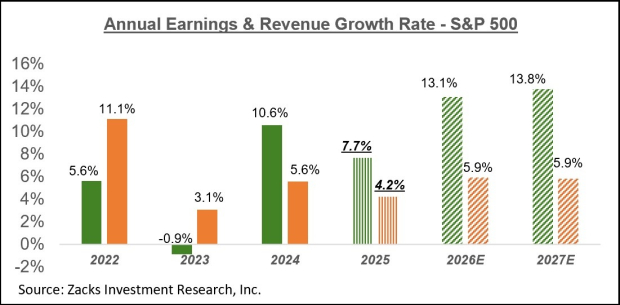

Equally, the chart below shows the S&P 500 index’s annual earnings picture.

Image Source: Zacks Investment Research

While estimates for this year have been revised downward recently, few changes have occurred for the ensuing two years. The following chart illustrates the pace at which this year’s estimates are being adjusted lower.

Image Source: Zacks Investment Research

Amid widespread concerns about economic growth momentum, it’s reasonable to anticipate further downward adjustments as the effects of tariffs begin to surface in financial data.

The negative GDP reading for the first quarter largely reflected anticipatory behavior among importers who stocked supplies ahead of new tariffs.

Final Thoughts

We will be closely monitoring these trends as they develop over the coming months.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`