Amdocs Reports Strong Q2 Earnings Amid Revenue Decline

Amdocs Limited (DOX) released its second-quarter fiscal 2025 results, exceeding expectations. The company reported non-GAAP earnings of $1.78 per share, surpassing the management’s guidance of $1.67-$1.73 and rising 14.1% year over year. This figure also beat the Zacks Consensus Estimate of $1.71.

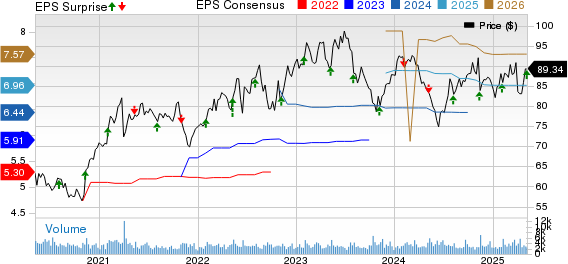

Over the last four quarters, Amdocs’s earnings outperformed the Zacks Consensus Estimate three times and matched once, achieving an average surprise of 0.1%. (Find the latest EPS estimates and surprises on Zacks earnings Calendar.)

Revenue Performance and Market Reaction

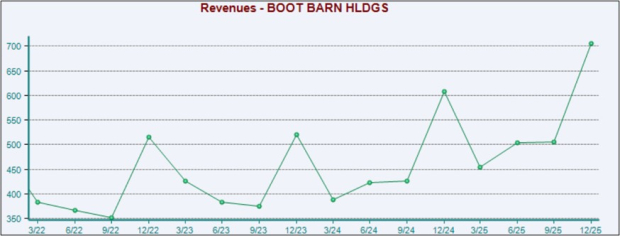

Amdocs’ second-quarter revenues reached $1.23 billion, exceeding the consensus estimate of $1.12 billion. However, this figure reflects a 9.4% decline from the same quarter last year, attributed to the phase-out of specific business activities. When excluding these activities, revenues actually increased by 4% year over year in constant currency.

Despite the strong earnings report, Amdocs shares dropped by 3.5% during Wednesday’s extended trading session due to third-quarter EPS guidance that fell short of the Zacks Consensus Estimate.

Amdocs Limited Price, Consensus, and EPS Surprise

Amdocs Limited price-consensus-eps-surprise-chart | Amdocs Limited Quote

Q2 Revenue Breakdown

Revenue declines were noted across all regions, primarily due to the phase-out mentioned earlier. North America generated $738.3 million, accounting for 65% of total revenues, and showed a drop of 10.3% year over year.

In Europe, revenue (16% of total) stood at $180.7 million, decreasing 2.2%. The Rest of the World (RoW) reported revenues of $209.2 million (19% of total), which declined by 12% year over year. Estimates for North America, Europe, and RoW revenues were $729.4 million, $166 million, and $230.6 million, respectively.

Conversely, managed services revenues rose by 3.7% year over year, totaling $747 million. At the end of the second quarter of fiscal 2025, Amdocs boasted a 12-month backlog of $4.17 billion, an increase of $30 million sequentially. Estimates for managed services revenues and backlog were $675 million and $3.87 billion, respectively.

The non-GAAP operating income rose 4.7% year over year to $240.1 million, leading to an expanded operating margin of 21.3%, up 290 basis points (bps).

Financial Position Update

As of March 31, 2025, Amdocs held cash and short-term investments of $324 million, down from $349 million as of December 31, 2024. Long-term debt remained stable at $646.6 million.

During the second quarter, Amdocs generated an operating cash flow of $172 million and a free cash flow of $156 million. For the first half of fiscal 2025, operating cash flow and free cash flow were $278 million and $235 million, respectively.

Guidance for Upcoming Quarters

Amdocs provided guidance for the third quarter while updating its outlook for the full fiscal 2025 year. Revenues for the third quarter are projected to be between $1.11 billion and $1.15 billion, with a midpoint of $1.13 billion. This aligns with the Zacks Consensus Estimate, indicating a year-over-year decline of 9.3%.

Non-GAAP earnings per share are expected to fall between $1.68 and $1.74, while the Zacks Consensus Estimate stands at $1.75 per share, suggesting an 8% year-over-year increase.

For fiscal 2025, Amdocs has revised its revenue decline rate guidance to between 9.1% and 10.9%, down from a previous range of 8.4% to 11.6%. The mid-point remains unchanged, forecasting a 10% decline. Additionally, the Zacks Consensus Estimate for revenues is now set at $4.52 billion, reflecting a 9.8% year-over-year decline.

The company continues to expect a non-GAAP operating margin in the range of 21.1% to 21.7% for the fiscal year, with non-GAAP earnings projected to grow between 6.5% and 10.5%. The Zacks Consensus Estimate for earnings is pegged at $6.97 per share, demonstrating an 8.2% year-over-year rise.

Amdocs expects free cash flow to remain between $710 million and $730 million.

Stock Performance and Industry Comparison

Currently, Amdocs holds a Zacks Rank #3 (Hold).

Impinj (PI), StoneCo (STNE), and Broadcom (AVGO) are notable stocks within the Zacks Computer and Technology sector. Both Impinj and StoneCo are rated Zacks Rank #1 (Strong Buy), while Broadcom holds a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Impinj’s 2025 earnings rose by 21 cents to $1.68 over the last 30 days, indicating a year-over-year drop of 20.4%. Impinj shares have declined by 38.4% over the past year.

StoneCo’s 2025 earnings estimate increased by 19 cents to $1.38, which reflects a 2.2% year-over-year growth. StoneCo shares fell by 20.8% in the last 12 months.

Broadcom’s fiscal 2025 earnings estimate was lifted by 4 cents to $6.60, suggesting a 35.5% rise from fiscal 2024’s results. Broadcom shares gained 56.8% in the past year.

Amdocs Business Outlook

This report aims to provide an insightful overview of Amdocs Limited’s recent financial performance and market standing.