Semiconductor Stocks Surge While Intel Faces Challenges in AI Era

Over the past few years, the technology sector has seen remarkable growth driven by the artificial intelligence (AI) revolution. In particular, semiconductor stocks have posted significant gains as chips become essential for generative AI development.

Since the commercial launch of ChatGPT on November 30, 2022, shares of Nvidia, Broadcom, and Taiwan Semiconductor Manufacturing have surged by 592%, 272%, and 110%, respectively. By contrast, the VanEck Semiconductor ETF has shown a total return of 93% during this timeframe.

Intel’s Decline Amid a Booming Market

While many semiconductor companies have thrived recently, some have struggled significantly. Intel (NASDAQ: INTC) investors have felt the impact, with the stock plummeting 32% since ChatGPT was released. Currently, Intel shares are nearing a 15-year low, raising the question: is it a good time to buy the dip?

Understanding why some semiconductor stocks have thrived while others falter is crucial. Nvidia, for instance, focuses on designing graphics processing units (GPUs), essential for training AI models. This specialization positions Nvidia at the forefront of AI application development.

In contrast, Broadcom specializes in providing crucial network equipment for data centers and assisting companies with custom chipsets. Taiwan Semiconductor Manufacturing plays a pivotal role by fabricating chips designed by leading companies like Nvidia, Advanced Micro Devices, and Qualcomm.

Intel, although diversified, particularly struggles in its foundry business. For 2024, Intel’s foundry segment saw $17.5 billion in revenue, down 7% from the previous year. Furthermore, this segment incurred an operating loss exceeding $13.4 billion last year—almost double its prior year’s losses.

In the first quarter of 2025, Intel generated $4.7 billion in the foundry segment. While this indicated a promising 7% year-over-year growth, management cautioned that some of this might be attributed to revenue pulled forward, suggesting slower growth in upcoming months.

Although Intel contributes to chip development, it has been losing market share to Taiwan Semiconductor Manufacturing. The company has struggled to manage its foundry operations effectively and profitability remains uncertain.

Image source: Getty Images.

Evaluating Intel’s Stock Potential

Despite a significant decline in Intel’s stock price, the extent of the sell-off may be justified. Currently, Intel is committing to a turnaround strategy, but it remains to be seen whether the new leadership can execute effectively.

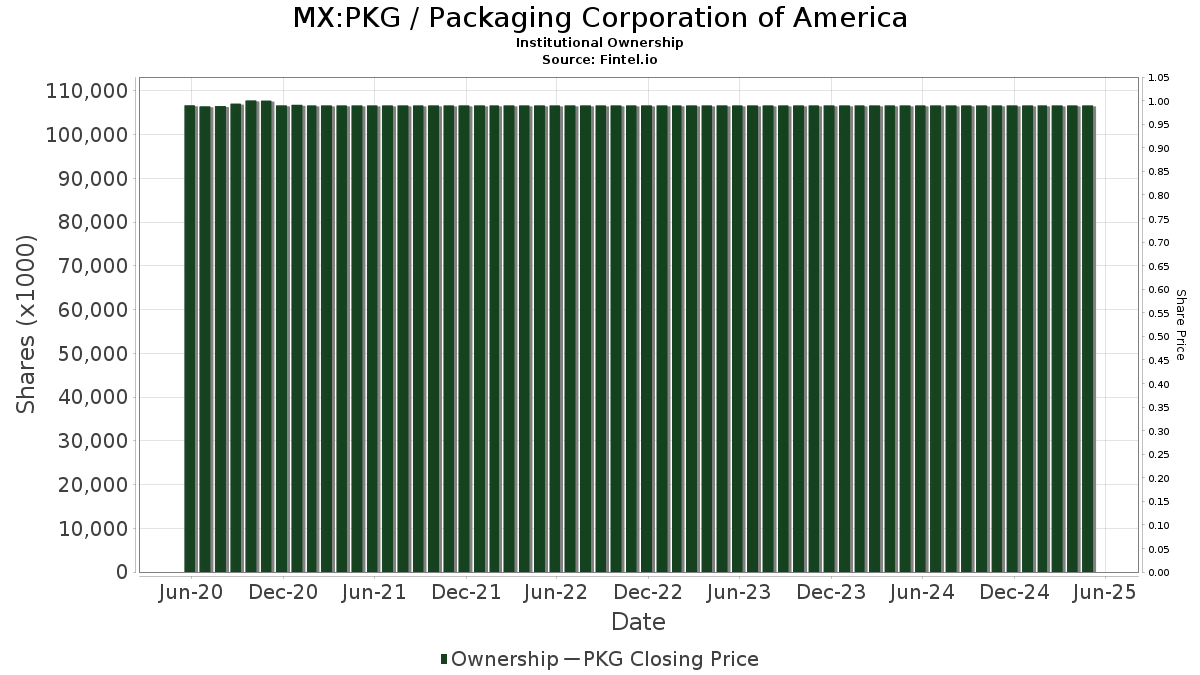

INTC Revenue Estimates for Current Fiscal Year data by YCharts

Wall Street’s predictions do not indicate significant revenue or earnings growth for Intel over the next few years. Given the inconsistency in Intel’s foundry business amid rising competition from TSMC, the stock appears speculative at best. For these reasons, I would recommend against purchasing shares of Intel.

Should You Invest $1,000 in Intel Now?

Before considering an investment in Intel, it’s crucial to note that the Motley Fool Stock Advisor team has highlighted other stocks as more promising options. Intel is not among the selected top stocks currently recommended.

Looking back, consider the case of Netflix; if you had invested $1,000 when it was recommended on December 17, 2004, it would now be worth over $614,911. Similarly, a $1,000 investment in Nvidia from April 15, 2005, would be valued at over $714,958.

Overall, the Stock Advisor program boasts an impressive average return of 907%, far exceeding the S&P 500’s 163% growth. The latest top 10 list is available to members.

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing, as well as Broadcom and related options on Intel. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.