Wells Fargo Downgrades International Paper’s Outlook Amid Market Changes

Fintel reports that on May 9, 2025, Wells Fargo downgraded its outlook for International Paper (XTRA:INP) from Equal-Weight to Underweight.

Analyst Price Forecast Indicates Significant Potential Upside

As of May 7, 2025, the average one-year price target for International Paper stands at 50.25 €/share. These forecasts range from a low of 40.13 € to a high of 60.40 €. The average price target suggests a potential upside of 60.28% from its most recent closing price of 31.35 € per share.

Projected Revenue and Earnings

The anticipated annual revenue for International Paper is 20,914 million €, reflecting an increase of 5.09%. The projected annual non-GAAP EPS is 3.10.

Fund Sentiment Analysis

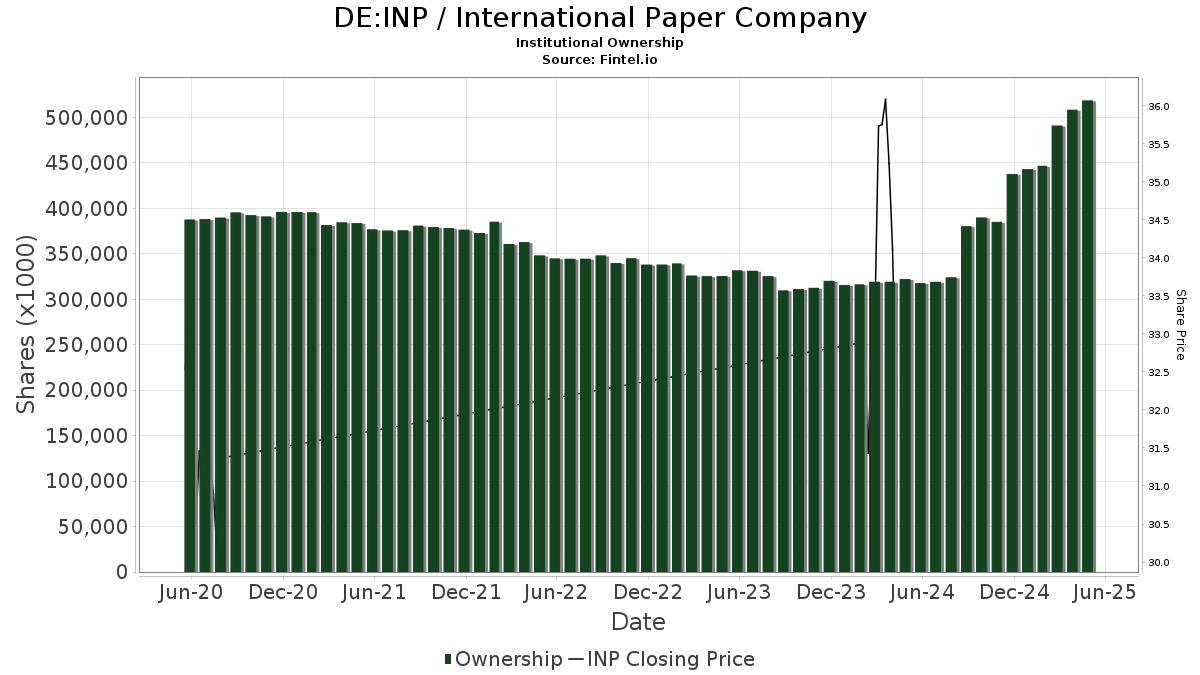

A total of 1,739 funds or institutions have reported their positions in International Paper, marking an increase of 70 owners, or 4.19%, over the last quarter. The average portfolio weight of all funds allocated to INP is 0.25%, an increase of 9.10%. Over the last three months, total shares held by institutions rose by 26.23% to 558,082K shares.

Activity Among Major Shareholders

Price T Rowe Associates holds 47,597K shares, accounting for 9.02% ownership of the company. This represents a slight increase from the 47,228K shares reported previously, reflecting a change of 0.77%. The firm has also boosted its portfolio allocation in INP by 11.17% in the last quarter.

Capital Research Global Investors owns 29,905K shares, representing 5.66% of the company. Previously, the firm held 17,713K shares, marking a significant increase of 40.77%. Their portfolio allocation in INP rose by 84.00% over the past quarter.

AMRMX – American Mutual Fund possesses 24,038K shares, which equals 4.55% ownership. This is up from 14,140K shares previously, resulting in an increase of 41.18%. The firm increased its portfolio allocation in INP by 67.61% in the last quarter.

Bank of New York Mellon currently holds 17,145K shares, reflecting 3.25% ownership. In its prior filing, it reported 14,363K shares, an increase of 16.23%. However, the firm reduced its portfolio allocation in INP by 88.47% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares comprises 10,921K shares, which is 2.07% ownership. Previously, the firm reported owning 10,990K shares, resulting in a small decrease of 0.63%, though it increased its portfolio allocation in INP by 7.89% over the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.