Salesforce Struggles Amidst Mixed Earnings and Market Performance

Headquartered in San Francisco, California, Salesforce, Inc. (CRM) is a leader in customer relationship management (CRM) technology that connects businesses with their customers worldwide. Currently, the company boasts a market capitalization of $267.5 billion and offers global sales, service, and subscription solutions, which facilitate data storage, lead tracking, and issue resolution.

Recent Market Performance

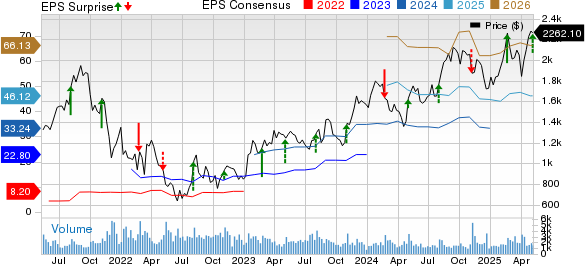

Over the past 52 weeks, Salesforce shares have underperformed compared to broader market trends. CRM stock increased by only 1.1%, while the S&P 500 Index ($SPX) rose by 8.6%. Additionally, year-to-date (YTD), CRM shares are down 15.7%, contrasting with SPX’s decline of 4.3% during the same period.

In a more focused look, Salesforce has also lagged behind the Technology Select Sector SPDR Fund’s (XLK) 6.5% increase over the past year and a 6.1% YTD loss.

Mixed Q4 Results Impact Investor Outlook

Salesforce shares dropped 4% the day following the release of its mixed Q4 2025 results on February 26. Revenue for the quarter reached $10 billion, marking a 7.6% year-over-year increase, primarily supported by $9.5 billion in subscription and support revenue, which rose 8% compared to the previous year. Additionally, the company reported adjusted earnings of $2.78 per share, up 21.4% from the same quarter last year.

Despite these positive figures, investor sentiment soured mainly due to the company’s disappointing guidance for fiscal 2026. Management projected Q1 revenue between $9.71 billion and $9.76 billion, with adjusted earnings per share (EPS) expected to be in the range of $2.53 to $2.55.

For the fiscal year ending January 2026, analysts anticipate a 6.6% year-over-year increase in adjusted EPS to $8.41. Furthermore, the company has a strong earnings surprise history, having exceeded consensus estimates in the last four quarters.

Analyst Sentiment and Price Targets

Of the 47 analysts monitoring Salesforce, the consensus rating remains a “Strong Buy,” supported by 35 “Strong Buy” ratings, three “Moderate Buys,” seven “Holds,” and two “Strong Sells.” This represents a more bullish outlook than three months ago, when there were only 33 “Strong Buy” ratings.

On April 25, Needham analysts reaffirmed a price target of $400 for CRM while maintaining a “Buy” rating. As of now, Salesforce is trading below the mean price target of $360.93, while the highest target of $440 implies a significant upside potential of 58.1%.

On the date of publication, Sohini Mondal did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are intended for informational purposes only. For further details, please refer to the Barchart Disclosure Policy here.

The views and opinions expressed in this article reflect those of the author and do not necessarily represent those of Nasdaq, Inc.