Tesla’s Stock Performance: Key Insights and Challenges Ahead

Tesla (TSLA) has become one of the most frequently searched stocks on financial platforms. Understanding the factors influencing its performance is crucial for investors interested in this electric vehicle manufacturer.

In the past month, Tesla’s shares have gained +12.9%, while the Zacks S&P 500 composite has increased by +13.7%. Comparatively, the Zacks Automotive – Domestic industry, which includes Tesla, recorded a 25.7% rise during this period. The essential question now is: What is the short-term outlook for Tesla’s stock?

While media speculation can lead to immediate price changes, fundamental factors ultimately guide long-term investment decisions. Examining these fundamentals can provide deeper insights into stock movements.

Earnings Estimate Revisions

At Zacks, we focus on changes in projected earnings because the present value of future earnings is crucial for determining a stock’s fair value. Analysts revise their earnings estimates to reflect current business trends, and an increase in these estimates typically signals upward movement in stock prices. Research shows a strong correlation between earnings estimate revisions and stock performance.

For the current quarter, analysts expect Tesla to report earnings of $0.45 per share, representing a decline of -13.5% compared to the same quarter last year. Over the last month, the Zacks Consensus Estimate has decreased by -40.5%.

The consensus earnings estimate for the current fiscal year is $1.98, showing a year-over-year decline of -18.2% and a change of -34.7% in the last 30 days.

Looking ahead to the next fiscal year, the consensus estimate rises to $3.01, reflecting a potential increase of +52.1% compared to last year. However, this estimate has also decreased by -14.5% recently.

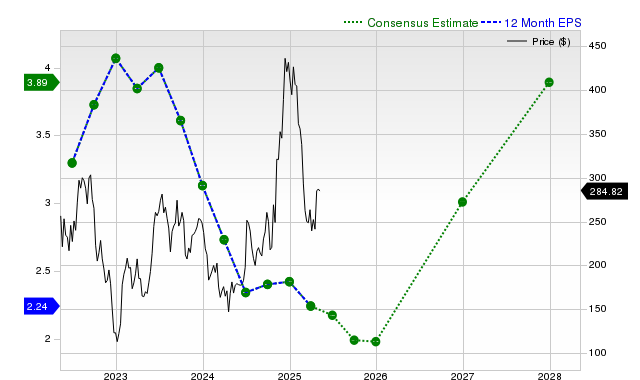

Considering the recent changes in consensus estimates and other factors, Tesla currently holds a Zacks Rank #5 (Strong Sell), indicating potential underperformance in the near term. The accompanying chart illustrates Tesla’s forward-looking consensus EPS estimates:

12 Month EPS

Revenue Growth Forecast

While earnings growth is vital, sustained revenue growth is essential for long-term profitability. It is challenging for a company to increase earnings without corresponding revenue increases.

For Tesla, the consensus sales estimate for the current quarter is $23.65 billion, indicating a -7.2% decline year-over-year. The sales estimates for the current and next fiscal years stand at $98.89 billion and $116.7 billion, signaling modest growth of +1.2% and +18%, respectively.

Last Reported Results and Surprise History

In its last reported quarter, Tesla generated revenues of $19.34 billion, a decrease of -9.2% from the prior year. Its EPS of $0.27 is down from $0.45 reported a year ago.

Compared to the Zacks Consensus Estimate of $20.98 billion, the reported revenues represented a surprise of -7.85%, while the EPS surprise was -38.64%. Over the last four quarters, Tesla has surpassed EPS estimates only once and has met revenue estimates just once.

Valuation

A comprehensive investment decision includes evaluating a stock’s valuation. Understanding whether a stock’s current price accurately reflects its intrinsic value and growth prospects is crucial for predicting future performance.

Utilizing valuation multiples like price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) helps in assessing whether a stock is fairly priced, overvalued, or undervalued, both historically and in comparison to its peers.

Through Zacks’ Style Scores system, Tesla has received an F rating for value, signifying that it is trading at a premium relative to its peers.

Conclusion

The insights shared may help investors determine the relevance of current market discussions around Tesla. However, its Zacks Rank #5 suggests that Tesla’s performance may lag behind the broader market in the short term.