News Corporation Reports Mixed Q3 Results Amid Digital Growth

News Corporation (NWSA) released its earnings for the third quarter of fiscal 2025, reporting a net profit of 17 cents per share. This figure fell short of the Zacks Consensus Estimate by 10.53% but represented a significant year-over-year increase of 54.5%.

NWSA’s revenues reached $2.01 billion, up 1% from the same quarter last year, though slightly below analyst expectations by 0.29%. The growth in revenue was primarily fueled by the Digital Real Estate Services, Book Publishing, and Dow Jones segments.

Following the earnings announcement, NWSA shares experienced a modest uptick of 1.06% during pre-market trading.

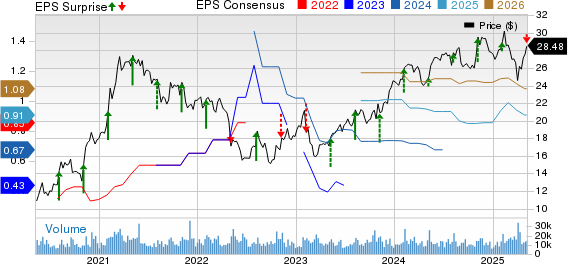

NWSA’s Price, Consensus, and EPS Surprise

NWSA shares have risen 3.4% year to date, contrasting with a 0.3% decline in the Zacks Consumer Discretionary sector.

Strategic growth in digital segments and operational efficiencies have been key drivers for NWSA’s performance.

Quarterly Highlights

Adjusted revenues, excluding the effects of foreign currency, mergers, and divestitures, increased 2% year over year. Total EBITDA also saw a 12% rise, reaching $290 million, primarily from contributions in the Digital Real Estate Services and Dow Jones segments.

Segment Performance Overview

Digital Real Estate Services

The Digital Real Estate Services segment’s revenues grew by 5% year over year to $406 million, aided by strong performance from REA Group. Move also reported a revenue increase for the second straight quarter, with revenues up 2% to $135 million thanks to growth in sellers, new homes, and rentals, including a partnership with Zillow. However, Realtor.com’s average monthly unique users saw an 8% decline to 66 million.

Lead volume decreased by 17% year over year as high mortgage rates and affordability challenges continued to impact the segment. REA Group’s revenues rose 6% year over year to $271 million, supported by higher Australian residential revenues attributed to price increases and market expansion.

In Australia, residential listing volumes remained stable, with slight fluctuations in major cities—4% growth in Sydney and a 3% drop in Melbourne.

Foxtel Sale

During the third quarter, NWSA successfully completed the sale of the Foxtel Group to DAZN, which included repaying outstanding shareholder loans and receiving a minority equity stake of roughly 6% in DAZN. Consequently, Foxtel’s assets are now classified as held for sale, and its operations have been reclassified as discontinued.

Dow Jones Performance

Revenues in the Dow Jones segment climbed 6% year over year, reaching $575 million, driven by increased circulation and subscription revenues. Digital revenues now account for 82% of total Dow Jones revenues, up from 81% last year. Adjusted revenues also saw a 6% rise.

Circulation and subscription revenues rose by 7%, largely due to a 6% growth in the professional information business, particularly in Risk & Compliance and Dow Jones Energy segments. However, advertising revenues remained unchanged year over year.

In total, Dow Jones’ average subscriptions reached 6.1 million, representing a 7% increase from the previous year. Additionally, digital-only subscriptions surpassed 5.5 million, while The Wall Street Journal recorded a 3% increase in subscriptions.

Book Publishing Segment

The Book Publishing segment reported revenues of $514 million, reflecting a 2% year-over-year increase, primarily driven by higher book sales following the acquisition of a German publisher. This quarter’s notable titles included “Wicked” and “Dream Girl Drama.”

Digital sales rose 3%, bolstered by audiobook sales attributed to a successful partnership with Spotify. Digital sales constituted 25% of Consumer revenues, with backlist sales making up approximately 65% of total revenues.

News Media Segment

Revenues in the News Media segment fell 8% year over year to $514 million due to declining advertising revenues and the transfer of third-party printing contracts. Adjusted revenues also decreased by 6%. Noteworthy declines occurred in both News Corp Australia and News UK, where advertising revenues faced a 9% drop year over year.

Despite the challenges, digital revenues grew to represent 39% of the News Media segment’s total revenues, an increase from 37% in the previous year.

News Corporation Reports Digital Subscriber Growth Amid Revenue Challenges

As of March 31, 2025, The Times and Sunday Times recorded 629,000 digital subscribers, a notable increase from 582,000 during the same quarter last year. This growth reflects a broader trend in digital readership, although challenges remain in terms of overall revenue.

In contrast, the New York Post’s digital network decreased to 85 million unique users in March 2025, down from 125 million the prior year. Similarly, The Sun experienced a decline, reaching 74 million global monthly unique users compared to 126 million a year earlier.

Financial Overview

News Corporation concluded the fiscal third quarter with cash and cash equivalents totaling $2.09 billion, alongside borrowings of $1.95 billion. Stockholder equity stood at $8.20 billion. These figures indicate a stable cash position, albeit amidst fluctuating digital engagement.

Zacks Rank and Other Stock Insights

Currently, News Corporation holds a Zacks Rank of #4 (Sell). In the broader sector, investors might consider better-ranked stocks such as Advance Auto Parts (AAP) with a Zacks Rank of #1 (Strong Buy), as well as Alibaba (BABA) and Canada Goose (GOOS), which both have Zacks Rank #2 (Buy).

Ahead of its first-quarter results set for May 22, Advance Auto Parts has faced a year-to-date share decline of 33.6%. Conversely, Alibaba has seen a 48.4% increase year to date, with its fourth-quarter fiscal 2025 results scheduled for May 15. Canada Goose shares have dropped 14% in the same period, with its fiscal reports due on May 21.

Conclusion

News Corporation navigates a challenging digital advertising landscape, contributing to mixed results in subscriber growth and overall financial health. As they adapt strategies, market participants should closely monitor their performance in the evolving media environment.