Understanding Summer Stock Market Trends: Key Insights and Stocks to Watch

Tom Yeung here with your Sunday Digest.

Have you ever questioned why the stock market seems to take a dip during the summer months?

Historical Roots of Summer Market Behavior

The trend may have roots in 18th-century England. Wealthy investors often sold their stocks before retreating to their country homes for the summer, resulting in financial downturns known as fire sales.

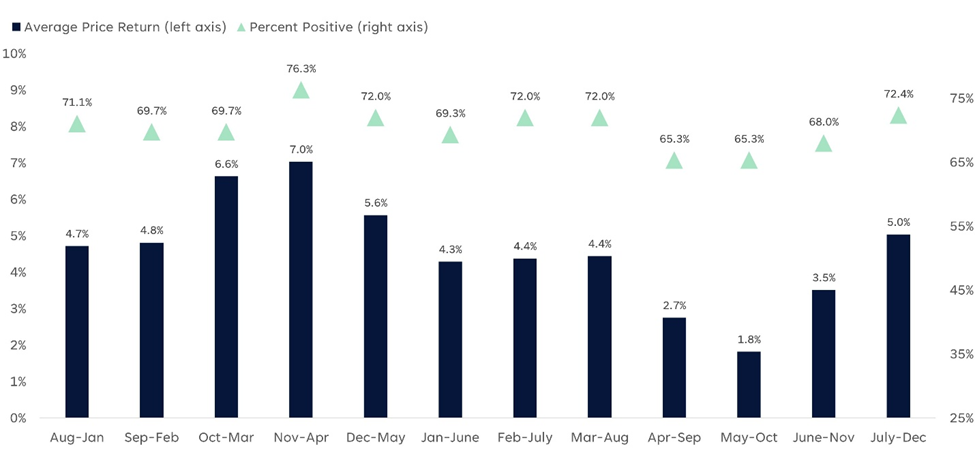

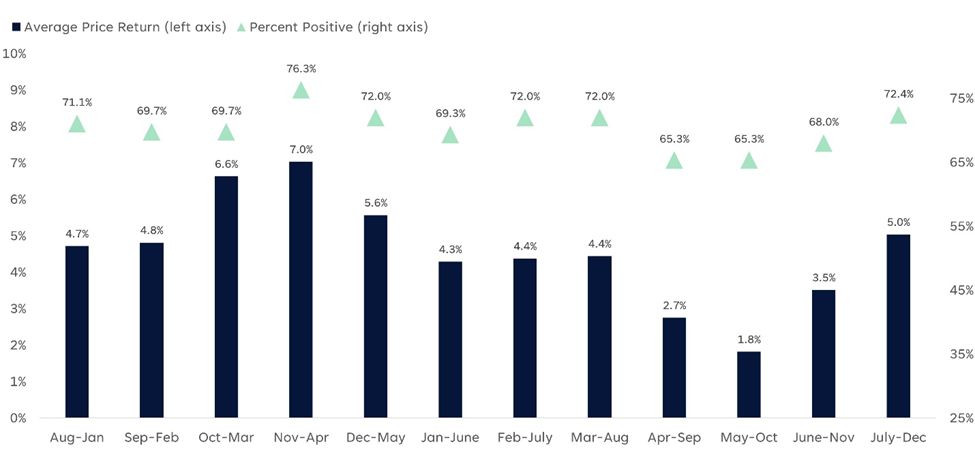

In our modern era, this tradition persists. A study by LPL Financial reveals that the stretch from May to October has yielded an average annual return of only 1.8% since 1950. As traders go on vacation, trading volumes decline, leading to insufficient buying demand to support stock prices.

In contrast, the period from November to April has brought investors a much stronger 7% return, as illustrated in the graph below.

Global Patterns in Market Performance

This trend isn’t limited to the U.S. A 2002 LPL study found that 36 of 37 global markets exhibited lower returns during the May to October period. The sole exception was Australia, which experiences opposite seasons.

However, simply selling off your entire investment portfolio in May has drawbacks beyond tax implications. This approach risks missing out on potential market recoveries.

For example, the S&P 500 increased by 12% during the summer of 2024 after the Federal Reserve cut interest rates. Investors who strictly adhered to the “sell in May” mantra may have missed these significant gains. Other historical events, like the recovery from the 2008 financial crisis and the resurgence following the 2020 COVID-19 pandemic, further illustrate the dangers of this strategy.

Reasons to Stay Invested This Summer

In this edition of the Digest, we’ll outline nine compelling reasons to remain invested during the summer. For now, let’s highlight two stocks worth your attention.

InvestorPlace Senior Analyst Luke Lango will reveal seven additional stocks in a portfolio crafted with his advanced stock algorithm to identify top investment opportunities and navigate monthly volatility. Details on this tool and the special seven-stock portfolio can be found in Luke’s latest free broadcast.

1. Capitalizing on Seasonal Performance

Some companies naturally thrive in warmer months. Think of outdoor sportswear brands, ice cream shops, and summer camps. One standout example is Intuit Inc. (INTU), a tax and accounting firm highlighted for 2025 growth.

As current tax laws are set to expire by year-end, major legislative changes are anticipated that will impact various tax aspects. Intuit is well-positioned to benefit from these changes, particularly among individual and small business clients.

People are more likely to use Intuit’s TurboTax software during major tax revisions. Back in 2017, INTU shares surged 80% during a similar change. Notably, most of the company’s profits are generated during the tax filing season, which concludes on April 15. Investors often express surprise over the substantial increase in operating profits disclosed in late May.

According to our partners at TradeSmith, seasonal investment analysis indicates that shares of Intuit typically appreciate by 10% between May 13 and August 11, responding to these profit announcements. The accompanying graph shows the historical price trajectory for INTU shares over the last 20 years.

We’re approaching one of the most favorable times to buy.

# TurboTax and Corning Stand Out in an Uncertain Market

In addition, TurboTax has several secular tailwinds supporting its growth. The company will benefit from the termination of the IRS Direct File program, which previously offered free tax filing software. TurboTax is also a leader in AI-powered accounting, enhancing sales of its widely used QuickBooks product.

While the average firm typically experiences weaker performance during summer months, tax firms such as Intuit and H&R Block Inc. (HRB) demonstrate that this trend doesn’t always hold true.

Performance Overview: November-April Returns

Returns from last November to April were notably subpar. During this period, the S&P 500 declined by 2.8%, compared to its historical average gain of 7%.

This decline has made the markets particularly attractive right now. The median S&P 500 company is currently trading at 17.9X forward earnings—5% lower than last November and 7% below the 19.2X seen in previous Mays.

This market condition has created strong opportunities for long-term investments, with Corning Inc. (GLW) emerging as a standout choice.

Corning, founded in upstate New York in 1851, is renowned for its high-end glassware. It developed Pyrex in 1915, low-loss fiber optic cables in 1970, and the iPhone’s “Gorilla Glass” in 2007.

Today, Corning leads in manufacturing liquid-crystal display (LCD) panels, smartphone screens, and fiber optic cables for broadband connections. Its success is attributed to consistent innovation in an industry that faces challenges like outsourcing.

Of particular interest, Corning also produces high-end fiber optics essential for data centers, enabling efficient data transfer in compact spaces. This sector has become a significant growth driver for the company. CEO Wendell Weeks noted in the first-quarter earnings call, “Our growth is primarily driven by powerful secular trends and more Corning content in our customers’ offerings.” He added that demand signals are strong, as evidenced by their order books and discussions with clients.

Corning’s profitability remains robust. The company has consistently reported positive operating earnings for the last two decades, even during recessions. Analysts predict a return on equity of 17% this year, which is approximately double the market average. Shares are trading at just 19X forward earnings, making them attractive following the November-April downturn.

However, some concerns linger. Corning supplies several top TV manufacturers now facing significant tariffs on exports to the U.S. Additionally, public funding for broadband expansion may be at risk in the upcoming federal budget. These factors have led to a 15% decline in Corning’s shares since February.

Nonetheless, it appears that the market’s quick sell-off may have created a compelling “Buy” opportunity. Current share prices are still about 20% below February highs, making Corning a potential investment worth considering.

Identifying Short-Term Opportunities

Market analyst Luke Lango asserts that there’s always a bull market to be found. Last year, 60 companies within the S&P 500 saw their shares rise more than 30%, including Iron Mountain Inc. (IRM) with a 58% increase and Nvidia Corp. (NVDA) soaring 60%.

Although Iron Mountain and Nvidia seem disparate—one a blue-chip warehousing firm and the other a cutting-edge chipmaker—both have shown strong growth leading into fiscal year 2024. Iron Mountain experienced a 24% growth in earnings before interest and taxes, while Nvidia’s earnings quadrupled to $37 billion.

In addition to their fundamental growth, both companies experienced strong stock price performance last year. Iron Mountain’s shares rose by 40%, while Nvidia’s surged by 240%. Historical patterns suggest that rising stocks tend to continue their upward trajectory, further supported by significant analyst upgrades.

After spending the past year developing a system called Auspex, Luke and his team now have insights into over 8,000 stocks each month to identify those with strong growth potential for shorter holding periods.

In a new presentation, Luke shares insights on seven elite stocks anticipated to thrive despite summer market challenges.

Navigating Market Timing Challenges

Research indicates that trying to time the market by selling in May and buying back in October often underperforms. Transaction costs and taxes can negate any benefits, even if proceeds are invested in yielding assets like T-bills.

This year has also shown impressive first-quarter results. According to FactSet, the average S&P 500 firm reported a 12.8% increase in earnings per share. Companies such as The Walt Disney Co. (DIS) saw a 16% rise on strong earnings, meaning selling now risks missing out on usual post-earnings gains.

For this reason, many investors are advised to maintain their positions in the market, as opportunities abound for those who search carefully.

Until next week,

Tom Yeung

Market Analyst